Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

You’ve come to the right place to create your Accounting business plan.

We have helped over 5,000 entrepreneurs and business owners create business accounting plans and many have used them to start or grow their accounting firms.

Below is a template to help you create each section of your Accounting business plan.

Executive Summary

Business overview.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana. We provide a full suite of accounting services to local businesses, including bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal client base from providing his services through competing firms. His expertise, reputation, and loyal client base will ensure that our firm is successful.

Product Offering

DeSanta & Co will offer its clients a full suite of accounting services. These services include bookkeeping, accounting, tax services, and auditing. The company will employ a large and diverse staff of professional accountants to ensure we can offer as many services as possible.

Customer Focus

DeSanta & Co will serve small and medium-sized businesses located in the Indianapolis, Indiana area. Most of these businesses will have less than 1000 employees and earn a revenue less than $10 million per year. We will also offer limited services to individuals, such as tax prep and help.

Management Team

DeSanta & Co’s most valuable asset is the expertise and experience of its founder, Michael DeSanta. Michael has been a certified public accountant (CPA) for the past 20 years. Throughout his career, he has developed a loyal client base, and many clients have stated that they will switch to DeSanta & Co once the company is established and running. Michael’s combination of skills, accounting knowledge, and loyal following will ensure that DeSanta & Co is a successful firm.

Success Factors

DeSanta & Co will be able to achieve success by offering the following competitive advantages:

- Michael DeSanta will initially help the client base that he has built carefully over the past twenty years.

- The company will emphasize providing client-focused service so that our clients feel valued.

- The company will provide our accounting services at an affordable rate.

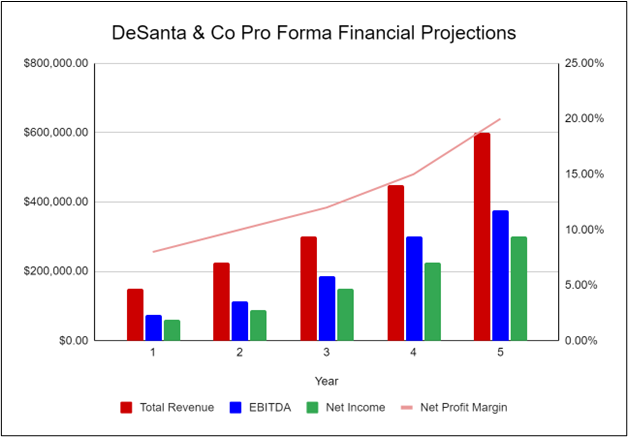

Financial Highlights

DeSanta & Co is currently seeking $400,000 to launch. The funding will be dedicated to the office build out, purchase of initial equipment, working capital, marketing costs, and startup overhead expenses. The breakout of the funding is below:

- Office design/build: $100,000

- Office equipment, supplies, and materials: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $50,000

- Working capital: $50,000

The following graph below outlines the pro forma financial projections for DeSanta & Co.

Company Overview

Who is desanta & co.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana that provides local businesses with a full suite of accounting services. We are a small firm but have considerable experience, so we can offer better quality of services than our competition. We expect that our most popular services will include bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal client base from providing his services through competing firms. After working for several accounting firms around town, he surveyed his client base to see if they would be willing to switch to his new company once launched. Most of his clients responded positively, which motivated Michael to finally launch his business.

DeSanta & Co History

Upon surveying his client base and finding a potential office, Michael DeSanta incorporated DeSanta & Co as an S-Corporation in April 2023.

The business is currently being run out of Michael’s home office, but once the lease on DeSanta & Co’s office location is finalized, all operations will be run from there.

Since incorporation, DeSanta & Co has achieved the following milestones:

- Found an office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

DeSanta & Co Services

DeSanta & Co will provide the following services to its clients:

- Bookkeeping

- Tax services

- Advisory services

- Investment services

- Management consulting

- Valuation and planning

Industry Analysis

The accounting industry is essential to the success of other businesses and industries. Accountants record and track financial transactions, which helps businesses ensure they are making a profit. As such, accounting services are always in demand and the industry often sees great growth.

There are several essential services that accounting firms can provide to businesses and individuals. The most popular services include bookkeeping, tax services, advisory services, and valuation and planning. Though most businesses employ their own accountants, many businesses are switching to hiring accounting firms to save on costs.

The accounting industry is expected to grow over the next several years. According to The Business Research Company, the accounting industry is expected to grow at a CAGR of 4.2% from now until 2027. This growth is due to the increasing demand for accountants worldwide. This increase in demand and industry growth ensures that DeSanta & Co will achieve success.

Customer Analysis

Demographic profile of target market, customer segmentation.

DeSanta & Co will primarily target the following customer profiles:

- Local small businesses

- Medium-sized businesses

- Individuals

Competitive Analysis

Direct and indirect competitors.

DeSanta & Co will face competition from other companies with similar business profiles. A description of each competitor company is below.

Perkins & Smith

Perkins & Smith is a small accounting firm that has intentionally remained small so that they can have stronger relationships with their clients. Since they opened in 1960, Perkins & Smith has been one of the leading accounting firms in the Four State Region. They offer a wide range of services including accounting, bookkeeping, payroll services, tax prep and planning, and advisory services. They have built up a loyal clientele and maintained a strong, positive reputation since their opening decades ago.

Premiere Accounting

Premiere Accounting is a large accounting firm that specializes in helping large businesses with accounting, taxes, and similar services. Since opening in 1995, they have acquired a loyal client base, including several multi-billion dollar companies. They employ over a hundred professionals who all have diverse backgrounds. This helps serve their diverse clientele and ensures they are meeting the specific needs of every business that works with them.

Jackson Brothers Accounting

Jackson Brothers Accounting is a privately held accountant practice that has been popular in the area since 1985. They offer a wide variety of services including, tax planning and preparation, payroll processing, financial planning, and small business accounting. Though they are open to helping nearly all businesses and sectors, they primarily focus on local small businesses and startups.

Competitive Advantage

DeSanta & Co will be able to offer the following advantages over the competition:

- Client-oriented service : DeSanta & Co will put a focus on customer service and maintaining long-term relationships. We aim to be the best accounting firm in the area by catering to our customer’s needs and developing a strong connection with them.

- Management : Michael has been extremely successful working in the accounting sector and will be able to use his previous experience to help his clients better than the competition.

- Relationships : Having lived in the community for 25 years, Michael DeSanta knows many of the local leaders, newspapers and other influences.

Marketing Plan

Brand & value proposition.

DeSanta & Co will offer a unique value proposition to its clientele:

- Client-focused financial services, where the company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for DeSanta & Co is as follows:

Targeted Cold Calls

DeSanta & Co will initially invest significant time and energy into contacting potential clients via telephone. In order to improve the effectiveness of this phase of the marketing strategy, a highly-focused call list will be used, targeting individuals in areas and occupations that are most likely to need accounting services. As this is a very time-consuming process, it will primarily be used during the startup phase to build an initial client base.

DeSanta & Co understands that the best promotion comes from satisfied customers. The Company will encourage its clients to refer other businesses by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Social Media

DeSanta & Co will invest heavily in a social media advertising campaign. The company will create social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Website/SEO

DeSanta & Co will invest heavily in developing a professional website that displays all of the company’s services. It will also invest heavily in SEO so that the firm’s website will appear at the top of search engine results.

The fees and hourly pricing of DeSanta & Co will be moderate and competitive so clients feel they are receiving great value when utilizing our accounting services.

Operations Plan

The following will be the operations plan for DeSanta & Co. Operation Functions:

- Michael DeSanta will be the Owner of DeSanta & Co. In addition to providing accounting services, he will also manage the general operations of the business.

- Michael DeSanta is joined by a full-time administrative assistant, Jessica Baker, who will take charge of the administrative tasks for the company. She will also be available to answer client questions and will be the primary employee in charge of client communications.

- As the company builds its client base, Michael will hire more accounting professionals to provide the company’s services, attract more clients, and grow our business further.

Milestones:

DeSanta & Co will have the following milestones completed in the next six months.

- 6/2023 Finalize lease agreement

- 7/2023 Design and build out DeSanta & Co

- 8/2023 Hire and train initial staff

- 9/2023 Kickoff of promotional campaign

- 10/2023 Launch DeSanta & Co

- 11/2023 Reach break-even

Though he has never run his own business, Michael DeSanta has worked as an accountant long enough to gain an in-depth knowledge of the operations (e.g., running day-to-day operations) and the business (e.g., staffing, marketing, etc.) sides of the industry. He also already has a starting client base that he served while working for other accounting firms. He will hire several other employees who can help him run the aspects of the business that he is unfamiliar with.

Financial Plan

Key revenue & costs.

DeSanta & Co’s revenues will primarily come from charging clients for the accounting services we provide. We will charge our clients an hourly rate that will vary depending on the services they need.

The notable cost drivers for the company will include labor expenses, overhead, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Number of clients:

- Year 4: 100

- Year 5: 125

- Annual Rent: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, accounting business plan faqs, what is an accounting business plan.

An accounting business plan is a plan to start and/or grow your accounting business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Accounting business plan using our Accounting Business Plan Template here .

What are the Main Types of Accounting Businesses?

There are a number of different kinds of accounting businesses , some examples include: Full Service Accounting Firm, Bookkeeping Firm, Tax Firm, and Audit Firm.

How Do You Get Funding for Your Accounting Business Plan?

Accounting businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an Accounting Business?

Starting an accounting business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Accounting Business Plan - The first step in starting a business is to create a detailed accounting business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your accounting business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your accounting business is in compliance with local laws.

3. Register Your Accounting Business - Once you have chosen a legal structure, the next step is to register your accounting business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your accounting business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Accounting Equipment & Supplies - In order to start your accounting business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your accounting business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful accounting business:

- How to Start an Accounting Business

- Paragraph Generator

- Cover Letter

- Authorization Letter

- Application Letter

- Letter of Intent

- Letter of Recommendation

- Business Plan

- Incident Report

- Reference Letter

- Minutes of Meeting

- Letter of Resignation

- Excuse Letter

- Research Proposal

- Job Application

- Acknowledgement

- Employment Letter

- Promissory Note

- Business Proposal

- Statement of Purpose

- Offer Letter

- Deed of Sale

- Letter of Interest

- Power of Attorney

- Solicitation Letter

3+ SAMPLE Accountancy Firm Business Plan in PDF

Accountancy firm business plan, 3+ sample accountancy firm business plan, an accountancy firm business plan, benefits of hiring an accounting firm, tips for increasing your accounting firm’s efficiency, types of accounting, how to create an accountancy firm business plan, how is an accounting business structured, what is the purpose of an accounting firm, is there a demand for accountants.

Accountancy Firm and Tax Services Business Plan

Sample Accountancy Firm Business Plan

Simple Accountancy Firm Business Plan

Accountancy Firm Business Plan Example

What is an accountancy firm business plan, 1. financial accounting, 2. managerial accounting, 3. cost accounting, 4. auditing, 5. accounting information systems, 6. forensic accounting, 7. governmental accounting, 1. create a concise executive summary., 2. conduct a market analysis of your industry., 3. describe management and operations in detail., 4. provide financial data about your business., share this post on your network, you may also like these articles, school business plan.

A school business plan is a comprehensive document outlining the objectives, strategies, and operational framework for establishing or managing a school. It details the vision, target audience, financial projections,…

Boutique Business Plan

A boutique business plan is a comprehensive roadmap tailored to the unique needs of boutique owners. It outlines the business's goals, market strategies, and financial projections while capturing the…

browse by categories

- Questionnaire

- Description

- Reconciliation

- Certificate

- Spreadsheet

Information

- privacy policy

- Terms & Conditions

IMAGES