- Solutions Industry Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Member Experience Technology Use case AskWhy Communities Audience InsightsHub InstantAnswers Digsite AI in Research LivePolls Journey Mapping GDPR 360 Feedback Surveys Research Edition Business Intelligence

- Resources Blog eBooks Survey Templates Case Studies Training Webinars Help center

Mobile Research

Mobile research is a rapidly growing discipline of researchers who focus primarily on mobile-based research studies..

Join over 10 million users

Content Index

- What is Mobile Research?

Applications of Mobile Research

Factors affecting mobile research.

- Advantages of Mobile Research

Mobile Research Survey Tool

Watch the 1-minute tour

Most of the 2000s were spent on static devices like desktops. The world has transformed since then and so has the use of digital platforms and these days every person is online “on the go”. Almost 95% of the US citizens own a mobile phone and 90% of them have mobile internet access. Moreover, smartphone usage has doubled in the past 3 years with October 2016 marking the first time in history when mobile access through smartphones surpassed desktops.

With the rapid growth of mobile internet access, there is an unprecedented opportunity to tap into this newly assembled base of users to conducted focused and more precise mobile research.

So, what is mobile research?

Mobile research is a rapidly growing discipline of researchers who focus primarily on mobile-based research studies to tap into the flexibility, customizability, accuracy, and localization to get faster and more precise insights.

It’s easy, convenient and straightforward to capture data from anywhere and anytime as it uses the benefits of “mobile” technology to conduct effective “research”.

This research type can be used in three major ways:

- Recruiting a panel that will take a survey using their mobile platforms.

- Appoint interviewers to collect responses using tablets or smartphones.

- Collect data without internet (Offline mobile surveys).

In the first method, you can arrange a panel that would respond to your surveys and give you precise insights. As a panel consists of selected, filtered and handpicked individuals who already qualify for the research, asking them questions and getting insights is not just more easier but far more accurate and detailed.

The second method is applied on site for B2B or B2C purposes where you appoint interviewers or in most cases employees, to collect data on mobile devices. This method is very effective during concerts or live events where face to face data collection is possible for understanding user experience and making improvements.

Another way of conducting this research is by collecting data from locations where internet isn’t available. In such cases, the data collected offline will get automatically synced once internet becomes accessible.

In mobile research, all respondents take part from a mobile device. This presents researchers with both - opportunities and some restrictions. In such a situation, it is important to keep in mind these factors that affect the mobile research process:

Scrolling can get on people’s nerves. Respondents do not mind switching pages to answers ‘n’ number of questions but they do mind long scrolling surveys. This may impact the number of people completing the survey and can be quite a decisive factor for mobile research. If your survey has too many questions, you should increase the number of pages rather than increasing the length of a single page that would increase the scrolling time.

This can also be done by evaluating the questions that you intend to add in this research survey. Removing all the redundant questions will not only shorten the surveys but will also increase the effectiveness of the survey as a shorter survey will be easy and less time consuming to fill out.

For any kind of survey, question types are important and when it comes to mobile surveys, this can be all the more important. Create questions that the respondents can easily reply to from their mobile devices. Multiple choice questions are one of the most popularly used questions for a mobile-friendly survey. You may also want to avoid using open ended or descriptive questions because of the limitations that come with the size of the mobile screen. Instead of asking longer questions, you can also split the question into various multiple choice questions which will get you better results.

Apart from the question types in general, you may want to take care of the answer options too. Offering positive options first and then the negative options will affect the kind of answers you get. For mobile devices, horizontal scrolling should be strictly restricted as it can get very laborious for respondents to do that.

Loading time of videos and images are different for laptops and for mobile devices. Most mobile devices are operated using the data from phone networks and not ethernet or wi-fi. Due to this, it takes more time for the videos to load on phone than it would take on a laptop.

Decide on the minimum number of videos that you would like to use on mobile devices that may not impact the number of people taking the mobile research survey.

A few other factors that affect mobile research-

- Create mobile compatible logos.

- Mobile-friendly fonts and texts.

- Option for full screen coverage that will eliminate interruptions from other applications.

Advantages of Mobile Research:

As everyone is on mobile devices these days, gauging attention of the respondents via mobile research is prompter than the other means. Due to the various modes like surveys or mobile applications or GPS, getting in touch with your respondents becomes a very easy job. If the survey has direct, relevant questions, survey makers can get faster and more accurate answers via these research surveys.

In case a survey requires the respondents to fill in specific details, uploading images or recording voice notes or collecting information in a diary format is easier using mobile surveys. This is the main reason why these surveys are more adaptable than the traditional ones.

Quicker survey completion time, higher rate in collecting data, tracking of the respondent’s geo location etc. are other reasons that mobile research surveys are better.

These research surveys can be made interactive by asking the respondents to submit videos or images.

All QuestionPro mobile research survey tools offer 100% mobile compatible surveys. All the surveys created using our online platform are by default mobile compatible with no display restrictions regarding of the type of questions (standard or advanced).

QuestionPro also offers an offline mobile application to conduct these surveys in locations where internet connection isn’t available. Incase the responses are collected offline, they can be conveniently synced when network is accessible again. Due to this integral feature, you can get in touch with respondents that you usually wouldn’t be able to with the other survey tools in the market.

Along with these offerings, QuestionPro also provides 250+ mobile friendly survey templates.

- Sample questions

- Sample reports

- Survey logic

- Integrations

- Professional services

- Survey Software

- Customer Experience

- Communities

- Polls Explore the QuestionPro Poll Software - The World's leading Online Poll Maker & Creator. Create online polls, distribute them using email and multiple other options and start analyzing poll results.

- Research Edition

- InsightsHub

- Survey Templates

- Case Studies

- AI in Market Research

- Quiz Templates

- Qualtrics Alternative Explore the list of features that QuestionPro has compared to Qualtrics and learn how you can get more, for less.

- SurveyMonkey Alternative

- VisionCritical Alternative

- Medallia Alternative

- Likert Scale Complete Likert Scale Questions, Examples and Surveys for 5, 7 and 9 point scales. Learn everything about Likert Scale with corresponding example for each question and survey demonstrations.

- Conjoint Analysis

- Net Promoter Score (NPS) Learn everything about Net Promoter Score (NPS) and the Net Promoter Question. Get a clear view on the universal Net Promoter Score Formula, how to undertake Net Promoter Score Calculation followed by a simple Net Promoter Score Example.

- Offline Surveys

- Customer Satisfaction Surveys

- Employee Survey Software Employee survey software & tool to create, send and analyze employee surveys. Get real-time analysis for employee satisfaction, engagement, work culture and map your employee experience from onboarding to exit!

- Market Research Survey Software Real-time, automated and advanced market research survey software & tool to create surveys, collect data and analyze results for actionable market insights.

- GDPR & EU Compliance

- Employee Experience

- Customer Journey

- Executive Team

- In the news

- Testimonials

- Advisory Board

QuestionPro in your language

- Encuestas Online

- Pesquisa Online

- Umfrage Software

- برامج للمسح

- Logiciel d'enquête

Awards & certificates

The experience journal.

Find innovative ideas about Experience Management from the experts

- © 2021 QuestionPro Survey Software | +1 (800) 531 0228

- Privacy Statement

- Terms of Use

- Cookie Settings

Being Mobile: How the Usage of Mobile Devices Affects Surveys with Highly Educated Respondents

- First Online: 13 September 2022

Cite this chapter

- Florian Bains 4 &

- Bruno Albert 5

Part of the book series: Higher Education Research and Science Studies ((HERSS))

1054 Accesses

In this article, we examine the effect on data quality of using mobile devices in online surveys with highly educated respondents. Utilising panel data from the German National Educational Panel Study (NEPS) student cohort, we employ regression analyses and propensity score matching to estimate the effects of devices while controlling for confounding factors. We find higher item non-response, shorter answers to open-ended questions and longer completion times on smartphones and tablets compared to laptops and PCs. Using the difference-in-difference estimator for respondents who switched devices between two waves of the panel, we further assess whether the effects we find can be attributed to the devices or to the individual characteristics or situation of the respondent. We find that switching from PCs to mobile devices is associated with a decline in data quality, while switching from mobile devices to PCs is associated with an improvement in data quality. We find that differences in data quality between mobile devices and PCs are, at least partly, associated with features of the device used. We thus conclude that data quality is influenced by a combination of the characteristics of devices and of the participants who chose those devices.

This paper uses data from the National Educational Panel Study (NEPS): Starting Cohort First-Year Students, https://doi.org/10.5157/NEPS:SC5:14.1.0 . From 2008 to 2013, NEPS data were collected as part of the Framework Program for the Promotion of Empirical Educational Research funded by the German Federal Ministry of Education and Research (BMBF). Since 2014, the NEPS has been conducted by the Leibniz Institute for Educational Trajectories (LIfBi) at the University of Bamberg in cooperation with a nationwide network.

Some of the conceptual work for this article was made possible by funding from the Deutsche Forschungsgemeinschaft (DFG, German Research Foundation) within the priority programme 2267 ‘Digitalisation of Working Worlds: Conceptualising and capturing a Systemic Transformation’ (project number 442171541).

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Similar content being viewed by others

Is there a growing use of mobile devices in web surveys? Evidence from 128 web surveys in Germany

Is There More Than the Answer to the Question? Device Use and Completion Time as Indicators for Selectivity Bias and Response Convenience in Online Surveys

Does Device or Connection Type Affect Health Preferences in Online Surveys?

For more information, visit https://www.neps-studie.de/Studien/Hochschulstudium-und-%C3%9Cbergang-in-den-Beruf .

Documentation of the Scientific-Use-File can be found at https://www.neps-data.de/Datenzentrum/Daten-und-Dokumentation/Startkohorte-Studierende/Dokumentation .

Antoun, C., & Cernat, A. (2019). Factors affecting completion times: A comparative analysis of smartphone and PC web surveys. Social Science Computer Review, 38 (4), 477–489. https://doi.org/10.1177/0894439318823703 .

Article Google Scholar

Antoun, C., Conrad, F. G., Couper, M. P., & West, B. T. (2019). Simultaneous estimation of multiple sources of error in a smartphone-based survey. Journal of Survey Statistics and Methodology, 7 (1), 93–117. https://doi.org/10.1093/JSSAM/SMY002 .

Antoun, C., Couper, M. P., & Conrad, F. G. (2017). Effects of mobile versus PC web on survey response quality: A crossover experiment in a probability web panel. Public Opinion Quarterly, 81 (S1), 280–306. https://doi.org/10.1093/poq/nfw088 .

Blossfeld, H.-P., Roßbach, H.-G, & von Maurice, J. (Eds.) (2011). Education as a lifelong process—The German National Educational Panel Study (NEPS). [Special Issue] Zeitschrift für Erziehungswissenschaft : 14.

Google Scholar

Buskirk, T. D., & Andrus, C. (2014). Making mobile browser surveys smarter: Results from a randomized experiment comparing online surveys completed via computer or smartphone. Field Methods, 26 (4), 322–342. https://doi.org/10.1177/1525822X14526146 .

Carini, R. M., Hayek, J. C., Kuh, G. D., Kennedy, J. M., & Ouimet, J. A. (2003). College student responses to web and paper surveys: Does mode matter? Research in Higher Education, 44 (1), 1–19. https://doi.org/10.1023/A:1021363527731 .

Couper, M. P., Antoun, C., & Mavletova, A. (2017). Mobile web surveys: A total survey error perspective. In P. P. Biemer, E. D. de Leeuw, S. Eckman, B. Edwards, F. Kreuter, L. E. Lyberg, C. Tucker, & B. T. West (Hrsg.), Total survey error in practice: Improving quality in the era of big data (S. 133–154). Wiley.

Chapter Google Scholar

Couper, M. P., & Peterson, G. J. (2017). Why do web surveys take longer on smartphones? Social Science Computer Review, 35 (3), 357–377. https://doi.org/10.1177/0894439316629932 .

Daikeler, J., Bach, R. L., Silber, H., & Eckman, S. (2020). Motivated misreporting in smartphone surveys. Social Science Computer Review (online first) . https://doi.org/10.1177/0894439319900936 .

de Bruijne, M., & Wijnant, A. (2013). Comparing survey results obtained via mobile devices and computers: An experiment with a mobile web survey on a heterogeneous group of mobile devices versus a computer-assisted web survey. Social Science Computer Review, 31 (4), 482–504. https://doi.org/10.1177/0894439313483976 .

de Bruijne, M., & Wijnant, A. (2014). Mobile response in web panels. Social Science Computer Review, 32 (6), 728–742. https://doi.org/10.1177/0894439314525918 .

Eurostat (2017). Digital Economy and Society: ICT usage in households and by individuals . http://ec.europa.eu/eurostat/web/digital-economy-and-society/data/database .

Keusch, F., & Yan, T. (2017). Web versus mobile web: An experimental study of device effects and self-selection effects. Social Science Computer Review, 35 (6), 751–769. https://doi.org/10.1177/0894439316675566 .

Lee, H., Kim, S., Couper, M. P., & Woo, Y. (2019). Experimental comparison of PC web, smartphone web, and telephone surveys in the new technology era. Social Science Computer Review, 37 (2), 234–247. https://doi.org/10.1177/0894439318756867 .

Lugtig, P., & Toepoel, V. (2016). The use of PCs, smartphones, and tablets in a probability-based panel survey: Effects on survey measurement error. Social Science Computer Review, 34 (1), 78–94. https://doi.org/10.1177/0894439315574248 .

Maineri, A.M., Bison, I., & Luijkx, R. (2019). Slider bars in multi-device web surveys. Social Science Computer Review, 39 (4). https://doi.org/10.1177/0894439319879132 .

Mavletova, A. (2013). Data quality in PC and mobile web surveys. Social Science Computer Review, 31 (6), 725–743. https://doi.org/10.1177/0894439313485201 .

Mavletova, A., & Couper, M. P. (2013). Sensitive topics in PC web and mobile web surveys: Is there a difference? Survey Research Methods, 7 (3), 191–205. https://doi.org/10.18148/srm/2013.v7i3.5458 .

Mavletova, A., & Couper, M. P. (2014). Mobile web survey design: Scrolling versus paging, SMS versus e-mail invitations. Journal of Survey Statistics and Methodology, 2 (4), 498–518. https://doi.org/10.1093/jssam/smu015 .

Meade, A. W., & Craig, S. B. (2012). Identifying careless responses in survey data. Psychological Methods, 17 (3), 437. https://doi.org/10.1037/a0028085 .

Meinefeld, W. (2010). Online-Befragungen im Kontext von Lehrevaluationen–praktisch und unzuverlässig. KZfSS Kölner Zeitschrift für Soziologie und Sozialpsychologie, 62 (2), 297–315. https://doi.org/10.1007/s11577-010-0098-x .

Messer, B. L., Edwards, M. L., & Dillman, D. A. (2012). Determinants of item nonresponse to web and mail respondents in three address-based mixed-mode surveys of the general public. Survey Practice, 5 (2), 1–8. https://doi.org/10.29115/SP-2012-0012 .

Müller, B., & Castiglioni, L. (2015). Attrition im Beziehungs- und Familienpanel pairfam. In J. Schupp & C. Wolf (Eds.), Non-response bias: Qualitätssicherung sozialwissenschaftlicher Umfragen (S. 383–408). Springer VS. https://doi.org/10.1007/978-3-658-10459-7_12 .

Porter, S. R., & Whitcomb, M. E. (2005). Non-response in student surveys: The role of demographics, engagement and personality. Research in Higher Education, 46 (2), 127–152. https://doi.org/10.1007/s11162-004-1597-2 .

Rammstedt, B., & John, O. P. (2007). Measuring personality in one minute or less: A 10-item short version of the Big Five Inventory in English and German. Journal of research in Personality, 41 (1), 203–212.

Schlosser, S., & Mays, A. (2018). Mobile and dirty: Does using mobile devices affect the data quality and the response process of online surveys? Social Science Computer Review, 36 (2), 212–230. https://doi.org/10.1177/0894439317698437 .

Steinhauer, H., Aßmann, C., Zinn, S., Goßmann, S., & Rässler, S. (2015). Sampling and weighting cohort samples in institutional contexts. AStA Wirtschafts-und Sozialstatistisches Archiv, 9 (2), 131–157. https://doi.org/10.1007/s11943-015-0162-0 .

Struminskaya, B., Weyandt, K., & Bosnjak, M. (2015). The effects of questionnaire completion using mobile devices on data quality. Evidence from a probability-based general population panel. Methods, Data, Analyses , 9 (2), 261–292. https://doi.org/10.12758/mda.2015.014 .

Toepoel, V., & Lugtig, P. V. (2014). What happens if you offer a mobile option to your web panel? Evidence from a probability-based panel of internet users. Social Science Computer Review, 32 (4), 544–560. https://doi.org/10.1177/0894439313510482 .

Toninelli, D., & Revilla, M. A. (2016). Smartphones vs PCs: Does the device affect the web survey experience and the measurement error for sensitive topics? A replication of Mavletova & Couper’s 2013 experiment. Survey Research Methods, 10 (2), 153–169. https://doi.org/10.18148/srm/2016.v10i2.6274 .

Tourangeau, R., Sun, H., Yan, T., Maitland, A., Rivero, G., & Williams, D. (2018). Web surveys by smartphones and tablets: Effects on data quality. Social Science Computer Review, 36 (5), 542–556. https://doi.org/10.1177/0894439317719438 .

Treischl, E., & Wolbring, T. (2017). The causal effect of survey mode on students’ evaluations of teaching: Empirical evidence from three field experiments. Research in Higher Education, 58 (8), 904–921. https://doi.org/10.1007/s11162-017-9452-4 .

Uhrig, S.C. (2008). The nature and causes of attrition in the British Household Panel Study (No. 2008–05). ISER Working Paper Series.

Verbree, A.-R., Toepoel, V., & Perada, D. (2019). The effect of seriousness and device use on data quality. Social Science Computer Review, 38 (6), 720–738. https://doi.org/10.1177/0894439319841027 .

Watson, N., & Wooden, M. (2009). Identifying factors affecting longitudinal survey response. In P. Lynn (Ed.), Methodology of Longitudinal Surveys (Vol. 1, S. 157–181). John Wiley & Sons, Ltd. https://doi.org/10.1002/9780470743874.ch10 .

Wells, T., Bailey, J. T., & Link, M. W. (2013). Filling the void: Gaining a better understanding of tablet-based surveys. Survey Practice, 6 (1), 1–9. https://doi.org/10.29115/SP-2013-0002 .

Wells, T., Bailey, J. T., & Link, M. W. (2014). Comparison of smartphone and online computer survey administration. Social Science Computer Review, 32 (2), 238–255. https://doi.org/10.1177/0894439313505829 .

Wells, W., Cavanaugh, M. R., Bouffard, J. A., & Nobles, M. R. (2012). Non-response bias with a web-based survey of college students: Differences from a classroom survey about carrying concealed handguns. Journal of Quantitative Criminology, 28 (3), 455–476. https://doi.org/10.1007/s10940-011-9148-4 .

Download references

Author information

Authors and affiliations.

Leibniz-Institute for Educational Trajectories (LIfBi), Bamberg, Deutschland

Florian Bains

Friedrich-Alexander-Universität Erlangen-Nürnberg, Nürnberg, Deutschland

Bruno Albert

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Florian Bains .

Editor information

Editors and affiliations.

Abteilung Bildungsverläufe und Beschäftigung, Deutsches Zentrum für Hochschul- und Wissenschaftsforschung (DZHW), Hannover, Deutschland

Gesche Brandt

Susanne de Vogel

Rights and permissions

Reprints and permissions

Copyright information

© 2022 Der/die Autor(en), exklusiv lizenziert durch Springer Fachmedien Wiesbaden GmbH, ein Teil von Springer Nature

About this chapter

Bains, F., Albert, B. (2022). Being Mobile: How the Usage of Mobile Devices Affects Surveys with Highly Educated Respondents. In: Brandt, G., de Vogel, S. (eds) Survey-Methoden in der Hochschulforschung . Higher Education Research and Science Studies. Springer VS, Wiesbaden. https://doi.org/10.1007/978-3-658-36921-7_5

Download citation

DOI : https://doi.org/10.1007/978-3-658-36921-7_5

Published : 13 September 2022

Publisher Name : Springer VS, Wiesbaden

Print ISBN : 978-3-658-36920-0

Online ISBN : 978-3-658-36921-7

eBook Packages : Education and Social Work (German Language)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

A mobile survey is still a survey: Why market researchers need to go beyond “mobile-first”

SUBSCRIBE Sign up to get new resources from Rival.

Recommended.

Study: Gen Zs and Millennials are ignoring emails, putting the future of market research at risk

Market research trends: Predictions on what’s next for the insights industry

What Are Research Communities?

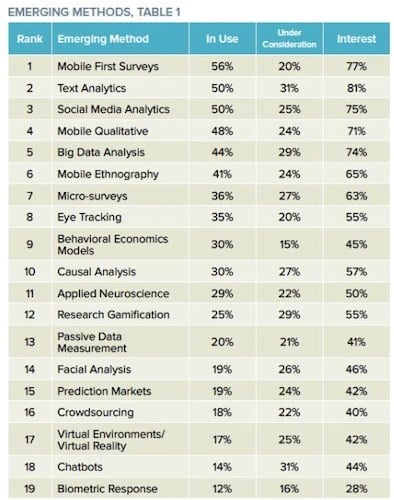

According to the 2020 Insights Practice edition of the GreenBook Research Industry Trends (GRIT) report, mobile-first surveys are finally the most popular emerging research method. The annual study found that 56% of researchers are now using mobile surveys , easily beating t ext analytics (50%) and social media analytics (50%) as the most widely used emerging market research method today.

The popularity of mobile surveys is pretty broad. For instance, a relatively equal percentage of research buyers (52%) and suppliers (58%) are using this technology. Globally, mobile surveys also enjoy wide adoption, with a majority of researchers in North America (55%), Europe (63%) and APAC (57%) using them.

While it’s encouraging to see that mobile surveys are finally being used by a majority of researchers, GreenBook’s study raises an important question: I s the market research industry adopting mobile-first practices fast enough? 🤔

GreenBook’s survey found that 20% of researchers are considering bringing in mobile survey software into their research toolkit, but 15% are still unsure—and 6% are not interested at all. Other mobile-first methodologies such as mobile ethnography and micro-surveys are growing but aren’t being used by the majority yet.

“I t is worrying that 20% of people only list mobile-first surveys as being under consideration ,” writes Ray Poynter, Chief Research Officer at Potentiate, in his analysis of GreenBook’s report. “ For some time, it has been necessary to accommodate mobile devices for most projects, and it is widely recognized that mobile first is the best way of doing that. ”

20% of researchers are considering bringing in mobile survey software into their research toolkit, but 15% are still unsure.

According to recent stats, 5 billion people globally have mobile devices. Many of these people—for instance, younger ones like Gen Zs —are mobile-first consumers or digital natives . If companies want to reach and hear from a more diverse set of customers, their market research strategy should be mobile-first rather than simply being mobile-friendly.

A mobile survey is still a survey

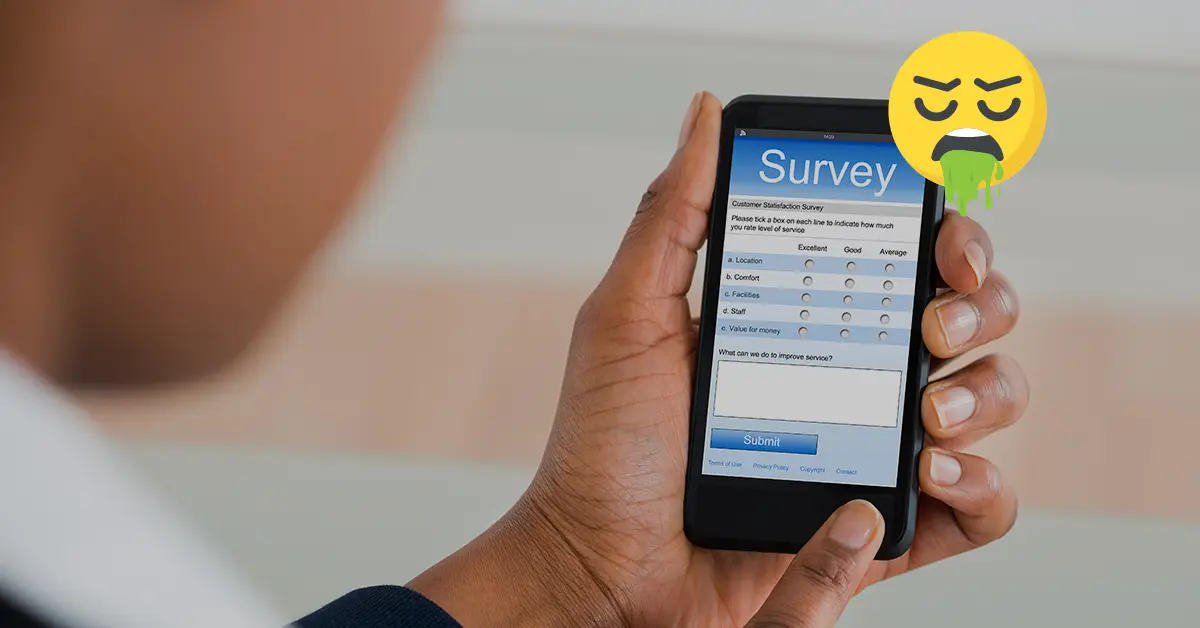

While adapting survey software that supports mobile-first initiatives is important, it’s also not enough if companies want to increase response rates, get richer insights and improve business outcomes. Using mobile surveys doesn’t address the hard reality that surveys in general are falling out of favor with consumers .

The volume of feedback requests people get is resulting to a survey backlash. As MarketingMag Editor Ben Ice recently pointed out, customers are “ buried under the immense weight of requests for feedback and survey participation .” From the ubiquitous NPS and CSAT questionnaires to those annoying pop-up website surveys, people are constantly being asked to rate this and that.

Unfortunately, customers don’t see or understand how their feedback is resulting to meaningful improvements .

“Many customers submit themselves to [the survey] process, hoping for better experiences ,” points out Gene Leganza , VP at Forreste r , in an article about his 2020 predictions . “B ut firms have rewarded these customers poorly: Customer experiences haven’t gotten better for three years .”

The terrible survey experience is resulting to lower response rates and declining ROI, according to Forrester. The research firm is predicting that more companies will adapt customer intelligence tools and build in-house research platforms this year as a result of the survey backlash.

“If you’ve ever taken an online survey, you know that most look like you’re taking a test."

Unfortunately, re-sizing buttons and open-text boxes so they fit on mobile screens won’t increase consumer appetite for surveys. What’s needed is a complete re-imagining of the survey experience and an examination of the value we’re providing research participants.

Think back to the last time you took an online survey. Was the experience fun and rewarding , or did it seem like a super long interrogation? I’m willing to bet it’s the latter.

“If you’ve ever taken an online survey, you know that most look like you’re taking a test ,” Reach3 Insights CEO & Founder Matt Kleinschmit recently explained to MediaPost . “They’re oftentimes very long, there are endless multi-choice grids, radio buttons, and very clinical, formalized language.”

This approach is problematic, according to Kleinschmit , as it results to feedback that’s not as rich or as candid and authentic.

“ People get into what I refer to as test-taking mode. They start to think about their answers, they’re rationalizing their responses, they feel like they’re trying to provide the answers that the person who is giving the test wants to hear. ”

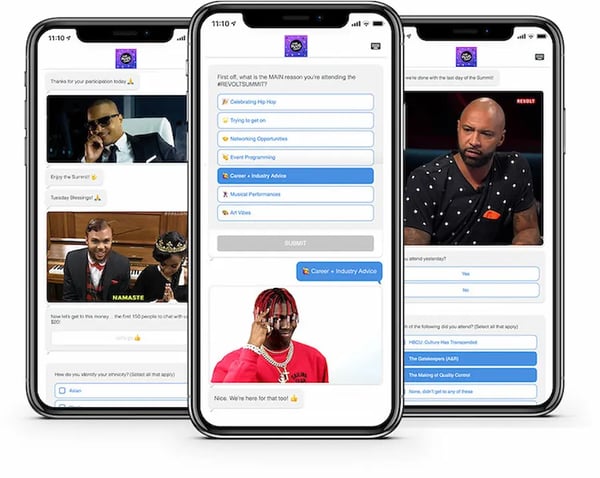

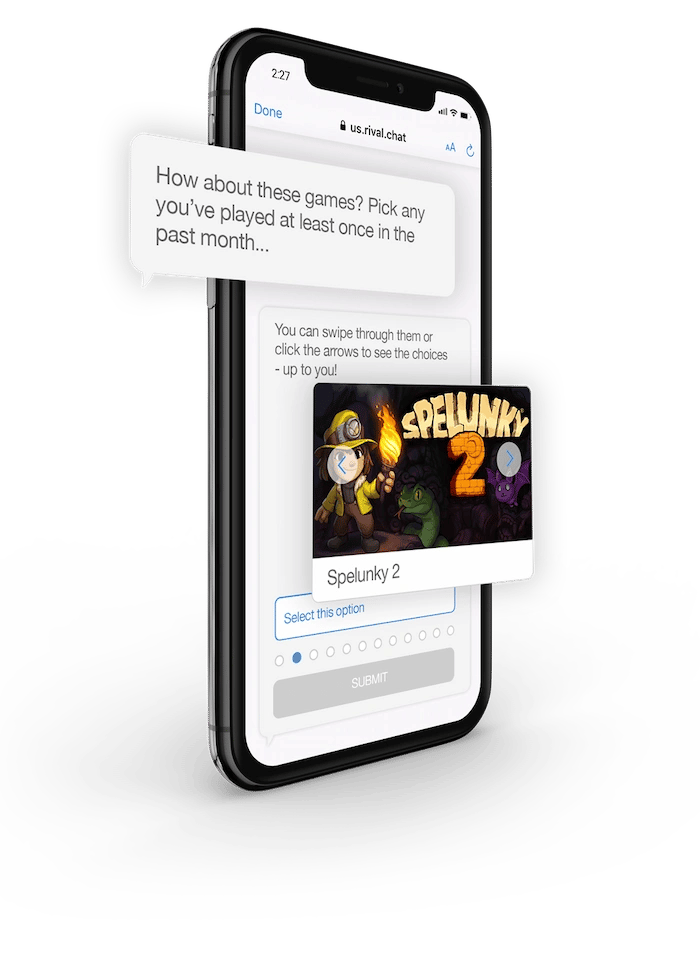

At Rival, we think the survey fatigue issue is so big that we created a new insight platform that —in many ways— is similar to t raditional survey tools , but is also significantly different.

We don’t call our surveys “surveys.” We call them chats— conversational surveys hosted through messaging apps like Facebook Messenger, WeChat, WhatsApp or on mobile web browsers. Chat surveys are mobile-first, but they’re not just mobile surveys.

Yes, you can capture both quantitative and qualitative data through chats, but they’re different from mobile surveys in several ways:

- Everything about chats—from the language and tone used to the user experience—is conversational . If it sounds like a survey, it’s not really a chat!

- Chats are friendlier than mobile surveys, more informal and more visual than mobile surveys

- They’re shorter and more iterative

- They use t he smartphones’ capabilities to make it easy and seamless for research participants to submit photos, audio and selfie video s

Early research-on-research on chats show s that people are responding to chats as a new way of engaging with brands.

Just as important, chats provide the continuity researchers need to be confident with the data they get . In a parallel study we did last year, we saw that chats would generally yield the same business decisions as traditional surveys . Chat survey research also does not introduce any demographic skews if the sample source is the same. That said, given that chats work seamlessly with popular mobile messaging apps and social media, we see a huge potential for this technology to improve in-the-moment research and to reach Gen Zs and more ethnically diverse respondents.

Conclusion

It’s great to see mobile surveys are moving from merely a market research trend into a mainstream, everyday tool for capturing customer insights . As we explored here, however, there’s a bigger opportunity to completely re-imagine surveys and deliver a respondent experience that’s more fun, more conversational and more human.

IT'S TIME TO GO BEYOND MOBILE SURVEYS

Watch our webinar, "Mobile Research Best Practices" to learn how to harness the full power of mobile tech to engage your customers and fans for insights.

Kelvin Claveria (@kcclaveria) is Director of Demand Generation at Rival Technologies.

You May Also Like

2022 GRIT Top 50 Most Innovative Suppliers: Thanks for voting for Rival!

Forrester's Cinny Little on elevating the impact of market research through mobile-first approaches

MRMW 2022: 5 panel sessions we can’t wait to see

Talk to an expert.

Got questions about insight communities and mobile research? Chat with one of our experts.

Subscribe by Email

No comments yet.

Let us know what you think

The Shift to Mobile-First Online Surveys: Navigating Market Research in the Smartphone Era

In today's fast-paced digital world, where nearly everyone owns a smartphone, market research has undergone a significant transformation. The shift from traditional online surveys to mobile-first approaches has become imperative. This article explores this transition, highlighting the increasing use of smartphones for surveys and its implications for market research.

Introduction: The Mobile Revolution in Market Research The advent of smartphones has revolutionized the way people access information, communicate, and interact with the digital world. With the global penetration of smartphones exceeding 50%, market researchers are leveraging this trend to gain deeper insights into consumer behaviour and preferences.

The Rise of Mobile-First Surveys

Understanding Mobile-First Surveys

Mobile-first surveys are designed with a primary focus on smartphones and mobile devices. Unlike traditional online surveys adapted for mobile use, these surveys are created from the ground up with mobile users in mind.

The Smartphone Phenomenon

Smartphones have become an integral part of our daily lives, with users spending an average of 4 hours per day on their devices. This presents a golden opportunity for market researchers to tap into this vast pool of potential respondents.

The Benefits of Mobile-First Surveys

Accessibility and Convenience

24/7 Connectivity

Smartphones provide continuous connectivity, allowing participants to respond to surveys at any time and from anywhere. This flexibility eliminates the need for participants to be tethered to a desktop or laptop.

Enhanced User Experience

Mobile surveys are designed for touchscreens and smaller screens, ensuring a seamless and user-friendly experience. This translates into higher response rates and more accurate data.

Real-Time Insights

Instant Feedback

Mobile-first surveys enable researchers to collect data in real-time, offering immediate insights into consumer behaviour. This rapid feedback allows businesses to make informed decisions promptly.

Geo-Location Data

Smartphones can provide valuable location data, allowing researchers to correlate survey responses with specific geographic regions. This feature is invaluable for localized marketing strategies.

Diverse Demographics

Global Reach

The widespread adoption of smartphones transcends geographical boundaries. Researchers can access a diverse pool of participants from around the world, providing a more comprehensive and representative sample.

Demographic Diversity

Smartphones are used by people of all ages, making it easier to target specific demographic groups. This diversity enhances the accuracy and applicability of research findings.

Challenges and Considerations

Survey Design

Mobile-first surveys require a different approach to design and formatting. Ensuring that questions are concise and easy to navigate is crucial for success.

Data Security

Mobile surveys must prioritize data security and privacy, especially when collecting sensitive information. Researchers must implement robust security measures to protect participant data.

The Future of Market Research

As the smartphone era continues to evolve, market researchers must adapt to stay relevant. The shift to mobile-first surveys is not a passing trend; it's a strategic move towards capturing accurate and timely consumer insights.

Conclusion: Embracing Mobile-First Market Research

The transition from traditional online surveys to mobile-first approaches is more than a technological shift; it's a paradigm change in market research. Embracing this change opens doors to a wealth of opportunities, from enhanced user engagement to real-time data collection.

In conclusion, market researchers must recognize the smartphone as a powerful tool for gaining insights into consumer behavior. Those who embrace mobile-first surveys will be better equipped to navigate the evolving landscape of market research and make informed decisions in a rapidly changing world.

Stay ahead of the curve by adopting mobile-first approaches and harness the potential of smartphones in your market research endeavors. For the latest updates and strategies in mobile-driven market research, visit martlenz.com .

Recent Posts

RegTech: How Technology is Streamlining Compliance in Financial Services

How Smart Data Management is Driving Digital Transformation in Real Estate

The Future of Telecommunications Convergence with Cloud Computing

Comentários

IMAGES

VIDEO