- Making a property investment business plan

- Rental yield calculations

- Property investment strategies

- How to quit your job and invest in property

Setting investment goals

- Are property training courses worth the money?

- Do you need a property mentor?

- The process of buying an investment property

- How to evaluate a property investment

- Property assessment checklist

- The 4 types of property deal I look for (and why)

- How to find a property sourcer

- Deciding where to invest

- How to flip a house: the ultimate guide

- Rent-To-Rent: The ultimate guide

- Lease Options explained

- Lending against property

- Lessons from running a letting agency

- How to get started with limited funds

- Mortgages: The ultimate guide

- Mortgages for limited companies

- New mortgage rules: rental cover and portfolio landlords

- Interest-only vs repayment mortgages

- Bridging finance: the ultimate guide

- Property joint venture agreements – The ultimate guide

- Recycling your cash

- Self-manage or use a letting agent?

- Landlord insurance guide

- How to find tenants

- Writing a tenancy agreement

- What does self-managing a property involve?

- Rent guarantee insurance

- The 18-year property cycle

- Will London house prices crash?

- Avoiding Inheritance Tax

- Exit strategies

- Mortgage interest relief

- Buying through a company

How to create a rental property business plan (and why you need one)

Last updated: 21 October 2022

Take it from someone who’s spoken to a lot of investors over the last few years: almost everyone who achieves great success started out with a solid plan.

All businesses start out with a plan . Even if that plan is just “I think I can buy this widget for £1 and sell it for £1.50”, it’s still a statement of what the business will do and how it will make a profit.

But many – in fact, most – wannabe property investors start out without even the most basic of plans. Often, people have nothing more than vague thoughts like “ property prices go up, so it’s a good investment ” or “ most wealthy people seem to own property ”.

It might feel like sitting around planning is just delaying you from getting out to look at properties and start making money. But take it from someone who’s spoken to a lot of investors over the last few years: almost everyone who achieves great success started out with a solid plan.

(Or to put it another, more painful way: almost everyone who didn’t start with a plan ends up disappointed with where they end up – however much effort, money and time they put in.)

What does a rental property business plan look like?

It certainly doesn't need to be 100 spiral-bound pages of projections and fancy charts. In fact, the best plan would be so simple that it fits on the back of an index card – meaning that you can commit it to memory and use it to drive every decision you make.

In order to get to that simplicity though, you might need to do some seriously brain-straining thinking first.

It's not easy, but it is simple: your plan basically just needs to set out…

Where you are now

- Where you want to get to, and

- What actions you're going to take to bridge the gap

DOWNLOAD MY BUSINESS PLAN WORKSHEET

Get your plan down on paper by downloading my printable worksheet that takes you through the planning process

You'll receive a one-off email with your download link, and be subscribed to my Sunday email where I round up the main property news stories of the week. You can unsubscribe at any time, and your data will never, ever be passed to anyone else.

To give a cheesy analogy, you can't plan a route unless you know where you're starting from.

Working out your starting point is the easiest part, because it involves information that's either known or easily knowable to you.

You'll need to be clear about:

- The amount of money you've got to invest

- The amount of savings you can allocate to property investment in future years

- The time you can invest each week or month

- The skills and knowledge you can apply to your property business

Note that I said it was the easiest part, but still not easy – because it involves honesty about what you can commit, and self-knowledge to determine where your strengths lie.

Knowing how much money you've got to invest should be straightforward, but it's probably worthwhile speaking to a mortgage broker to check that you'll have borrowing options – because this will determine your total investment figure. A broker will also be able to tell you about your options around releasing equity from your own home, if that's something you want to consider.

I'd also strongly encourage you to consider what “emergency fund” you want to keep in cash, and deduct that from your total investable funds. I suggest having at least six months' expenses in the bank at all times: the last thing you want is to plough every last penny into investments, then lose your job the next day and be unable to pay your bills.

Where you want to get to

So now you know where you're starting from, where do you want to end up? In other words, what's your goal?

Yes, you want to be “rich”, or “secure”, or “build a future” – but what does that actually mean, in pounds and pence terms, for you?

And just as importantly, when do you want to have achieved that?

You might be surprised by how much thought is involved in answering these questions properly. It's easy to throw around terms like “enough to fund my lifestyle” and assume that it might involve an income of £10,000 per month, but it's another matter entirely to look honestly at your ideal lifestyle and determine what a genuinely meaningful figure is.

The same is true for “when” – and it's an often-ignored factor that actually cuts to the heart of the most basic of investment decisions.

For example, take a choice between two properties:

- Property 1 will give a return on your investment of 15% but will probably never increase in value

- Property 2 will give a return of 7% but has the potential to double in value over the next decade.

If your goal is to create a certain monthly income within three years, the Property 1 is likely to be a better choice. Growth is unlikely to happen to any great extent over that time, so you need to optimise for cash in the bank right now.

On the other hand, if you have a decade before you want to have achieved your goal, Property 2 is probably the better bet. It very much is a “bet” because you're taking something of a gamble on capital growth, but it's got a lot of time to happen – and when it does, your returns will dwarf the higher rental income you'd have made from the other property.

That's just one example of why making even simple decisions in your property business are impossible without having that most basic ingredient of your plan: where you ultimately want to end up, and when.

So, by this point in the plan you need to:

- Assess your finances to build up an honest picture of where you are now

- Put some serious thought into where you want to get to, and when

If you need help with this goal-setting process, I co-own Property Hub Invest which offers free strategy meetings . It's often easier to work this stuff out in conversation with someone who knows their stuff, rather than doing it all in your own head.

That's a great start, but for most people it'll produce an uncomfortable insight: the gap between where you are and where you want to be seems impossibly large! With the resources you've got now, how are you possibly going to reach your goal in a sensible period of time?

Well, that's where it's time to start thinking about the details of the third step: the strategy you'll use to pursue your goal.

A strategy to bridge the gap

The steps you take to get from Point A to Point Z are what's commonly referred to as your strategy – and strategy is a vital component of your business plan.

The way I like to think about strategy is the way you compensate for a lack of cash . It's an unusual way to look at it, but I find it useful – because it tells you (given your timeframe and your goal) how much heavy-lifting your strategy will need to do to keep you on track.

Think of it like this: if you had £10m in the bank and your goal was to make an income of £5,000 per month within a year, you wouldn't need any strategy at all . You could just use your £10m to buy any properties, anywhere – you wouldn't need to maximise the rent, manage them well or even keep them all occupied at all times! You'd be able to buy so much property that you really couldn't fail.

Sure, it'd be a pretty stupid thing to do – you should really have had a more ambitious goal – but you get the point.

Obviously, most of us aren't in that position – and that's why we need a strategy.

So, just what position are you in?

A rule of thumb

A handy way of looking at it is to take the amount of money you've got to invest in property, and assume that you can get a 5% annual return on that money (ROI) – which is a rough rule-of-thumb for a normal property bought with a 75% mortgage.

So, if you've got £100,000, you can generate a (pre-tax) profit of £5,000 per year – or £416 per month.

That's unlikely to be enough to hit most people's goals – but then there's the time factor. If you save up the rental income for 20 years, you'll be able to buy another batch of properties just like the first – so you'll now have income of £832 per month.

If you're happy with that, then you've already got your strategy: buy properties that will give you your desired ROI, then wait!

Portfolio-building strategies

But most people will want more than that: we've hardly been talking about life-changing sums, and 20 years is a long time to wait before you can buy again!

This is where more of an advanced strategy comes in, allowing you to get better results, faster.

This might include:

- Buying properties and adding value, so you can refinance at the higher value and buy your next property more quickly ( learn more about this strategy )

- Buying properties at a discount, allowing you again to refinance at the higher value and move on to the next one

- Turning properties into HMOs, so you can generate a higher ROI on them

- “Flipping” properties for a profit, so you can replenish your cash more quickly ( read my guide to flipping )

…or something else entirely.

I go into different strategies in enormous detail in my book, The Complete Guide To Property Investment .

Simply appreciating the need for one of these strategies from the start is a really big deal.

Most people don't: they'll rush in, use all their money to buy properties that generate (say) £500 profit per month, then…what? They'll be stuck – because they didn't go in with a plan for how they were going to get to their target number . They'll effectively be starting from scratch, having to scrape together the money to go again.

It's extremely common, and it doesn't surprise me – but it does frustrate me. If they'd started with just a bit of time making a plan, they wouldn't have made this mistake – because it would have become very obvious that they wouldn't reach their goal without applying some strategy.

Any of the strategies I listed (or a different one, or a combination of several of them), when applied effectively, can get you to where you need to be. But that's not to say that all of them will be equally good for you. Each of them has different risk factors, requires different time commitments, are suited to different skill sets, and so on.

That's why this is your business plan: copying someone else's homework isn't going to do you any good, because their skills, attributes and preferences will be different from yours.

For example, one person's plan might be to get their hands dirty by renovating properties for resale – completing two projects per year, and using the profits to buy an HMO. Within five years they'll have five HMOs, which will give them all the income they need.

Someone else might be hopeless at anything hands-on, but a master negotiator. Their plan could be to buy at enough of a discount that they can pull at least half of their funds back out again by refinancing – and keep doing that until in ten years' time they have 15 single-let properties giving them their target income figure.

(That's why when someone emails me asking if their strategy “sounds good”, I have to say that I don't know: usually it sounds like on paper like it would work for someone , but I have no idea if they're the right person to execute it.)

So, coming up with your strategy involves:

- Starting with an assessment of where you are now

- Deciding where you want to get to, and by when

- Seeing how far you'll fall short by just buying “normal” properties

- Thinking about your own skills, time and preferences to choose which strategy (or strategies) you'll use to fill in the gap

It might take a while, and that's OK – it's not an easy decision . To take the pressure off though, remember: your plan isn't set in stone. It's important to start with a clear vision and not get distracted by every new opportunity that comes your way, but every plan is just a starting point: you'll be seeing what works, reviewing and adjusting course along the way.

Once you've got a strategy down on paper, that's a huge step – and you should congratulate yourself, because it's a step that most people will never make (and will suffer for).

But of course, the act of writing the plan isn't going to magic it into existence: you need to get out there and execute on the plan.

Turning your property business plan into action

Having an appropriate goal and a solid strategy to get you there are essential, sure – but nothing is going to happen until you actually take the steps that are necessary to execute that strategy.

If you don't take the time to identify the steps and make a plan to carry them out, you'll end up in “pulling an all-nighter the day before your homework is due in” mode. And you don't want that: it's no good setting a five-year goal, feeling all virtuous for being such a strategic and big-picture thinker, then realising in four years and 364 days that you've not actually got any closer towards making it a reality!

So let's get those steps in place. And the good news is…it's really simple. (The best things usually are.)

Breaking it down

However big, ambitious and far in the future a goal seems to be, all goals are achieved in exactly the same way : by breaking them down into individual tasks, and working through those tasks one by one.

As you work through those tasks, it’s important to have sub-goals as “checkpoints” along the way.

Sub-goals are how you stay on track: by setting a deadline for each sub-goal, you can make sure that your progress is fast enough. They also keep you motivated, because it means you’ll always have a small “win” on the horizon: you won’t just be looking at the main goal (potentially) years off in the future. Think of them as mile markers at the side of a marathon course.

To put it another way:

Small task + Small task + Small task = Sub-goal Sub-goal + Sub-goal + Sub-goal = Overall goal

It's those small daily tasks that are the foundations of your achievement. And that's the beauty of a good plan: all you need to concentrate on is ticking off your tasks each day, and your overall goal is achieved automatically!

So, this final step in your plan is about breaking that big goal down into sub-goals, and those sub-goals down into bite-sized individual tasks. That's it!

As you break it down, there are a few things I find are useful to think about…

One-off tasks v recurring tasks

Your business will have two types of task:

- One-off tasks , like finding a mortgage broker

- Recurring tasks , like viewing properties and making offers

These two types of task will both appear in your weekly, monthly and quarterly to-do lists. A useful way of planning your time is to start by filling in your recurring tasks – like going through portals to find new potential acquisitions every day, and calling agents to follow up on offers once per week – then adding your recurring tasks on top.

By thinking about both types, you'll make sure you're not dropping the ball on the important day-by-day stuff, but you're also not ignoring the big-picture one-offs that are going to make a huge difference to your business in the long run.

The first, simplest step

Just like you break a goal down into sub-goals and sub-goals down into tasks, I favour breaking every one-off task down into the smallest possible unit .

For example, “find a mortgage broker” could be an important one-off task for you, but it's not something you can just sit down and do until it's done. Because it seems nebulous and you can never identify a block of time when you can do it from start to finish, you can end up never doing it at all.

Instead, you'll make yourself feel better by ticking off smaller tasks that seem easier – but are often less important.

The solution is to break every task down into as many sub-tasks as possible. So instead of “find a mortgage broker”, the tasks become :

- Email 3 contacts to ask for recommendations

- Post on The Property Hub forum to ask for recommendations

- Email everyone who is recommended to set up a quick call

- Draw up a shortlist of 2-3 people to have a longer conversation with

- Pick a winner

Doesn't that seem much easier already? You can imagine sitting down and bashing out the first task in five minutes right now, then you're underway!

Who will do each job?

Here's a potential lightbulb moment: you don't have to do everything in your business yourself.

Any business has different “functions”, or departments – like sales, manufacturing, and admin. A property business is no exception.

The basic functions of all property businesses are the same:

- Acquisition

- Refurbishment

- Refinancing/selling

The types of task that fall within each function will depend on your business plan. For example, if your aim is to find properties you can buy “below market value”, acquisition could be a major part of the business – involving direct-to-vendor marketing, networking with estate agents, and attending auctions.

On the other hand, if your model involves buying properties that you think will experience strong capital growth, there could be a lot more tasks in the “research” part of the business – and acquisition could be very straightforward once you’ve identified the opportunity itself.

Could you do every task within every function yourself? Maybe.

Could the business achieve better results if you bring in specialists to do what they do best? Definitely .

You could go big and employ an assistant to view properties and make offers for you, or just make sure you outsource functions like management and accountancy to the relevant professionals.

Whatever you do, once you start thinking about your property venture as a business with various departments, you'll start to break away from the idea that this is something you have to do all on your own – and that's a very powerful insight.

OK, this has been a long one – but we've covered a lot of ground.

To recap, those critical steps are:

- Assess where you are now

- Work out where you want to be, and by when

- Outline a strategy to get you there

- Fill in the detail, to get you from “big picture” to individual steps

It's a process that's worked for me, and I've seen it work for many investors I've encouraged to put it into action too.

Its power is in its simplicity: you take the time to intelligently decide exactly what you need to do, then you figure out a way to (to borrow a registered trademark) just do it . As long as you show up and work through your to-do list each day, the big, scary, long-term goal takes care of itself!

Of course, you'll need to assess your progress and adjust course along the way: nothing will pan out exactly as expected, and there's a lot that can change over a timespan of several years.

But by having your plan, what you won't do is get distracted by every new idea that comes your way – researching HMOs one day, and holiday lets the next – and end up getting nowhere.

(You'd be amazed by how many plan-less people that description fits to a tee.)

So now you know how to put a property business plan together. It's not a plan that will necessarily get you funding from the bank, but it's something more important than that: a plan you can use every day to make sure you stay on track to hit your goals.

The one thing that every successful investor does

Property Rental Business Plan Template & PDF Example

- September 4, 2024

- Real Estate

Creating a comprehensive business plan is crucial for launching and running a successful property rental business. This plan serves as your roadmap, detailing your vision, operational strategies, and financial plan. It helps establish your property rental business’s identity, navigate the competitive market, and secure funding for growth.

This article not only breaks down the critical components of a property rental business plan, but also provides an example of a business plan to help you craft your own.

Whether you’re an experienced entrepreneur or new to the real estate industry, this guide, complete with a business plan example, lays the groundwork for turning your property rental business concept into reality. Let’s dive in!

Our property rental business plan is structured to cover all essential aspects needed for a comprehensive strategy. It outlines the rental operations, marketing strategy, market environment, competitors, management team, and financial forecasts.

- Executive Summary : Offers an overview of the property rental business’s concept, market analysis , management, and financial strategy.

- Properties, Amenities & Services: Describes the diverse range of properties, from urban apartments to countryside cottages, each equipped with customized amenities and services to cater to various guest preferences.

- Properties Deep Dive: Offers a detailed look into each property, including design style, location, key features, and financials related to purchase and renovation.

- Key Stats: Shares industry size , growth trends, and relevant statistics for the short-term rental market.

- Key Trends : Highlights recent trends affecting the short-term rental sector, such as the rise of eco-friendly properties, technology integration, and the shift towards local experiences.

- Key Competitors: Analyzes main competitors and differentiates the business based on unique property offerings and guest experiences.

- SWOT : Strengths, weaknesses, opportunities, and threats analysis.

- Marketing Plan : Strategies for marketing the properties to maximize occupancy and revenue.

- Timeline : Key milestones and objectives from property acquisition and planning through launch and operational optimization.

- Management: Information on who manages the property rental business and their roles.

- Financial Plan : Projects the business’s financial performance, including revenue, profits, and expected expenses, with a focus on achieving profitability and sustainable growth.

Property Rental Business Plan Template (Airbnb / VRBO)

Fully editable 30+ slides Powerpoint presentation business plan template.

Download an expert-built 30+ slides Powerpoint business plan template

Executive Summary

The Executive Summary introduces your property rental business plan, providing a succinct overview of your rental operation and its offerings. It should detail your market positioning, the variety of properties you manage, their locations, sizes, and an overview of day-to-day management practices.

This section should also discuss how your property rental business will fit into the local real estate market, including the number of direct competitors in the area, identifying who they are, along with your business’s unique selling points that set it apart from these competitors.

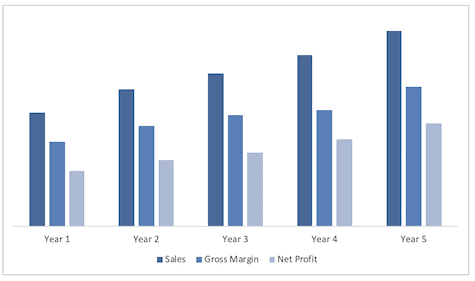

Moreover, it’s important to include information about the management and co-founding team, detailing their roles and contributions to the business’s success. Additionally, a summary of your financial projections, including revenue and profits over the next five years, should be presented here to provide a clear picture of your property rental business’s financial plan.

Property Rental Business Plan Executive Summary Example

Business Overview

The business overview should define the key characteristics of your rental business, including your approach to property selection, design, furnishing, and the tailored guest experiences you offer. Highlighting what sets your properties apart in the competitive short-term rental market is key to attracting interest and investment.

Example: “StayUnique Rentals,” a dynamic property rental business, has a portfolio of 7 unique properties, ranging from urban apartments to countryside cottages. Each property is meticulously designed and furnished to create a distinctive living experience. Beyond standard rentals, StayUnique offers personalized guest services like a 24/7 concierge, local experience packages, and tailored amenities, enhancing the overall guest experience.

Market Analysis

This section should analyze the short-term and vacation rental market’s size, growth trends, and competitive landscape . It positions your business within the industry and underscores its potential in meeting the growing demand for unique and flexible lodging options.

Example: StayUnique Rentals enters a US market valued at $19 billion, with a 1.49% CAGR. The business differentiates itself amidst various competitors by offering properties that provide unique, localized experiences, catering to a trend where travelers increasingly value authenticity and personalized services over traditional hotel stays.

Management Team

Detailing the management team’s background and roles is essential. This part of the summary should emphasize their experience in real estate, hospitality, and operational management, highlighting their capability to lead the business to success.

Example: The CEO of StayUnique, with 15 years of experience in real estate and hospitality, leads the business strategy and expansion. The COO, an expert in hospitality management, focuses on operational efficiency and guest experience, ensuring each property maintains high standards of service and guest satisfaction.

Financial Plan

Clearly outlining the financial goals and projections is crucial. This section should include revenue targets and profit margins, offering insight into the business’s financial health and growth prospects.

Example: StayUnique Rentals aims to achieve $800,000 in yearly revenue with a 5% EBIT margin by 2028. Supported by a strategic approach to property management and marketing, coupled with exceptional guest experiences, the company is positioned for significant growth in the evolving short-term rental market.

For a Property Rental Business, the Business Overview section can be effectively divided into 2 main sections:

Properties & Locations

Describe the range and types of properties within your portfolio, such as apartments, single-family homes, vacation rentals, or commercial spaces. Emphasize the diversity and quality of your properties, including any unique features or high-demand attributes they may have. Discuss the locations of your properties, stressing their accessibility and the convenience they offer to tenants.

Highlight properties that are strategically located near key amenities, such as public transport, business districts, schools, or recreational areas. Explain why these locations are beneficial in attracting and retaining your target tenants.

Amenities & Services

Detail the amenities and features available with your properties, such as in-unit laundry, security systems, fitness centers, communal spaces, or eco-friendly installations. Highlight how these amenities meet the needs and preferences of your target tenant demographic.

Outline your leasing terms and pricing strategy , ensuring they align with the value provided by your properties and the competitive market landscape. Discuss any flexible leasing options, promotional offers, or loyalty incentives you provide to enhance tenant retention and attract new tenants.

Market Overview

Industry Size & Growth

In the Market Overview of your property rental business plan, begin by examining the size of the property rental industry and its growth potential. This analysis is vital for understanding the market’s breadth and pinpointing opportunities for expansion.

Key Market Trends

Next, discuss recent trends in the property rental market, such as the growing demand for flexible leasing options, the rise of smart home technology in rental properties, and the increasing preference for properties with green, sustainable features. Highlight the shift towards more personalized tenant experiences and the popularity of properties that offer unique amenities, such as co-working spaces or pet-friendly environments.

Competitive Landscape

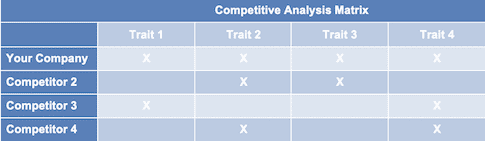

A competitive analysis is not just a tool for gauging the position of your property rental business in the market and its key competitors; it’s also a fundamental component of your business plan.

This analysis helps in identifying your property rental’s unique selling points, essential for differentiating your business in a competitive market.

In addition, competitive analysis is integral to laying a solid foundation for your business plan. By examining various operational aspects of your competitors, you gain valuable information that ensures your business plan is robust, informed, and tailored to succeed in the current market environment.

Identifying Your Competitors in the Property Rental Market

The first step to a comprehensive competitive analysis is to identify who your competitors are. Start by listing out local property rental agencies, including those that specialize in the same type of properties as you, such as luxury apartments, family homes, or vacation rentals. For example, if your focus is on high-end luxury rentals, your direct competitors would include other high-end rental agencies as well as luxury hotels offering extended stays. It’s also important to consider indirect competitors, like budget hotels or Airbnb hosts, which could offer alternative accommodation options to potential tenants.

Utilize online platforms like Zillow, Airbnb, and Booking.com to understand the geographical spread and concentration of competitors. Websites like Yelp and TripAdvisor, although more commonly associated with restaurants and travel, can also provide customer reviews and ratings for vacation rentals and long-term stays, offering insights into what tenants value or dislike about their experiences.

Property Rentals Competitors’ Strategies

When analyzing your competitors’ strategies, consider the following:

- Property Offerings: Evaluate their portfolio of rental properties. If a competitor like “CityView Rentals” is successfully attracting young professionals with its modern, tech-enabled apartments in the city center, this indicates a trend and a potential gap in your offerings.

- Rental Pricing: Compare your pricing with that of your competitors. Are your properties priced competitively with those offered by “Affordable Living Spaces,” or do they align more with the upscale properties managed by “Luxury Living Rentals”?

- Marketing Approaches: Observe how competitors market their properties. Do they rely heavily on digital marketing and platforms like Instagram and Facebook, or do they engage more with local community events and traditional advertising methods?

- Tenant Experience: Consider the overall tenant experience offered. A property management company known for its exceptional tenant service and community building, like “Happy Homes,” might provide insights into how to enhance your own tenant relations.

- Operational Efficiencies: Note if competitors are using technology or innovative methods to improve their operations, such as online rental payments, virtual property tours, or efficient maintenance request systems through “SmartRent Solutions.”

What’s Your Property Rental Business Unique Selling Point?

Reflect on what makes your property rental business unique. Perhaps you offer properties that come with unmatched amenities, or maybe your service is highly personalized, catering to the specific needs of each tenant.

Identify opportunities by listening to tenant feedback and observing industry trends. For instance, an increasing demand for pet-friendly accommodations or properties with green, sustainable features might represent a niche market that is underserved by your competitors.

Location Strategy: Consider how your properties’ locations influence your business strategy. A property rental business in a bustling city center might focus on convenience and proximity to amenities, while one in a more scenic or secluded area might emphasize the peace, privacy, and unique experiences available to tenants.

First, conduct a SWOT analysis for your property rental business, identifying Strengths (like diverse property portfolio and prime locations), Weaknesses (such as maintenance costs or vacancy rates), Opportunities (for instance, the growing demand for flexible housing and rental spaces), and Threats (like market saturation or regulatory changes impacting rental operations).

Marketing Plan

Then, devise a marketing strategy that details how to attract and retain tenants through strategic online listings, virtual tours, referral incentives, a strong online presence, and engagement with the local community.

Marketing Channels

Utilize various marketing channels to effectively showcase your rental properties and entice prospective tenants.

Digital Marketing

Establish a strong online presence:

- Property Listing Websites: Advertise your properties on popular rental listing platforms, providing detailed descriptions, high-quality images, and virtual tours.

- Social Media : Establish a robust online presence by listing properties on renowned rental platforms, providing detailed descriptions, high-quality images, and engaging virtual tours. Leverage social media platforms like Facebook, Instagram, and LinkedIn to showcase property highlights, share tenant testimonials, and offer insights into the local community.

- Email Marketing: Build an email list of potential tenants and send regular newsletters featuring available properties, leasing specials, and local community updates.

Local Advertising

Connect with the local community:

- Real Estate Publications: Advertise in local real estate magazines, newspapers, and online forums to reach a wider audience.

- Community Engagement: Participate in local events, sponsor community initiatives, and collaborate with neighborhood associations to increase visibility and credibility.

Promotional Activities

Entice potential tenants with attractive offers:

- Special Rental Deals: Introduce limited-time promotions such as ‘Move-in Specials’ with reduced security deposits or ‘Refer-a-Friend’ programs offering incentives for tenant referrals.

- Tenant Incentives: Offer incentives like a month of free rent for longer lease commitments or complimentary amenities for new tenants.

Sales Channels

Sales channels in property rental encompass diverse methods through which you promote and offer rental services to potential tenants, playing a pivotal role in revenue generation and ensuring tenant satisfaction.

- Property Tours and Open Houses: Organize captivating property tours and open houses showcasing unique property features and benefits to prospective tenants. Engaging and informative tours significantly impact tenant interest and engagement. Informative tours significantly influence tenant interest and contribute to successful lease agreements.

- Online Leasing Platforms: Implement user-friendly online leasing platforms that simplify the application process, enable digital lease signing, and facilitate secure rental payments. Seamless online platforms enhance tenant convenience and streamline the leasing process. Offer digital lease signing and secure payment options, enhancing tenant convenience and expediting lease finalization.

Tenant Retention Strategies

Focus on retaining existing tenants:

- Exceptional Tenant Service: Focus on exceptional tenant service, providing timely responses and personalized experiences to build strong tenant-landlord relationships. Superior service enhances tenant satisfaction and loyalty.

- Renewal Incentives: Offer attractive lease renewal incentives such as rent discounts, property upgrades, or exclusive amenities to encourage existing tenants to extend their leases. Rewarding loyalty reinforces tenant retention and ensures prolonged occupancy.

Strategy Timeline

Lastly, establish a comprehensive timeline that marks key milestones for the launch of your rental operations, marketing initiatives, tenant engagement plans, and growth or diversification goals, ensuring the business progresses with a focused and strategic approach.

The Management section focuses on the property rental business’s management and their direct roles in daily operations and strategic direction. This part is crucial for understanding who is responsible for making key decisions and driving the property rental business towards its financial and operational goals.

For your property rental business plan, list the core team members, their specific responsibilities, and how their expertise supports the business.

The Financial Plan section is a comprehensive analysis of your financial projections for revenue, expenses, and profitability. It lays out your property rental business’s approach to securing funding, managing cash flow, and achieving breakeven.

This section typically includes detailed forecasts for the first 5 years of operation, highlighting expected revenue, operating costs and capital expenditures.

For your property rental business plan, provide a snapshot of your financial statement (profit and loss, balance sheet, cash flow statement), as well as your key assumptions (e.g. number of customers and prices, expenses, etc.).

Make sure to cover here _ Profit and Loss _ Cash Flow Statement _ Balance Sheet _ Use of Funds

Related Posts

Real Estate Broker Business Plan Template & PDF Example

- Business Plan

Home Inspection Business Plan Template & PDF Example

Competitive Analysis for a Real Estate Broker Business (Example)

- Business Plan , Competitive Analysis

Privacy Overview

- iPropertyManagement

- Rental Property Investing

- Start Rental Business

How to Start a Rental Property Business in 7 Steps

Last Updated: March 29, 2024 by Cameron Smith

To start a rental property business, you’ll need to figure out your financial goals, property acquisition, financing, property management, corporate business structure, and much more.

What is a Rental Property Business?

A rental property business simply means that you’re earning income from at least one rental property. Some people see their business as a way to earn a few extra hundred dollars per month while the property appreciates, while others have thousands of properties that earn millions of dollars per year.

One huge benefit of owning a rental property business is that rental income isn’t subject to self-employment tax. It’s reported to the IRS as ordinary income, so the government doesn’t categorize your rental income as coming from a business.

Why You Should Invest in Rental Properties

Many investors will tell you that owning property is the best investment out there. There are a lot of reasons for this, including:

- Appreciation. Your property is going to go up in value significantly over time.

- Leverage. You can purchase a property with only 20% down and finance the rest. Any gains made on the value come back to you as if you’d bought the entire property with cash.

- No mortgage payment. Your tenants cover the mortgage on your asset.

- Cash flow. Done right, you should also be earning some cash flow. This may be small in the beginning, but as rental prices increase, you’ll earn more and more.

- Tax benefits. You can deduct most expenses for your rental business. You can even deduct the value of the house spread out over 27.5 years (known as depreciation).

- Asset control. You get full control over when you decide to sell, the improvements you want to make, and who gets to live in the property. This isn’t the case when you buy a stock.

How to Start a Rental Property Business

To get your rental property business running, here are the steps you’ll want to take:

- Develop Your Goals

- Decide How You’ll Find Properties

- Determine Financing

- Get the Property Ready to Rent

- Manage the Property

- Plan for Unexpected Costs

- Systematize

1. Develop Your Goals

The main thing to ask yourself when developing your goals is this:

What does your perfect rental business look like?

From there, you can start brainstorming. Get as specific as you like, because it’s often those kinds of details that help your business solidify in your mind.

Here are a few things that you should consider addressing when answering this question and setting goals:

- How much do you want to earn per month or year from rental income?

- How many properties do you need to hit this income goal?

- How long until you want to hit this goal?

- How many properties do you need to acquire per year?

- Are you only going to work with rental properties, or use other strategies as well?

- Are you planning to manage the properties yourself?

- What’s your exit plan for the properties? Do you want to sell them at a high point, when you retire, or never?

- Are you planning to pay off the rentals as quickly as you can or make the minimum mortgage payment?

There are plenty more that you can ask at this point, but much more will be answered in the next steps of starting your rental business.

2. Decide on Property Acquisition

If you’re considering a rental property business, then you’ve likely already thought about how you want to acquire properties.

However, it can be different for your first property than it is for acquiring many properties over the years.

Acquiring your first property

Many investors get into their first rental property when they want to move and turn their current home into a rental unit.

New investors like this strategy because it’s simple. You already know the neighborhood, the condition of the house, and what upkeep it needs. A new, strange house can be scarier to rent out.

It can also be cheaper to acquire a house this way, as you might be able to buy your new home using an FHA loan. This means you can pay 3.5% down rather than 20%.

If your current home is an FHA loan, you’ll need to refinance before you can purchase your next home with an FHA loan. You can’t hold two at the same time.

If you are interested in buying a separate rental property, you’ll likely be required to put 20% down. Some people choose to buy brand new properties, as they require less maintenance at first. Many new investors find that a less scary prospect.

3. Determine Financing

The scariest part of getting into a rental property is bringing that initial chunk of cash. Generally, if you’re looking at a $500k property, you’ll need $100k cash on hand to make the deal work.

However, there are other ways that you can find ways to finance your rentals:

- BRRRR – This stands for Buy, Rehab, Rent, Refinance, Repeat. Basically, you treat the house as if you’re going to do a fix and flip where you first secure a hard money loan (some have 0% down options). Then, instead of reselling the house, you refinance into a long-term loan and rent out the house.

- Find a Partner – If you’re willing to do the work of finding and managing the rental, you can often find someone who’s willing to put up some or all of the money upfront for you. You can go to your friends and family, but also networking at events is a great way to find partners.

- Refinance Your House – If you can pull $100k out of your home’s equity, that’s the easiest possible solution.

- Home Equity Loans – Rather than pulling out equity, you can borrow against your equity and pay it off over time.

4. Preparing the Property

Now, you’re the proud owner of a new rental property. Is it time to throw it up on the market?

Rarely will your property be 100% rental-ready. Consider a brand new home, for example. There’s a good chance you’ll need to landscape the yards, install curtains, purchase a fridge, and do whatever else is necessary to make it a liveable property.

If you’ve purchased an older house, some maintenance will be necessary.

With rentals, it’s important to make the place look nice, but not to go overboard. Sure, you may think the property would look better with new marble countertops, but how long will it take to earn back that cost in rental income?

In many cases, your best options are to fix anything that is obviously broken, give the walls a fresh coat of paint, and professionally clean the carpets. These are lower-cost activities that still make the property presentable.

5. Manage the Property

The ongoing management of the property takes a lot of work with many moving parts to sort out. Here are just some of the tasks you’ll have to figure out:

- Property Marketing . Are you going to run Facebook ads? Put up signs in front of the property? Which rental listing sites are you going to use? You’ll also have to write headlines and descriptions for these sites as well.

- Applicant Screening. You’ll need to decide on a tenant screening service and what your minimum requirements are for credit scores, bankruptcies, and more. You’ll also need to check in on references (landlords, employer, personal) and also conduct open houses with a bit of an interview with attendees.

- Property maintenance requests. When something goes wrong, the tenants need to call someone to get it sorted out. Will that person be you? If so, you’ll need to have trusted vendors on speed dial.

- Emergency response. If the house floods in the middle of the night, you’ll need a plan for handling it.

- Regular communication. You’ll need to schedule inspections, handle complaints, and communicate about lease end dates and possible renewals.

DIY or Property Manager

Of course, much of managing a property can be outsourced to a property manager. You’ll sleep better at night and have more free time.

However, you might also eat through the last of your thin monthly margin. Is it worth having little-to-no passive income at the beginning to hire a property manager?

Many investors will handle the upkeep for a few properties in order to pocket more money. However, upon expansion, you’ll certainly need a property manager who can spend much more time than you can (or want to).

6. Manage Finances

If you’re going to run your rentals like a true business, that means that you need complete transparency and understanding about what’s happening to every penny.

There’s nothing worse than realizing you have a big tax bill with nothing set aside or confusion about why your business is in the red.

At the very least, you should keep a spreadsheet with all of your income and expenses. One of the easiest ways to manage this is to keep an entirely separate bank account so all of the funds are easy to manage.

Then, be sure that you understand future costs. This includes taxes, planned renovations, vacancies (where you have to cover the mortgage), and emergency repairs. Without money set aside for these, your business may be short-lived.

7. Systematize and Grow

All the steps covered so far are generally more for starting and managing your first few rental properties.

But if you’re planning to expand into dozens or hundreds of rentals, you’ll need to figure out a few more things along the way.

Mass Acquisition of Properties

When it’s time to scale, it’s likely going to become too time-consuming to evaluate every property from scratch. It’s not efficient to research an entirely new area or type of property with each property you want to acquire.

For this reason, it makes sense to pick a niche. For example, some people buy up student housing near a single university. You can quickly understand rent prices and know exactly how much you can pay for a new property. Research becomes automatic.

Or perhaps, you only buy new townhomes within a certain part of a single city. Or, you decide to do a lot of research at once and go in on a large apartment building.

Funding Properties

Funding a property or two at the beginning is much different than funding dozens in a short amount of time. If you’re lucky enough to have a bunch of cash on hand, perhaps you can afford to keep putting down 20% yourself on every property.

Or, maybe you’ll need to refinance those first few properties to afford adding more to your portfolio, although that isn’t a well that you can draw from forever.

Often, your best solution is to find a financing partner. Rather than a bank with strict rules and regulations, you can find a private lender who may be willing to put up all the money while you handle the business side of things.

This goes much easier once you already have a portfolio of successful properties.

Property Manager

As mentioned before, you’ll certainly need a property management company to handle your properties once you have several in your portfolio.

At some point, it may also make sense to hire a full-time property manager who works only for you. Many owners prefer this because they can retain more control than they could by handing everything to a third-party company.

You’ll likely need an online rental management software that can handle things like:

- Collecting rental applications

- Sending and collecting signed contracts

- Collecting rent

- Recording rent

- Taking maintenance requests

Business Structure

You’ll certainly want to form your rental business into an actual company, and there are plenty of options at your disposal.

A common one is to form an LLC , but be sure to talk to a lawyer before settling on a final decision. The tax implications alone can be enormous.

Top Reasons Rental Owners Quit and How to Avoid Them

Rental property owners often get frustrated and decide to sell their properties, sometimes on a whim to a fix & flip investor who sent them a postcard.

While it may end up being the right decision for you, it does mean you’re missing out on the long-term appreciation.

Here are three of the most common reasons rental owners quit and how you can protect yourself against those reasons.

Bad Tenant Behavior

Every rental owner has nightmares about showing up to their property one day and seeing the windows broken, the walls graffitied, and everything inside destroyed.

Landlords who get in this situation and then receive a postcard from an investor who wants to buy the home may find this offer tempting.

Tenants can also infuriate owners with behavior such as:

- Constant maintenance requests

- Refusal to follow all lease rules

- Poor communication

- Frequent complaints

- Late rent payments

How to Avoid Bad Tenant Behavior

There are two main solutions to handling bad tenant behavior:

- Hire a property manager . The bad behavior may still be there, it just won’t be you dealing with it on a day-to-day basis.

- Find top-notch tenants . Always follow up with their employers, previous landlords, and personal references. Get the most comprehensive tenant screening reports. It’s worth a bit extra time and money to get a tenant who will treat the property like they own it.

Unexpected Costs

Most landlords deal with fairly thin margins those first few years. There’s nothing more infuriating than unexpected costs showing up and wiping out any profit you thought you’d earned.

Some unexpected costs include:

- Roof replacement

- Burst pipes

- HVAC needs to be replaced

- Long vacancies

How to Avoid Unexpected Costs

Handling unexpected costs isn’t easy, because (by definition) you can’t predict them. But, you can run your business as if there’s always an unexpected cost around the corner.

There are a few ways experts suggest for determining how much money to set aside:

- 1% – 2% of the value of your home each year

- $1 per square foot per year

Whichever method you choose, try to be generous in what you set aside. One year, your maintenance might be minimal, while the next year you might replace a roof.

In addition, unexpected costs are generally lower on new properties. While a bit pricier to purchase, it might be worth it with higher rental rates and lower maintenance.

Need Liquid Money

Perhaps another investment opportunity comes your way that you’re more excited about than a rental. Or, you might need some cash to pay off another debt or life expenses if you lose your job.

While owning rentals can be profitable, they can also be frustrating with how effectively they tie up your cash.

How to Avoid Needing Liquid Money

The best advice here is to understand that owning a rental likely isn’t for you if money is tight elsewhere. Wait until you have sufficient cash reserves before investing in a rental property (this helps you avoid unexpected costs, as well).

If you have equity in the property, consider a cash-out refinance. This can raise your monthly mortgage payment, but may be worth it to pull out a considerable lump sum.

More Property Management Resources

Benefits of Owning Rental Property

Rental Profit

Rental Property Expenses

Rental Tax Deductions

Buy Property without Money

Rental Renovations

How to Write a Business Plan as a Landlord

Editor's Note: This post was originally published in April 2020 and has been completely revamped and updated for accuracy and comprehensiveness.

Buying investment properties and renting them out to tenants is a great way to diversify your real estate portfolio and earn passive income. If you are considering becoming a landlord, writing a rental property business plan is vital to make your investment thoughtfully and deliberately. A well-crafted business plan can help you secure financing from lenders. A business plan demonstrates that you clearly understand your business and its potential, making you more attractive to potential lenders. Let's begin! This piece will walk you through what a rental property business plan is, why you should create one, and how to put one together.

What is a rental property business plan?

Most simply, a rental property business plan is a document that describes the following:

- You and your rental business.

- What your intentions and goals are with a property.

- Your plan for executing these goals.

Your rental property business plan will outline the strategies and goals for managing your properties.

Why should you develop a rental business plan?

Here are some reasons why you should create a rental property business plan:

- Provides a clear direction: A business plan outlines the goals and objectives of the rental property business, which helps you stay focused on achieving your vision. It also provides a roadmap for decision-making and ensures all activities align with the overall strategy.

- Helps secure financing: A business plan shows that you understand your business well, making your business more appealing to lenders.

- Identifies potential risks: A business plan identifies potential risks associated with the rental property business and provides strategies to mitigate them. This helps to avoid costly mistakes and ensures that you're well-prepared for any challenges that may arise.

- Enhances property management: A business plan includes a strategy outlining how you will manage your rental properties effectively.

- Enables monitoring and evaluation: A business plan provides performance metrics that will help you to monitor and evaluate your progress. This also allows you to identify areas for improvement and adjust your strategy accordingly.

First things first — set your business plan objectives.

Before creating your business plan, consider your specific objectives for your rental business. By setting your objectives, you're providing yourself with a target to aim for. A SMART goal incorporates all of these criteria to help focus your efforts and increase the chances of achieving your goal. This is a specific, measurable, achievable, relevant, and time-bound goal commonly used in business and project management to set and achieve goals.

The acronym SMART stands for:

- S - Specific: The objective should be clear and well-defined so everyone involved understands what they need to accomplish.

- M - Measurable: The objective should be quantifiable to measure and track progress over time.

- A - Achievable: The objective should be realistic and achievable based on available resources and the timeframe.

- R - Relevant: The objective should be relevant to your business's or project's overall mission or goals.

- T - Time-bound: The objective should have a specific deadline or timeframe for completion so you can monitor progress and make adjustments as needed.

Here are some examples of SMART goals for a rental investment business:

- Own four properties by the end of the year

- Earn $5k in rental revenue per month

- Earn $150k in rental profit by the end of year 5

- Hire a team of 4 business partners and open an office in Nashville, TN, in the next five years

- Find 15 tenants by the end of next year

You may only have one key objective or multiple, but each goal should have strategies and tactics to help achieve it.

Strategies and tactics for your SMART objectives

Let's take the relatively straightforward objective — own four properties by the end of the year. Easier said than done, right? Your strategy will be your rough game plan to achieve this goal. Here are some examples of strategies you may employ:

- Study local housing markets to find undervalued neighborhoods.

- Use hard money lending groups and meetups to help secure capital.

- Specialize in and become a master of a specific housing type (single-family homes, duplexes, apartments, townhouses, etc.)

You can then drill down each strategy into specific tactics. Here's what that looks like:

Study local housing markets to find undervalued neighborhoods:

- Study Zillow and MLS listings to see locations and figures of sales.

- Physical drive-thrus of neighborhoods to see house styles, number of For Sale signs

- Attend foreclosure auctions in different Tennessee counties

- Leverage social media to identify potential properties

- Try creative methods to find undervalued properties beyond the MLS

Use hard money lending groups and meetups to secure affordable and scalable financing:

- Join online hard money communities and see which lenders offer low rates, good terms, etc.

- Go to real estate conferences and network with lenders, wholesalers, etc.

Specialize in and become a master of a specific housing type:

Focus on 3br/2b single-family homes between 1500-2500 sq feet

How to write a rental property business plan

Now that you've thought about precisely why and how you will structure your business and execute your investment, it's time to write it! A rental property business plan should have the following components: The business plan typically includes the following elements:

- Executive Summary

- Business Description

- Market Analysis

- Marketing and Advertising

- Tenant Screening

Property Management

- Financial Projections

Risk Management

- Exit Strategy

Let's go through each of them separately.

Executive summary

The executive summary of a rental property business plan provides an overview of the key points of the plan, highlighting the most critical aspects. Here's an example of an executive summary:

[Your Business Name] is a real estate investment firm focused on acquiring and managing rental properties in [location]. The business aims to provide tenants high-quality rental properties while generating a steady income stream for investors. The rental property portfolio comprises [number] properties, including [type of properties]. These properties are located in [location], a growing market with a high demand for rental properties. The market analysis shows that rental rates in the area are stable, and the demand for rental properties is expected to increase in the coming years. The business's marketing and advertising strategies include online advertising, signage, and word-of-mouth referrals. The tenant screening process is thorough and includes income verification, credit checks, and rental history verification. The property management structure is designed to provide tenants with excellent service and to maintain the properties in excellent condition. The business works with a team of experienced property managers, maintenance staff, and contractors to ensure that the properties are well-maintained and repairs are made promptly. The financial projections for the rental property portfolio are promising, with projected revenue of [revenue] and net income of [net income] over the next [timeframe]. The risks associated with owning and managing rental properties are mitigated through careful screening of tenants, regular maintenance, and appropriate insurance coverage. Overall, [Your Business Name] is well-positioned to succeed in the rental property market in [location], thanks to its experienced team, careful management, and commitment to providing high-quality rental properties to tenants while generating a steady stream of income for investors.

Your executive summary is the Cliff Notes version of the complete business plan. Someone should be able to understand the full scope of the project just by reading this section. When writing your executive summary, assume it is the only part of your plan that someone reads. Aim for a half-page to full-page in length.

Business description

The business description section of a rental property business plan provides an overview of the company, including its mission, history, ownership structure, and management team. Here's an example of a company description section:

[Your Company Name] is a real estate investment company focused on acquiring and managing rental properties in [location]. The company was founded in [year] by [founder's name], who has [number] years of experience in the real estate industry.

Mission: Our mission is to provide high-quality rental properties to tenants while generating a steady income stream for our investors. We aim to be a trusted and reliable partner for tenants, investors, and stakeholders in our communities.

Ownership structure: [Your Company Name] is a privately held company with [number] of shareholders. The majority shareholder is [majority shareholder name], who holds [percentage] of the company's shares.

Management team: The management team of [Your Company Name] includes experienced professionals with a proven track record of success in the real estate industry. The team is led by [CEO/Managing Director's name], who has [number] years of experience in real estate investment and management. The other members of the management team include:

[Name and position]: [Brief description of their experience and role in the company] [Name and position]: [Brief description of their experience and role in the company]

Market analysis

Researching neighborhood trends can help you identify areas poised for long-term growth. This can enable you to make strategic investments that will appreciate over time, providing a stable source of income for years to come. The Market Analysis section of a rental property business plan for landlords should provide a comprehensive overview of the local rental market. Below are some key elements you should include in the Market Analysis section of your rental property business plan.

- Property Value: The value of a rental property is highly dependent on its location. By researching neighborhood trends, landlords can stay updated on changes in property values, both positive and negative. They can make informed decisions about whether to purchase, hold or sell their properties based on changes in the area.

- Rental Rates: Knowing the rental rates in a neighborhood can help landlords determine how much to charge for rent. Understanding how much other landlords charge for similar properties in the area can help a landlord price their property competitively and attract quality tenants.

- Tenant Preferences: Different neighborhoods appeal to different types of tenants. For example, families with children may prefer neighborhoods with good schools and parks, while young professionals may prefer areas with trendy restaurants and nightlife. By understanding neighborhood trends, landlords can cater to the preferences of their target tenants.

- Neighborhood Safety: Safety is a significant concern for tenants, and landlords can be held liable for any harm that befalls their tenants due to unsafe conditions on the property. Competitive landscape: There are several steps that landlords can take to research the competitive landscape of a rental market. These include identifying competitors, analyzing rental rates, researching amenities offered by competitors, and checking their online reviews.

- Growth potential: Consider external factors that may affect the rental market, such as population growth, job growth, or changes in zoning laws. This can help landlords identify potential growth opportunities in the market.

Marketing strategy

The marketing strategy section of your rental property business plan outlines how you will promote and advertise your rental properties to potential tenants. Below are some key elements to include in this section.

- Target Market: Identify the target market for rental properties, such as young professionals, families, or retirees. Describe their demographics, interests, and needs, and explain how the rental properties cater to these groups.

- Unique Selling Proposition: Identify the unique selling proposition of the rental properties, such as location, amenities, or affordability. Explain how these factors differentiate the properties from competitors in the market.

- Advertising Channels: Describe the advertising channels you'll use to promote the rental properties, such as online rental listings, social media, or local newspapers. Explain how you'll use these channels to reach the target market.

- Promotion Strategy: Describe the promotion strategy to attract tenants to the rental properties, such as discounts, referral bonuses, or move-in incentives. Explain how you'll communicate promotions to potential tenants and how they will be tracked and measured for effectiveness.

- Branding: Develop a branding strategy for the rental properties, including a logo, website, and promotional materials. Explain how the branding will reflect the unique selling proposition of the properties and how it will be used consistently across all marketing channels.

- Budget: Develop a marketing budget outlining each advertising channel's expected costs and promotion strategy. Explain how you'll track and adjust the budget as needed to ensure maximum return on investment.

Tenant screening

This section should outline the steps you or your property manager will take to evaluate potential tenants and ensure they fit your rental property well. This can ensure that your company has a thorough and fair process for evaluating potential tenants and selecting the best fit for their rental property. B elow are some critical components to include in this section.

- Criteria for Screening: Define the criteria you will use to evaluate potential tenants. This includes credit score, income, employment, criminal, and rental history.

- Application Process: Detail the application process that potential tenants will go through. This may include the application form, application fee, and required documentation such as pay stubs, rental history, and references.

- Background Checks: Describe the background checks you'll conduct on potential tenants. This may include a credit check, criminal background check, and reference checks with previous landlords.

- Approval Process: Outline the process for approving or denying a tenant application. This may include a review of the applicant's qualifications, background check results, and a decision based on the landlord's discretion.

- Fair Housing Compliance: Include a statement about compliance with fair housing laws. Landlords and property managers must ensure they do not discriminate against applicants based on protected classes such as race, color, religion, sex, national origin, disability, or familial status.

This section should outline the steps you or the property manager you have hired will take to manage the rental property effectively and ensure a positive experience for tenants. Below are some key components to include in the property management section of a rental property business plan.

- Maintenance and Repairs: Outline the process for addressing maintenance and repair issues. This may include a description of how tenants can report problems, the timeline for responding to requests, and the types of repairs that are the landlord's responsibility versus the tenant's responsibility.

- Rent Collection: Detail the process for collecting rent from tenants. This may include the due date for rent payments, late fees, and consequences for non-payment.

- Lease Agreement: Describe the lease agreement that tenants will sign. This may include the length of the lease, rent amount, security deposit, and rules and regulations for the property.

- Tenant Communications: Outline your approach to communicating with tenants. This may include regular newsletters or updates on property maintenance, a process for addressing tenant concerns, and emergency contact information.

- Compliance and Risk Management: Include a statement about compliance with regulations and risk management. This may include descriptions of insurance coverage, safety protocols, and any regulatory requirements the business must follow.

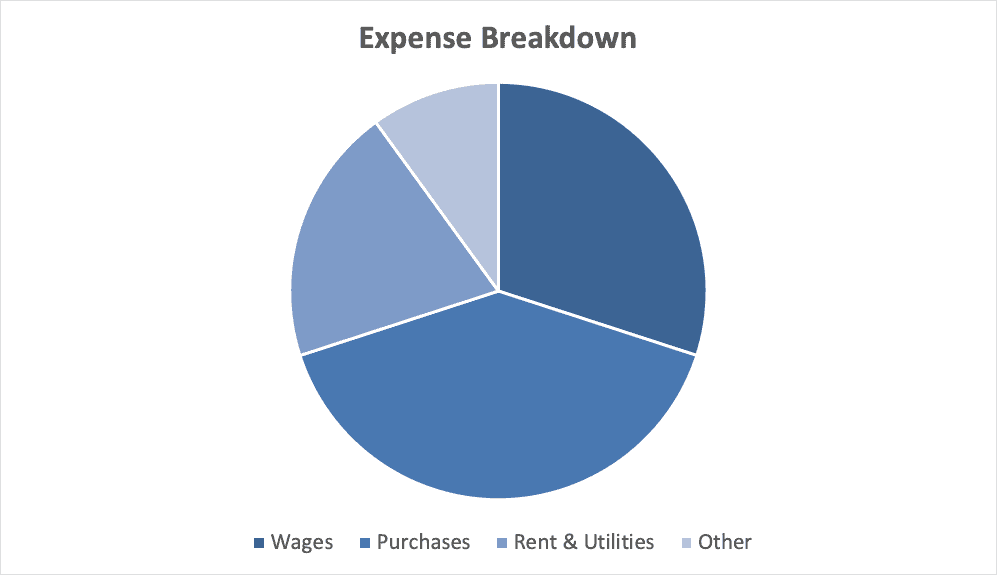

The financials section of your rental property business plan is crucial for demonstrating the business's financial feasibility and potential profitability of the investment. Let's take a look at what you can include.

- Income projections: Start by estimating the expected rental income from the property. This should be based on market rates for similar properties in the area, considering location, size, amenities, and condition. Consider any potential income streams beyond rent, such as laundry facilities or parking fees.

- Expense projections: Next, estimate the ongoing expenses associated with owning and managing the property, including mortgage payments, property taxes, insurance, utilities, maintenance and repairs, and property management fees, if applicable. Be sure to factor in seasonal or irregular expenses, such as snow removal or landscaping.

- Cash flow projections: Based on the income and expense projections, calculate the expected net cash flow for the property monthly and annually. This will give you a sense of how much income the property will likely generate after paying expenses.

- Financing plan: If you plan to finance the purchase of the property, outline your financing plan, including the loan amount, interest rate, and repayment terms. Be sure to calculate the impact of financing on your cash flow projections.

- Return on investment: Calculate the property's expected ROI based on the initial investment and projected cash flows over a specified time (e.g., five years). This will give you a sense of whether the investment will likely be profitable in the long term.

- Sensitivity analysis: Conduct sensitivity analysis to assess the potential impact of changes in key assumptions (e.g., vacancy rate, rental income, expenses) on your cash flow projections and ROI. This will help you identify potential risks and make informed decisions about the investment.

As a landlord, you must include a risk management section in your rental property business plan to address potential risks and establish strategies for mitigating them. Below are some key steps you can take to create a risk management section for your business plan.

- Identify potential risks: Identify risks associated with your rental property business. This may include risks related to property damage, tenant safety, liability, financial loss, and legal compliance.

- Assess the likelihood and impact of each risk: Once you have identified potential risks, assess the likelihood and potential impact of each risk on your rental property business. This will help you prioritize which risks to address first and determine the resources you must allocate to manage each risk.

- Establish risk management strategies: Develop a plan for managing each identified risk. This may include measures to prevent the risk from occurring, as well as steps to mitigate the impact of the risk if it does happen. For example, you may establish a routine property inspection program to identify and address maintenance issues before they become significant problems. You may also require tenants to carry renters' insurance to mitigate financial loss if they cause damage to the property.

- Review and update your risk management plan regularly: Risks can change over time, so it's essential to review and update your plan regularly. This will help you ensure that your strategies are still effective and that you are prepared to manage new risks as they arise.

- Seek professional advice: Consider seeking professional advice from a lawyer, insurance agent, or another expert to help you identify potential risks and develop effective risk management strategies. This can help you ensure your business is well-protected and minimize risk exposure.

By including a comprehensive risk management section in your rental property business plan, you can demonstrate to potential investors, lenders, and tenants that you are committed to running a safe and sustainable rental property business.

Exit strategy

An exit strategy is integral to any rental property business plan as it helps you plan for the future and maximize your ROI. You most likely plan on renting out your property for a long or indefinite time. If you have a shorter or more definite timeline, like renting it out for ten years and then selling it, mention it here. Should your property go vacant for a long time, or economic circumstances, cause rent prices to fall dramatically, maintaining your property may no longer be sustainable. You should have a plan, or at least a framework, to decide what to do if this happens. Otherwise, your exit strategy should be your backup plan if things don't go as planned.

Final thoughts

Creating a comprehensive rental property business plan provides you with a clear direction for your business, helps secure financing, identifies potential risks, enhances property management, and enables monitoring and evaluation of performance. A business plan is valuable for landlords who want to run a successful rental property business.

Dreaming of scaling your real estate investments?

Kiavi leverages cutting-edge tech and data to fuel your growth with fast, reliable capital.

Related Articles

The above is provided as a convenience and for informational purposes only; it does not constitute an endorsement or an approval by Kiavi of any of the products, services or opinions of the corporation or organization or individual. The information provided does not, and is not intended to, constitute legal, tax, or investment advice. Kiavi bears no responsibility for the accuracy, legality, or content of any external content sources.

ZenBusinessPlans

Home » Sample Business Plans » Real Estate

How to Write a Rental Property Business Plan (Sample Template)

Are you about starting a rental property business? If YES, here is a complete sample rental property business plan template & feasibility report you can use for FREE . The Apartment Rental industry is a very vast industry and there are loads of businesses opening up in the industry. There are several business opportunities an aspiring entrepreneur who has good capital base can start and one of such opportunities is a rental property business.

If you want to start a rental property business, then you need to write your own business plan. The essence of writing a business plan before starting any business is for you to have a blueprint of how you want to setup, manage and expand your business. Below is a sample rental property company business plan template that will help you to successfully write yours with little or no stress.

A Sample Rental Property Business Plan Template

1. industry overview.

Rental property business is grouped under the Apartment Rental industry and this industry is made up of companies that rent one-unit structures, two- to four-unit structures, five- to nine-unit structures, 10- to 19-unit structures, 20- to 49-unit structures and 50- or more unit structures.