Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

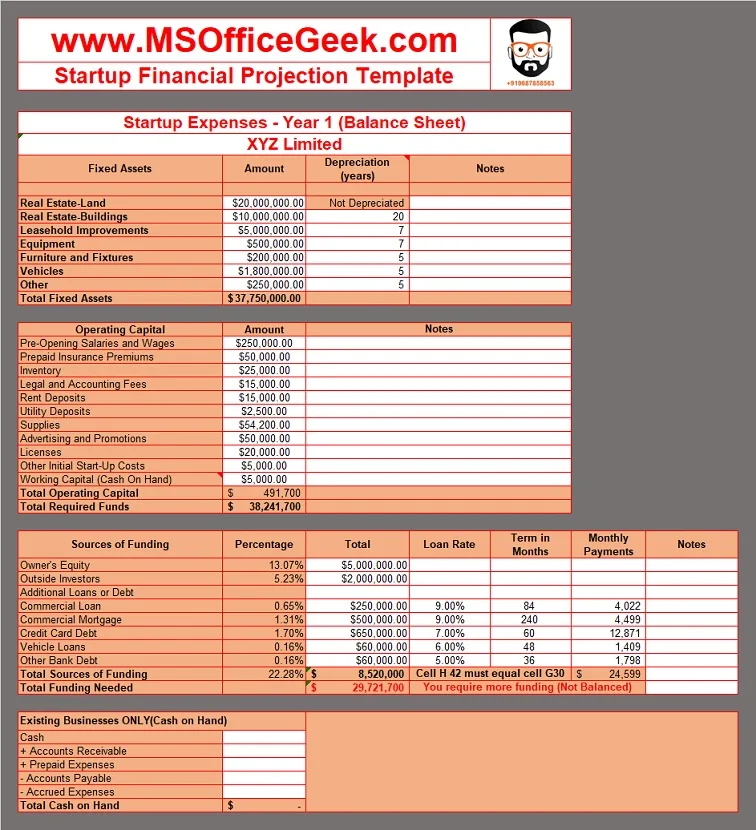

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

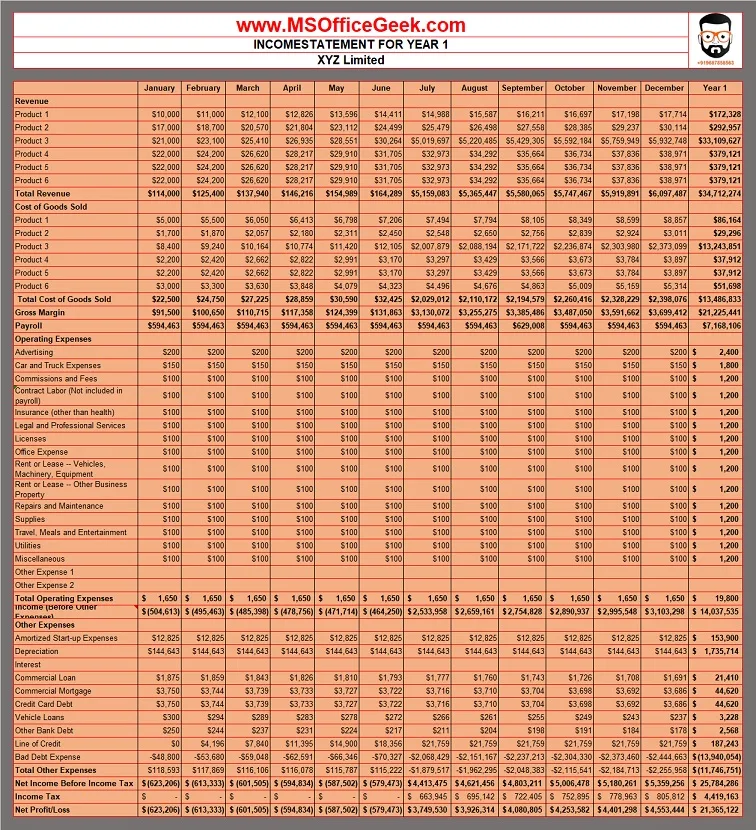

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

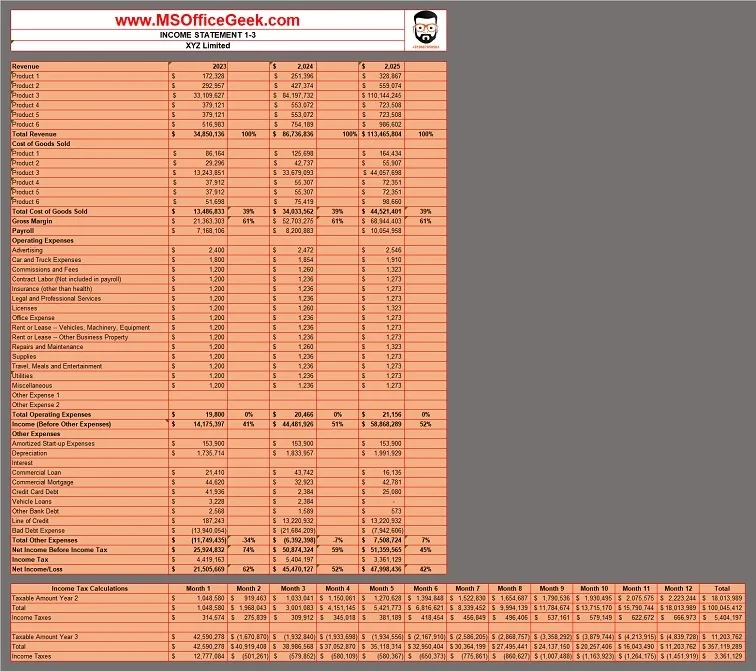

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

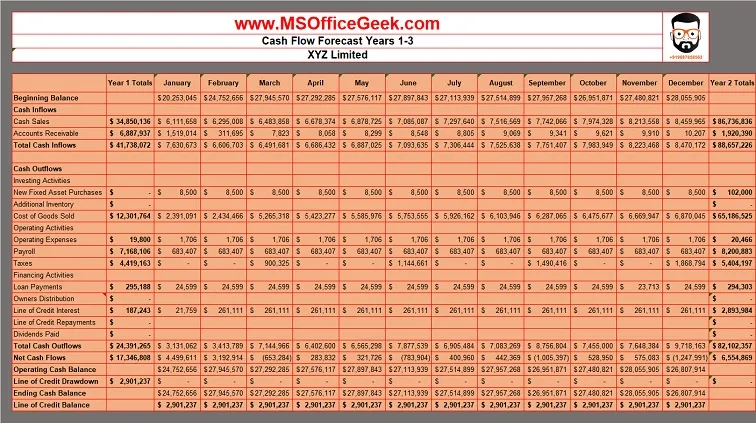

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

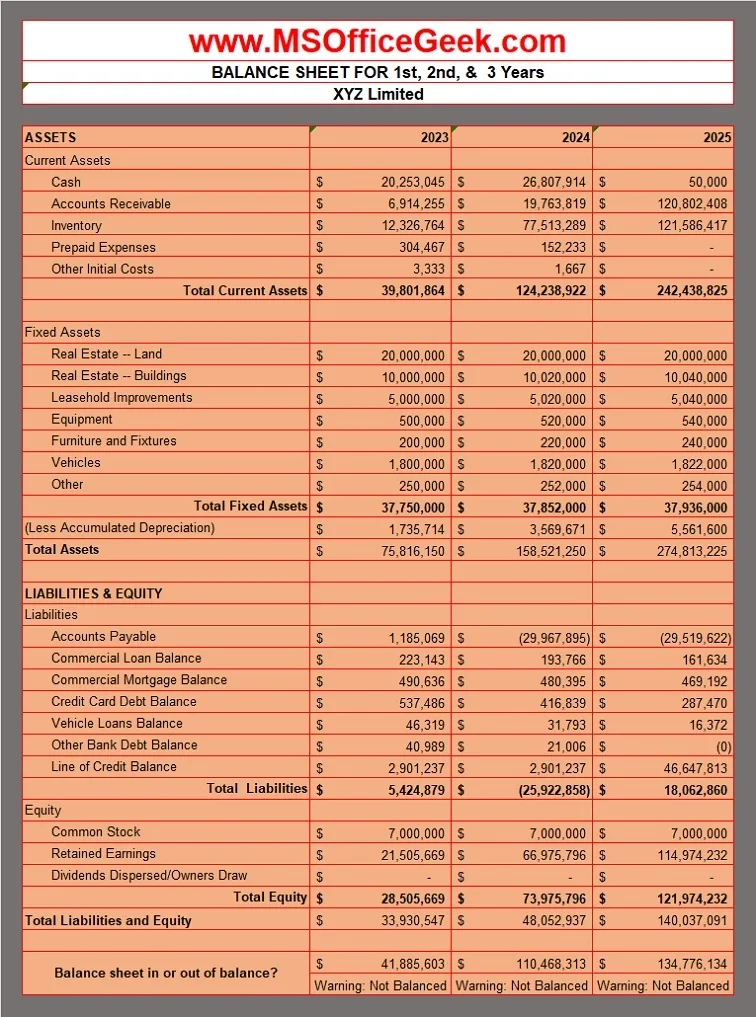

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

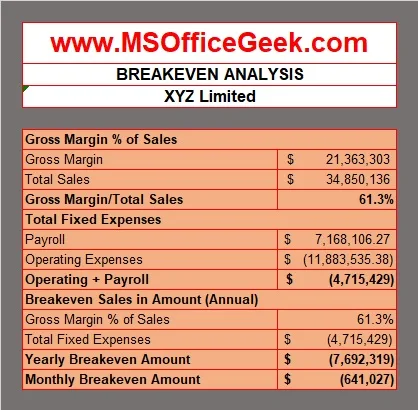

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

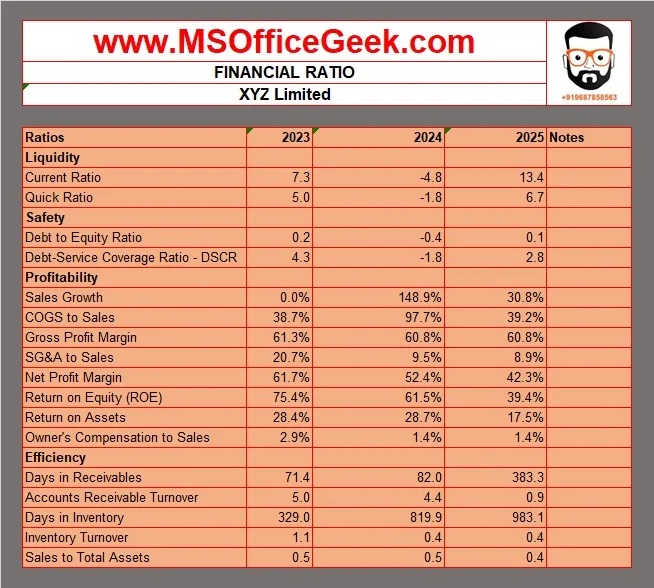

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Plan Projections

ideas to numbers .. simple financial projections

Home > Financial Projection Online Calculator

Financial Projection Online Calculator

This 3 year financial projection calculator is a free online tool. The calculator produces income statements, balance sheets, and cash flow statements for the next 3 years, and provides a quick and easy way to test the outline feasibility of your business idea.

Simply enter the amounts in the highlighted input cells and hit the 'Calculate' button. All amounts entered will be rounded to the nearest integer.

The contents of this calculator will be lost if you reload the page or press the reset button.

3 Year Financial Projections

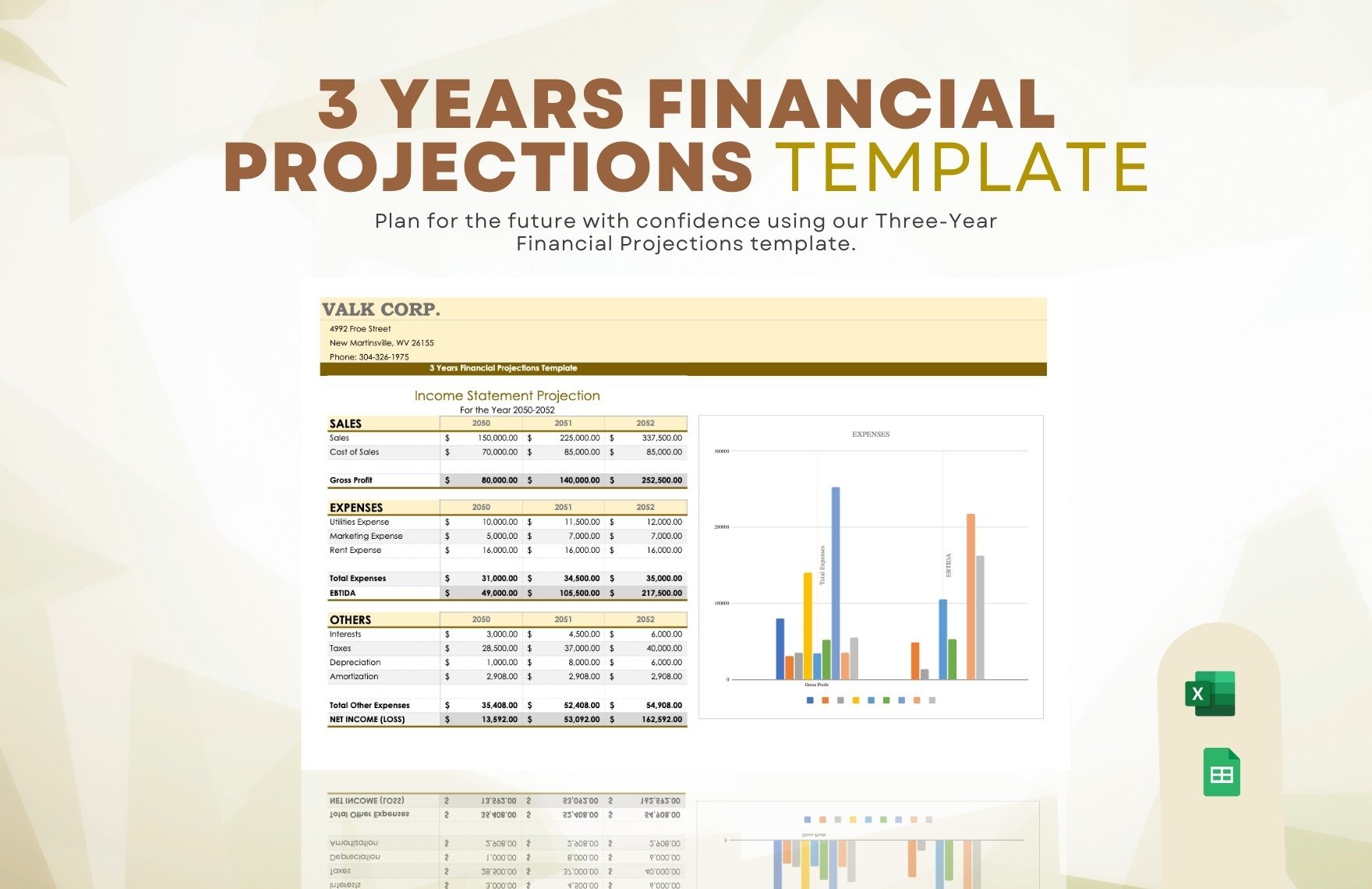

Free 3 Years Financial Projections Template

Free Download this 3 Years Financial Projections Template Design in Excel, Google Sheets Format. Easily Editable, Printable, Downloadable.

Get ahead of the game with our 3 Years Financial Projections Template. No more financial guesswork, no more surprises. Our easy-to-use tool will help you accurately forecast expenses and revenue for the next 3 years, so you can confidently plan for success and impress stakeholders with your financial acumen.

Already a premium member? Sign in

- , Google Sheets

You may also like

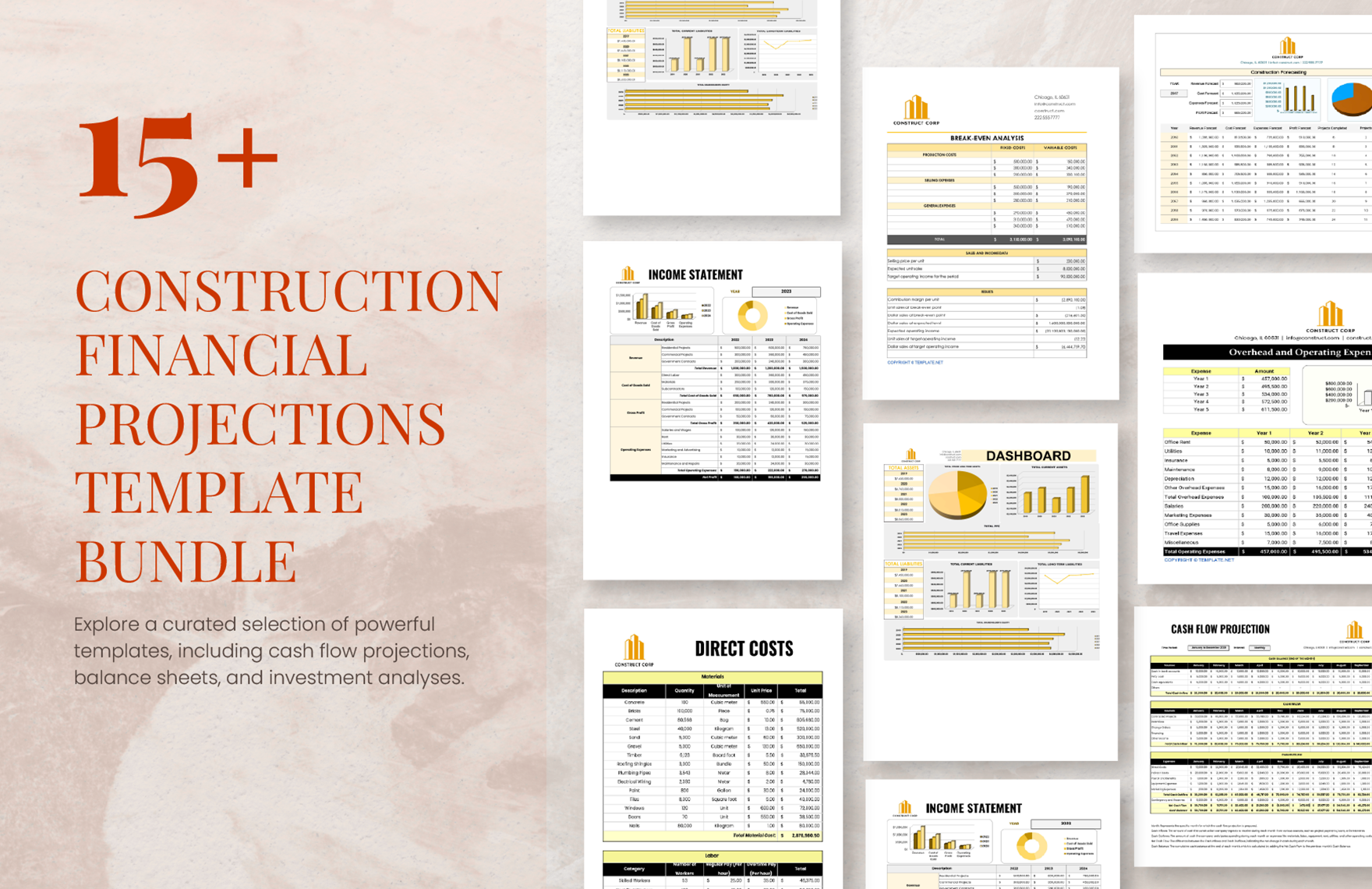

15+ Construction Financial Projections Template Bundle

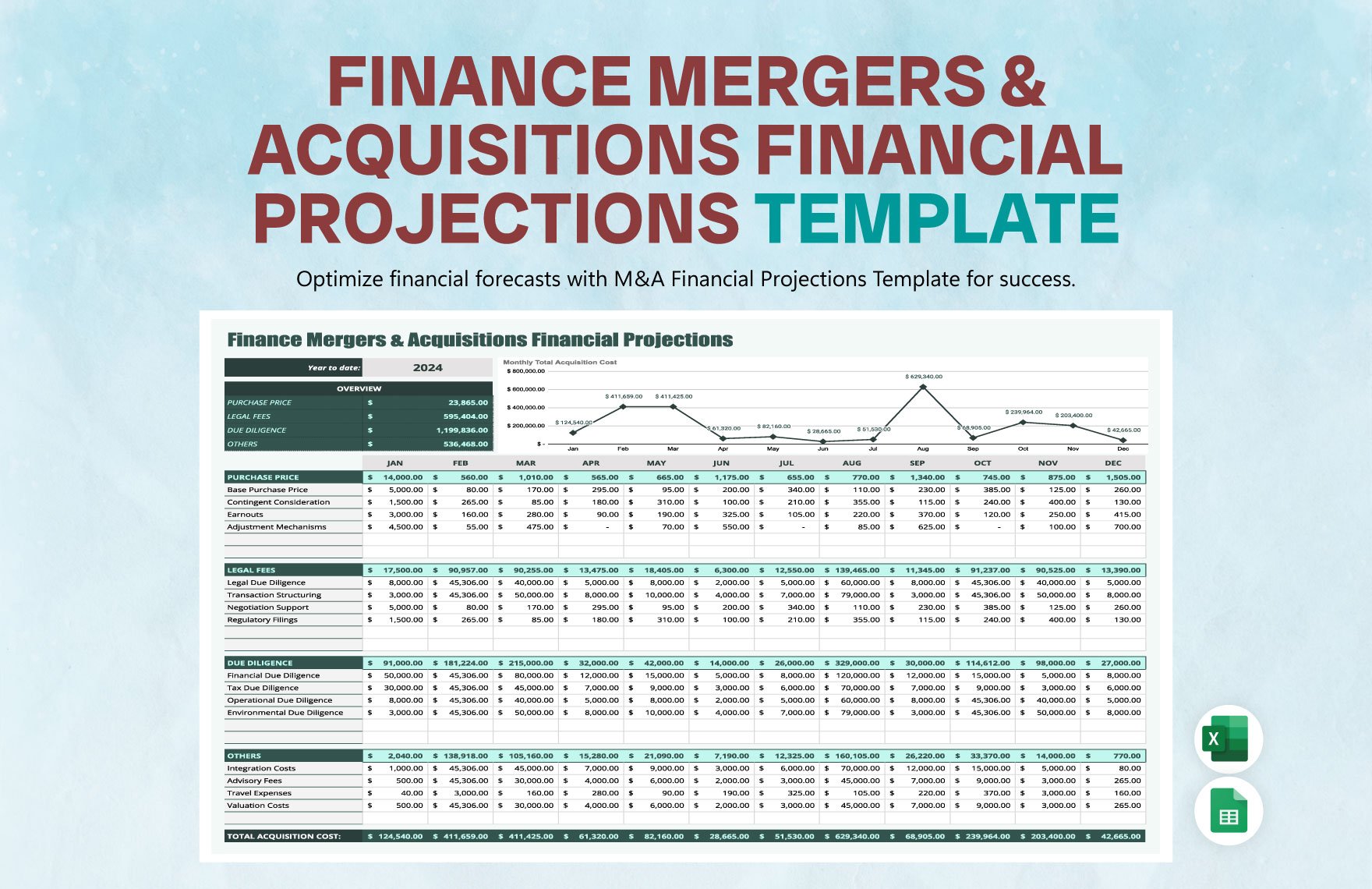

Finance Mergers & Acquisitions Financial Projections Template

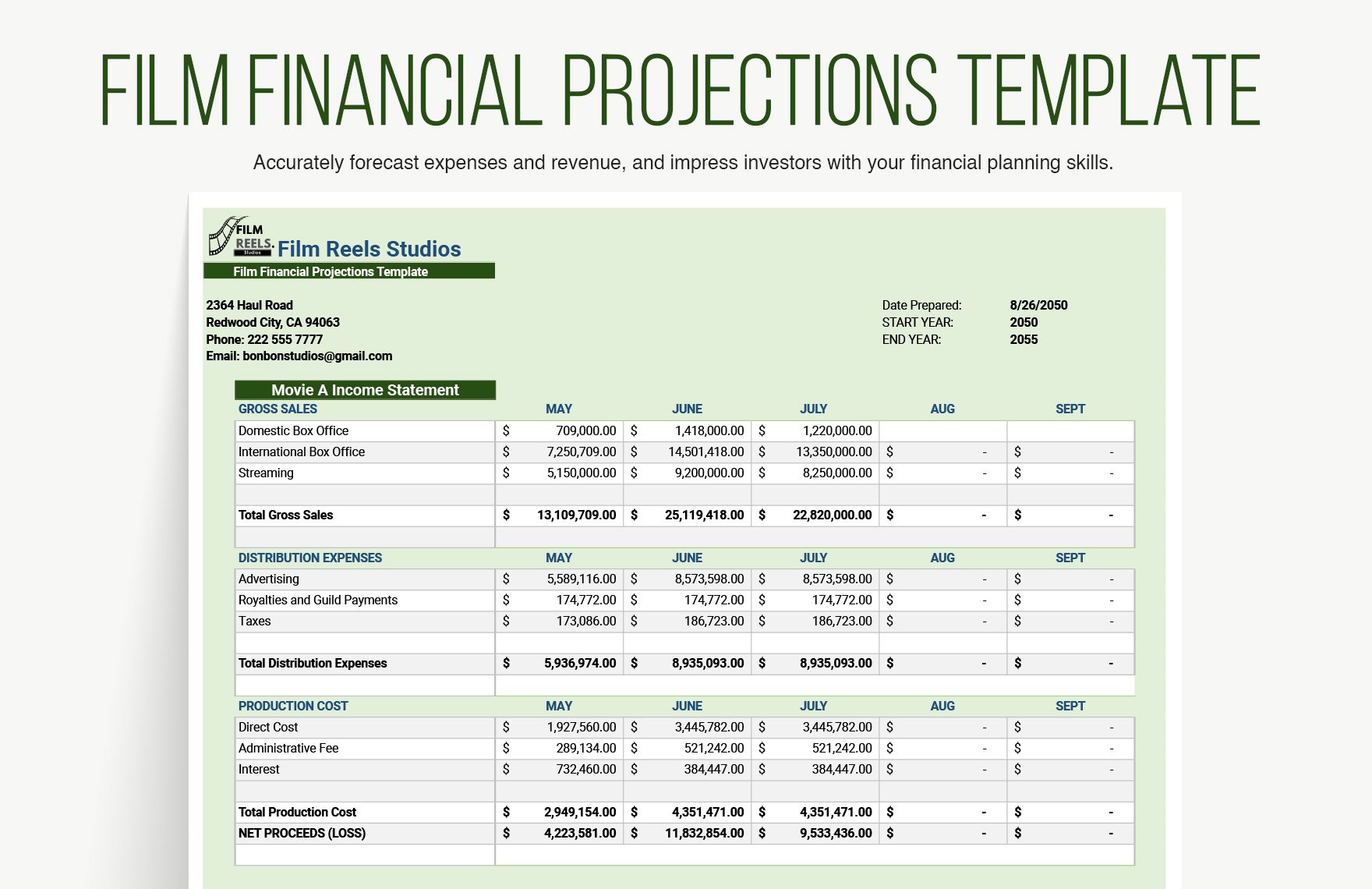

Film Financial Projections Template

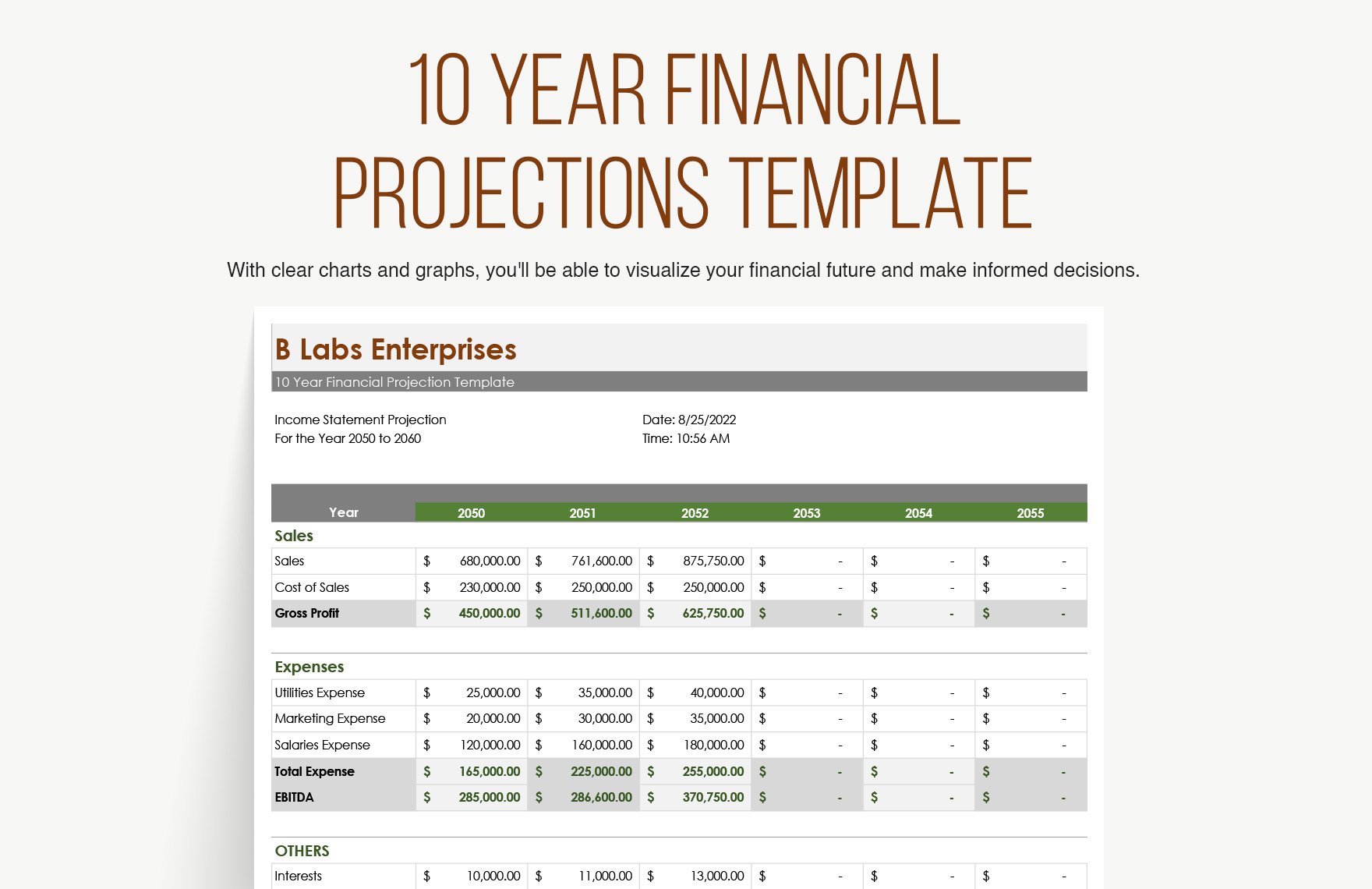

10 Year Financial Projections Template

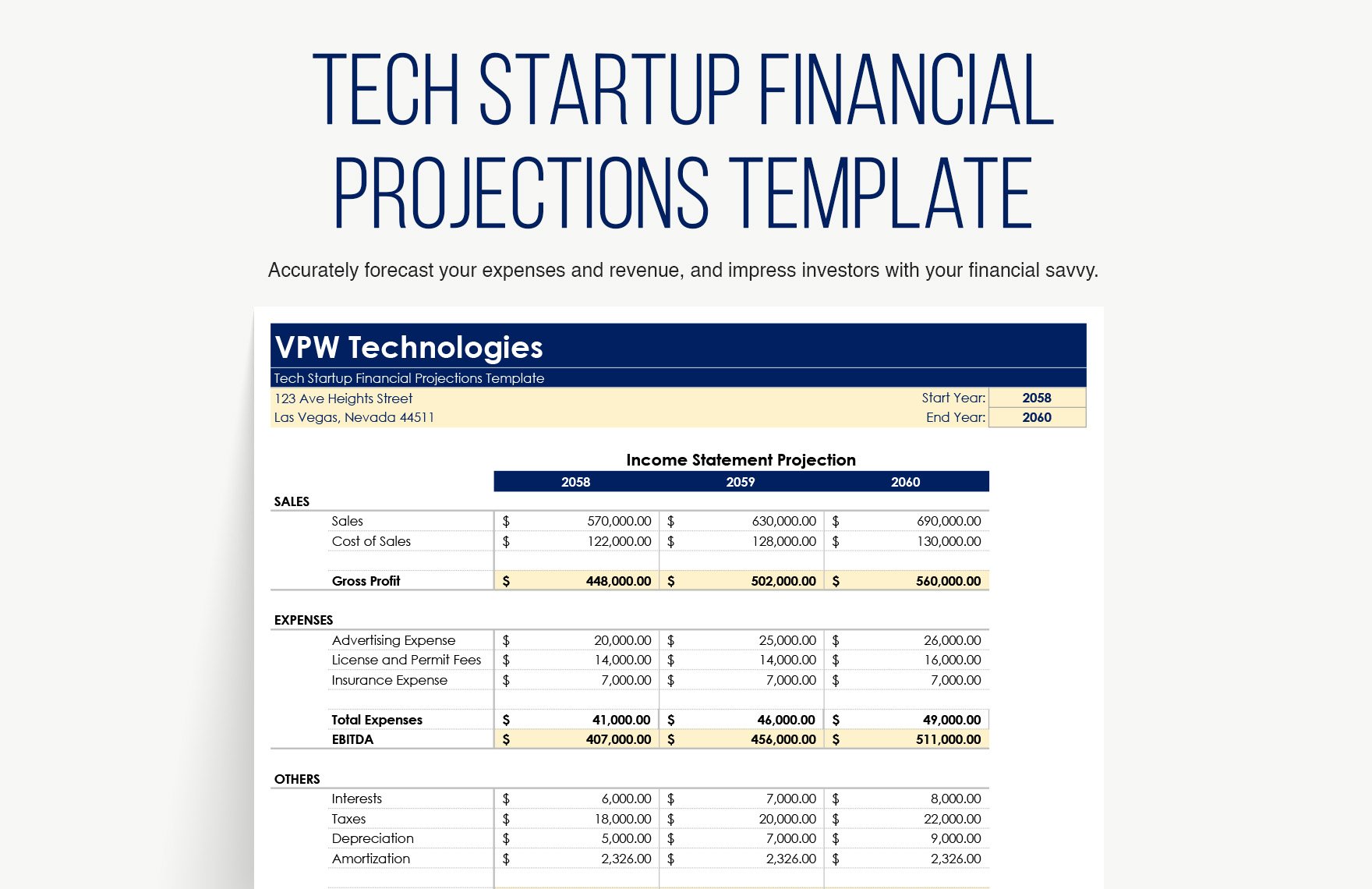

Tech Startup Financial Projections Template

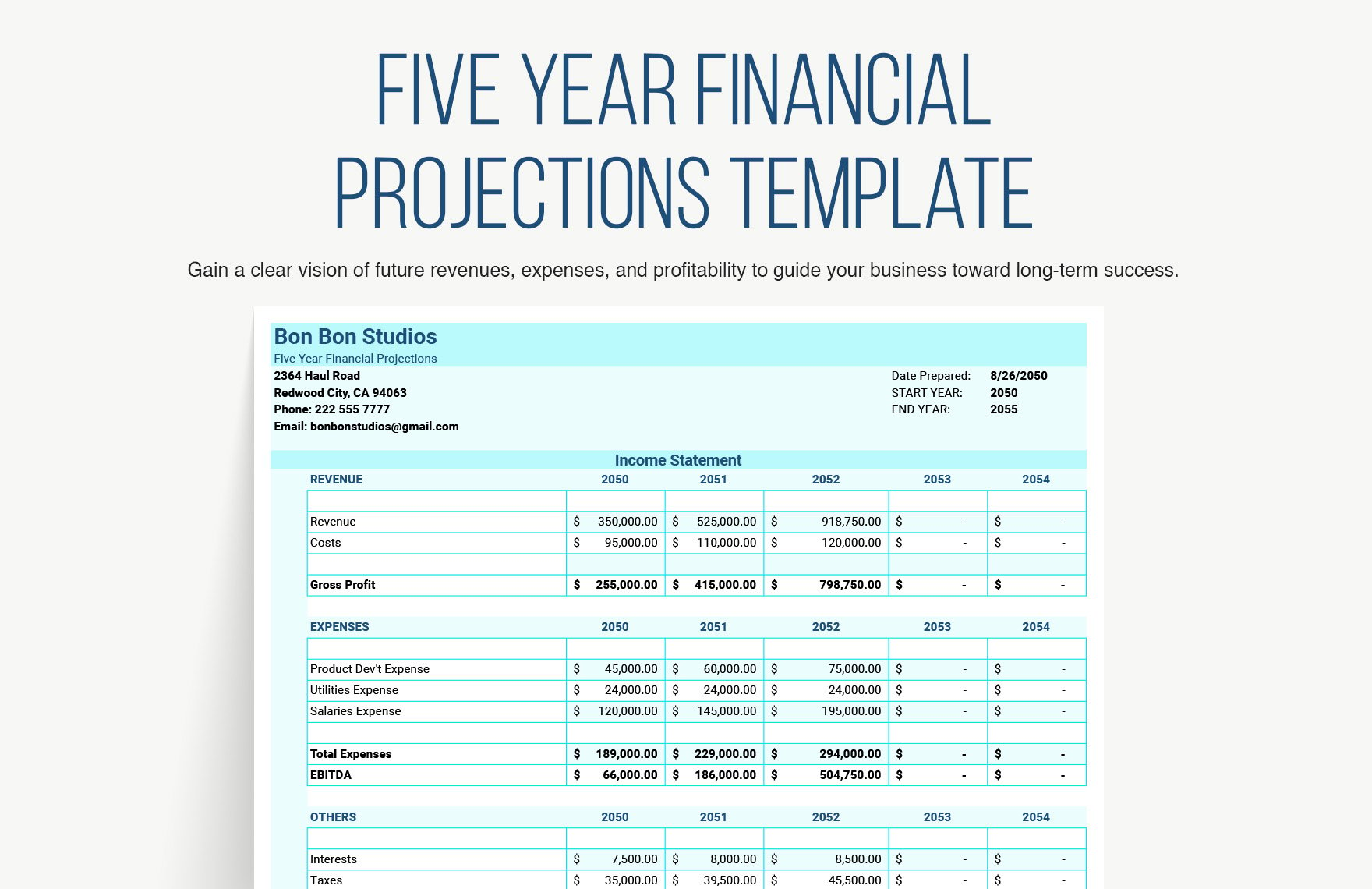

Five Year Financial Projections Template

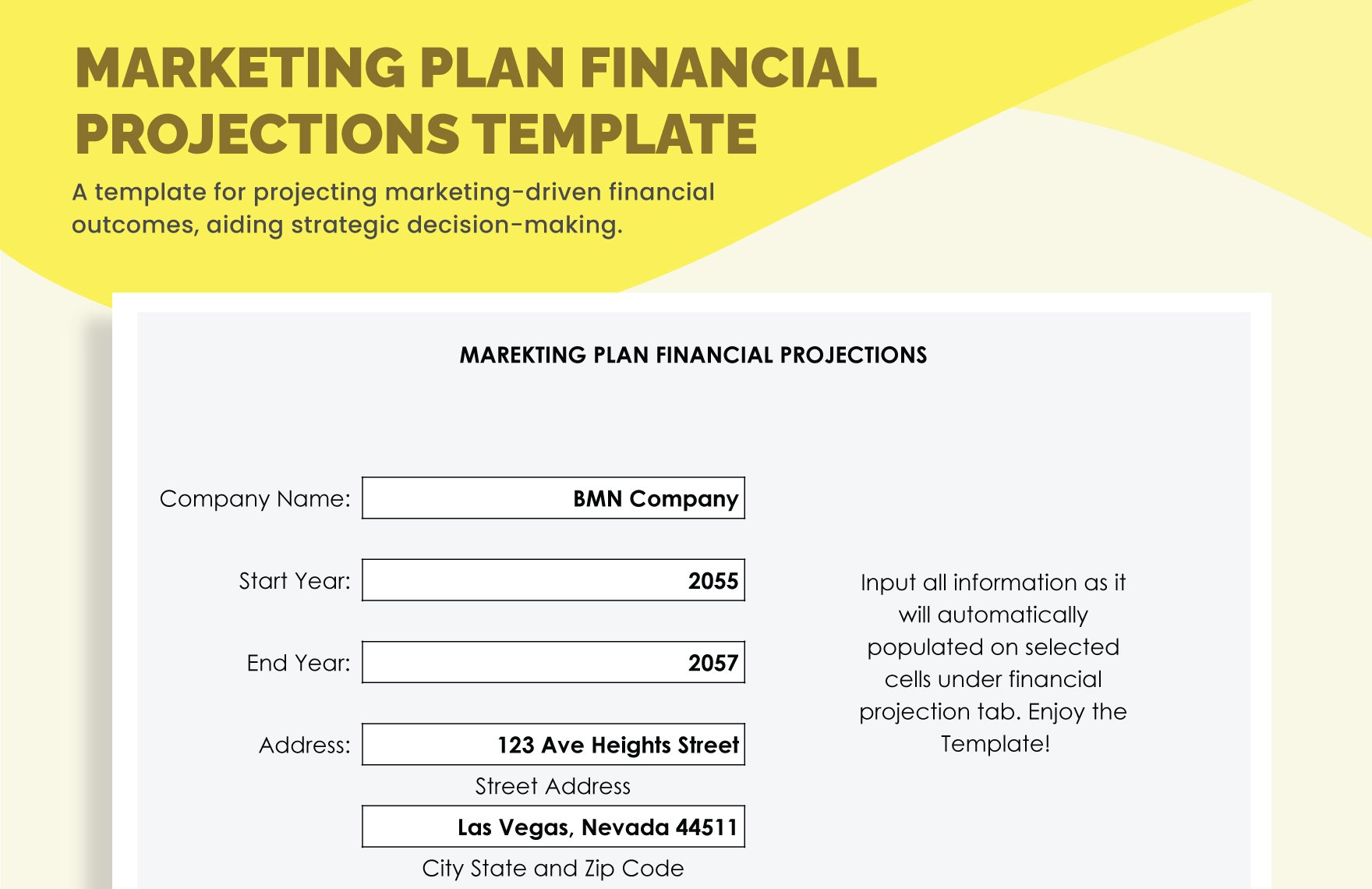

Marketing Plan Financial Projections Template

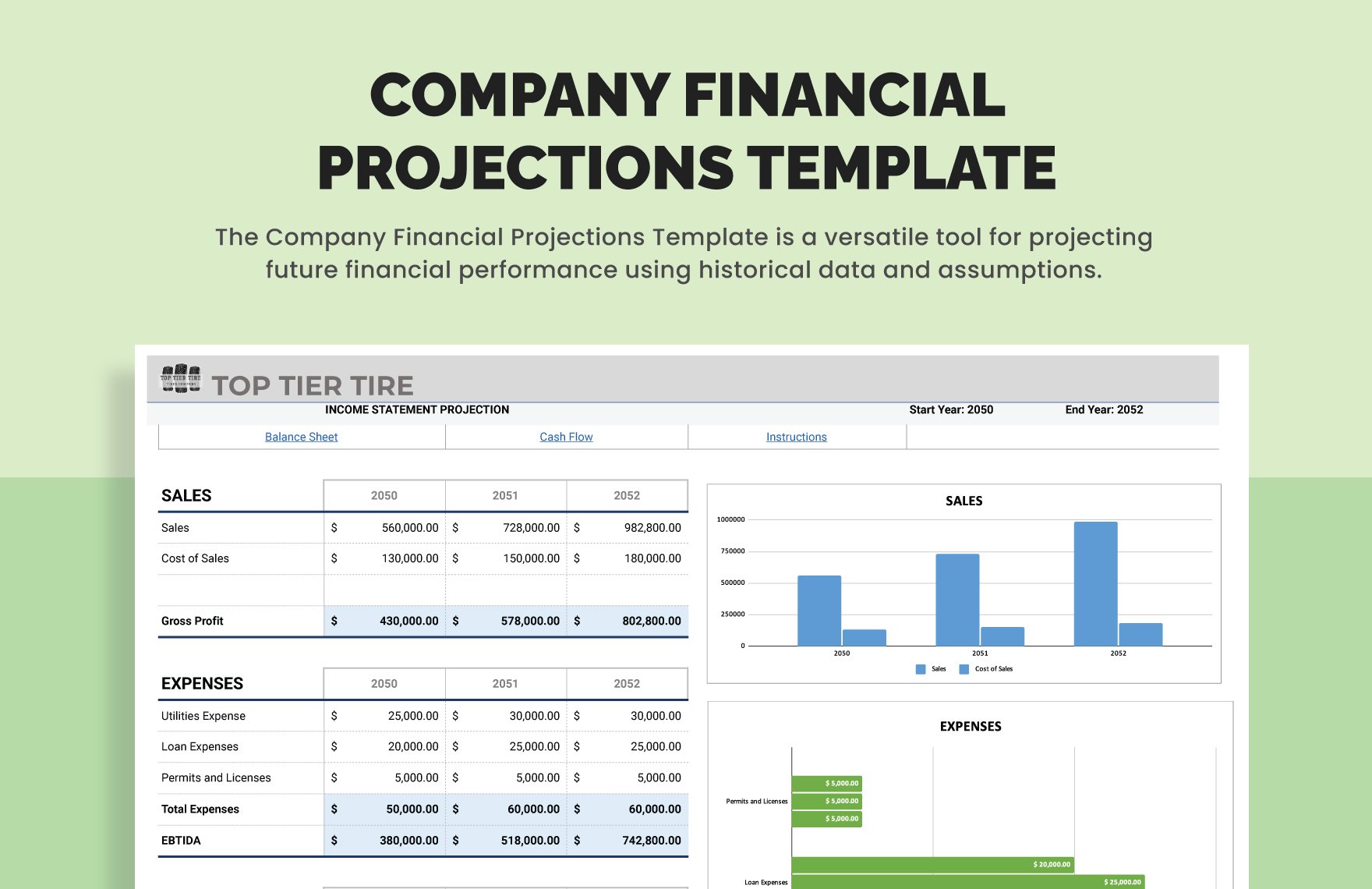

Company Financial Projections Template

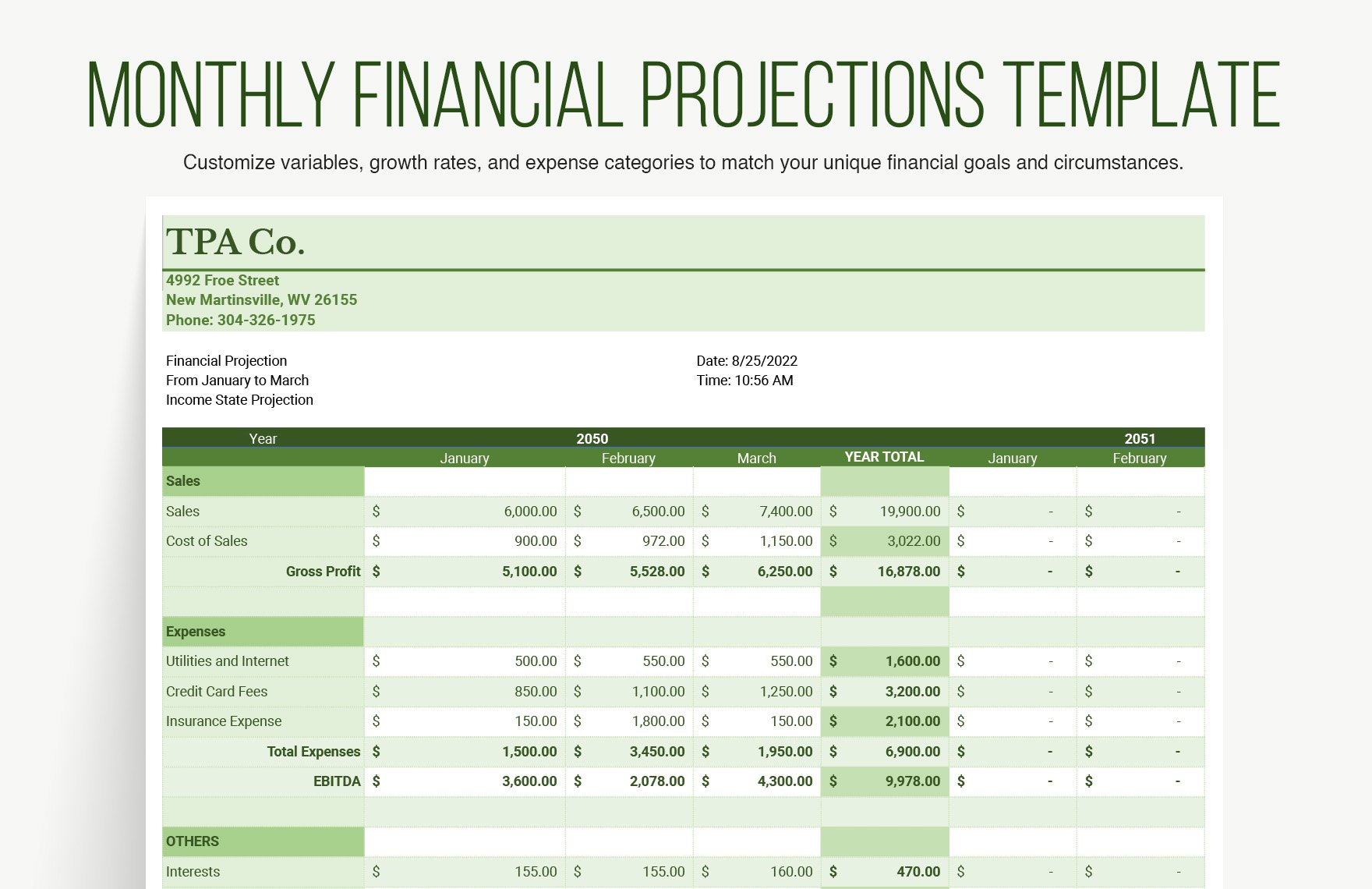

Monthly Financial Projections Template

Real Estate Financial Projections Template

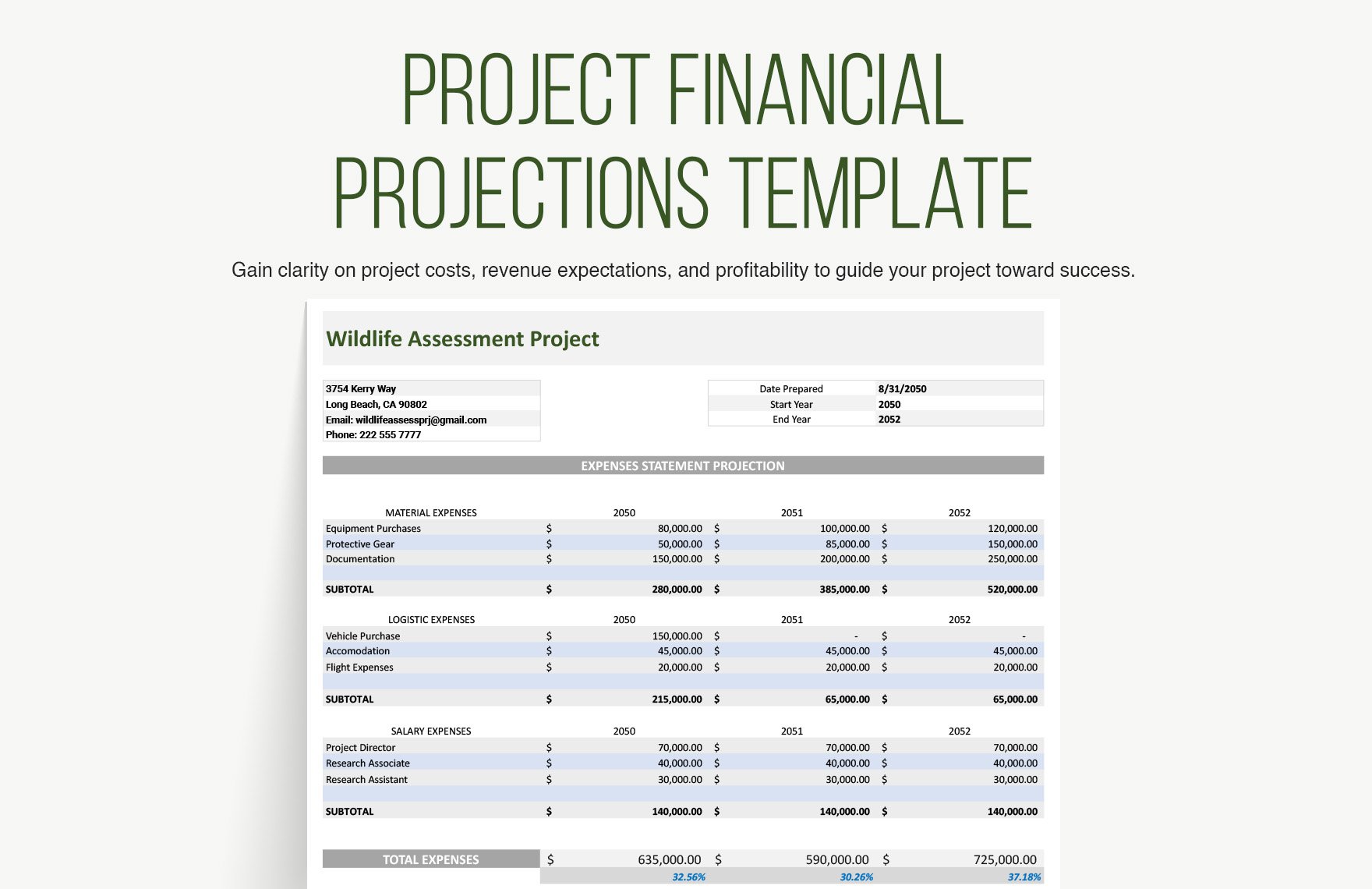

Project Financial Projections Template

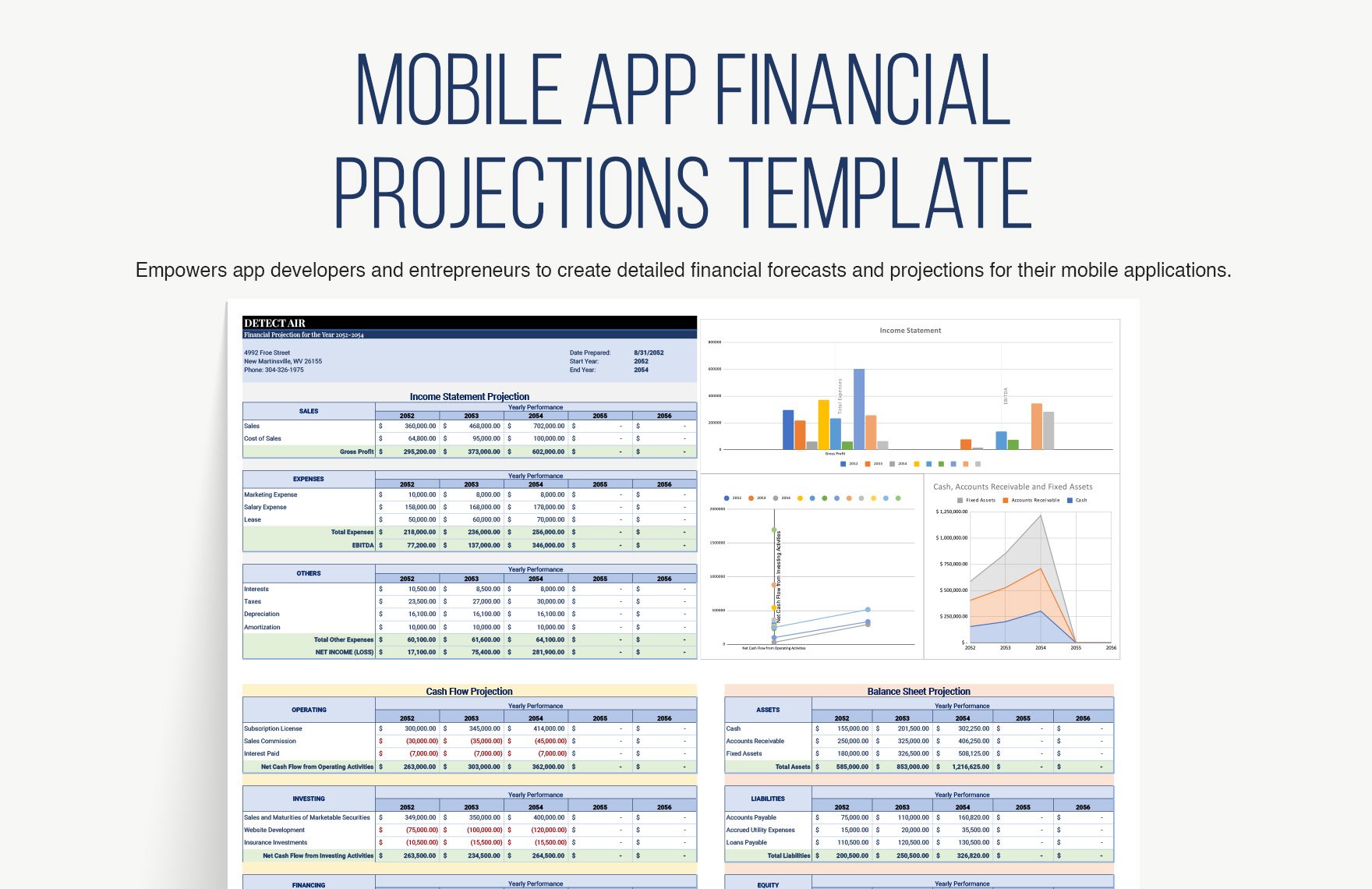

Mobile App Financial Projections Template

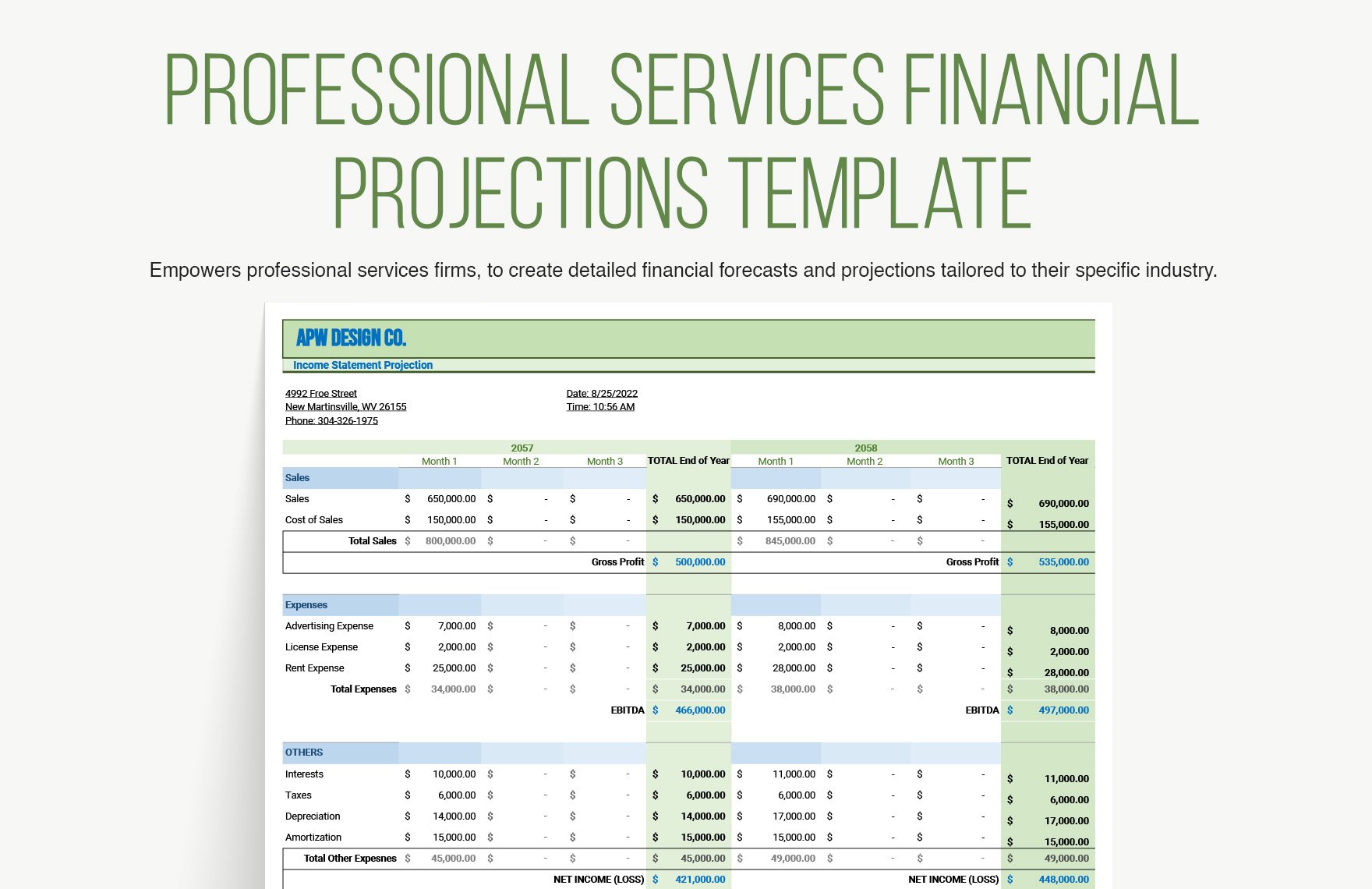

Professional Services Financial Projections Template

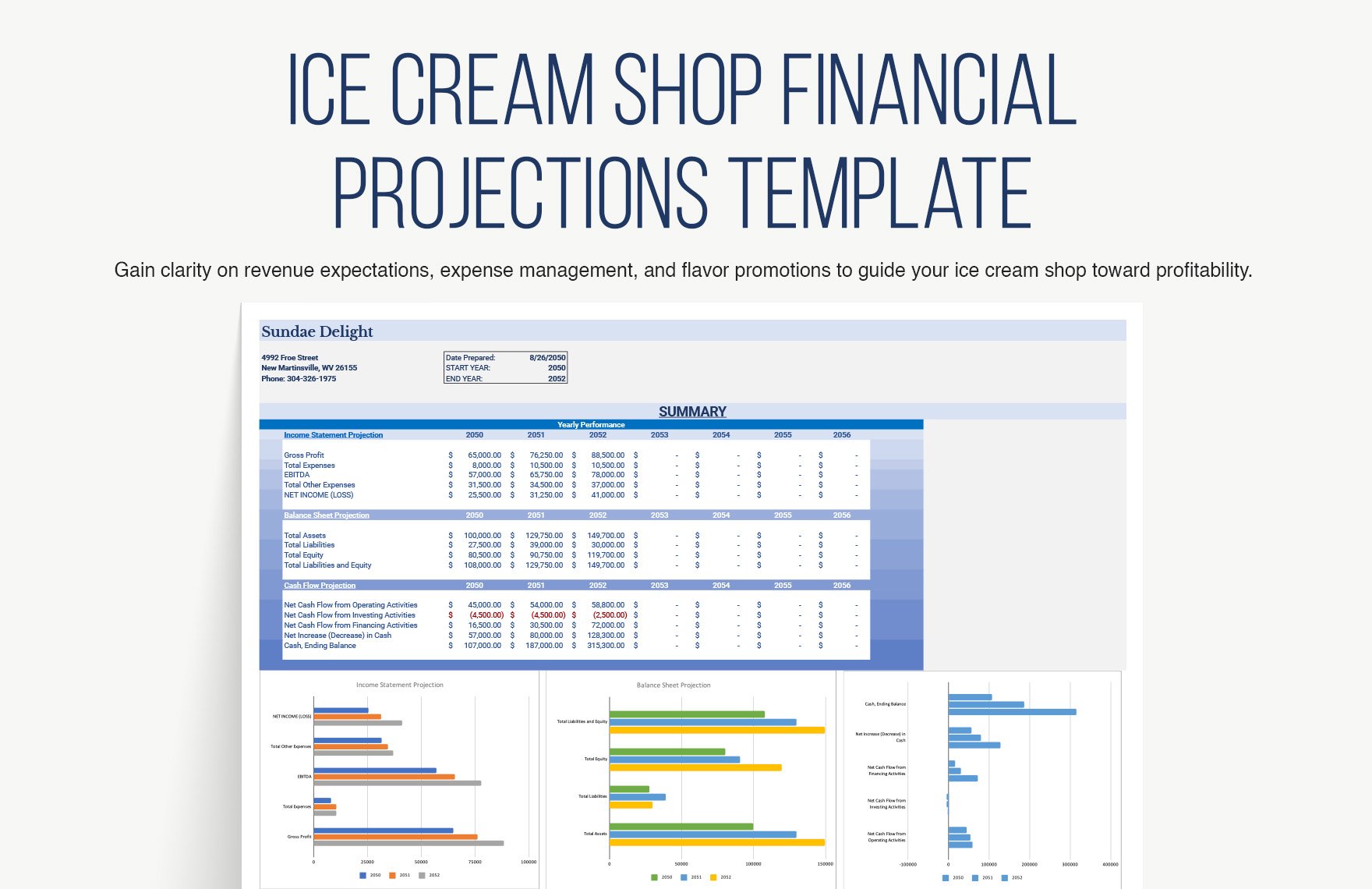

Ice Cream Shop Financial Projections Template

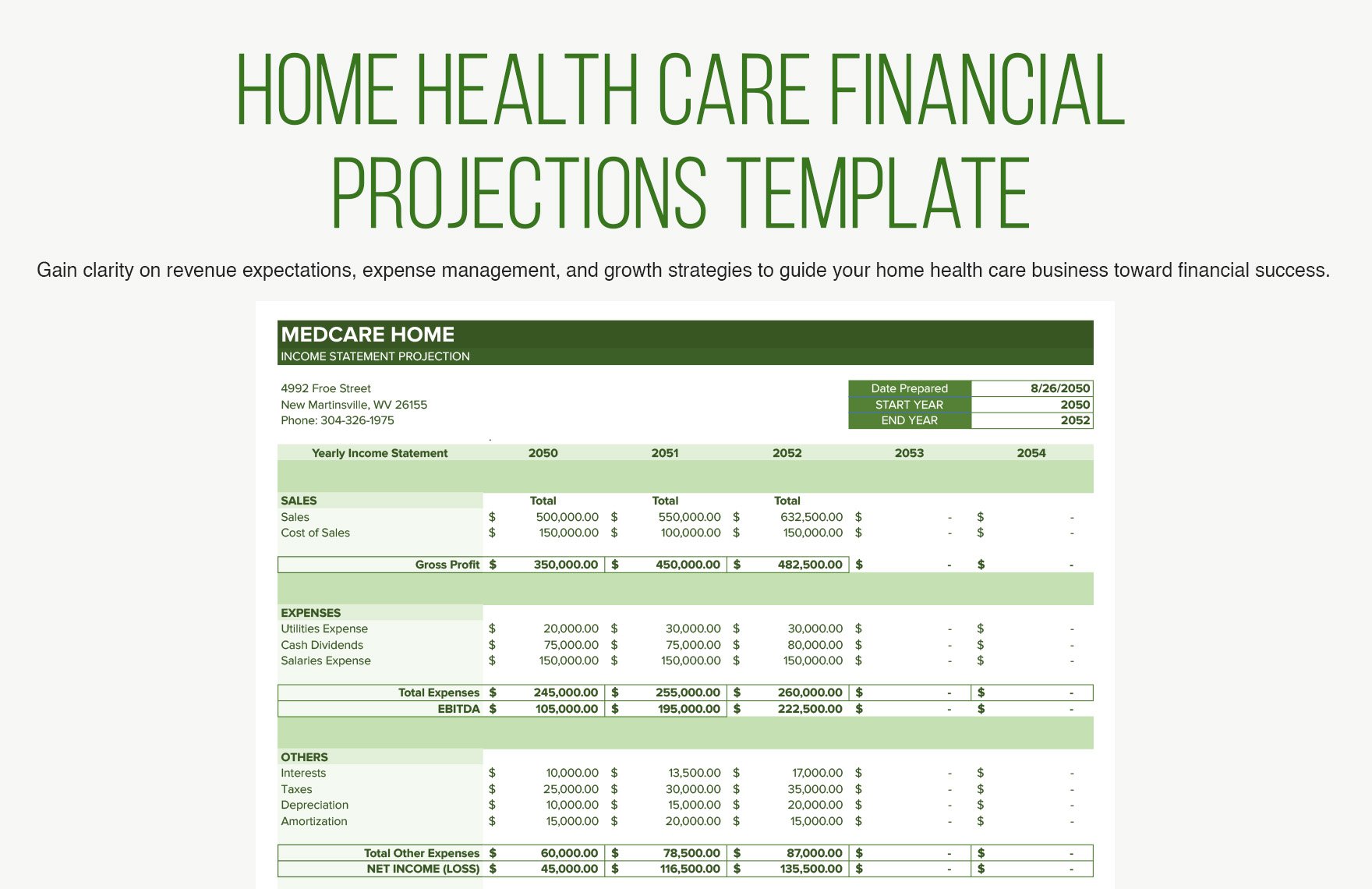

Home Health Care Financial Projections Template

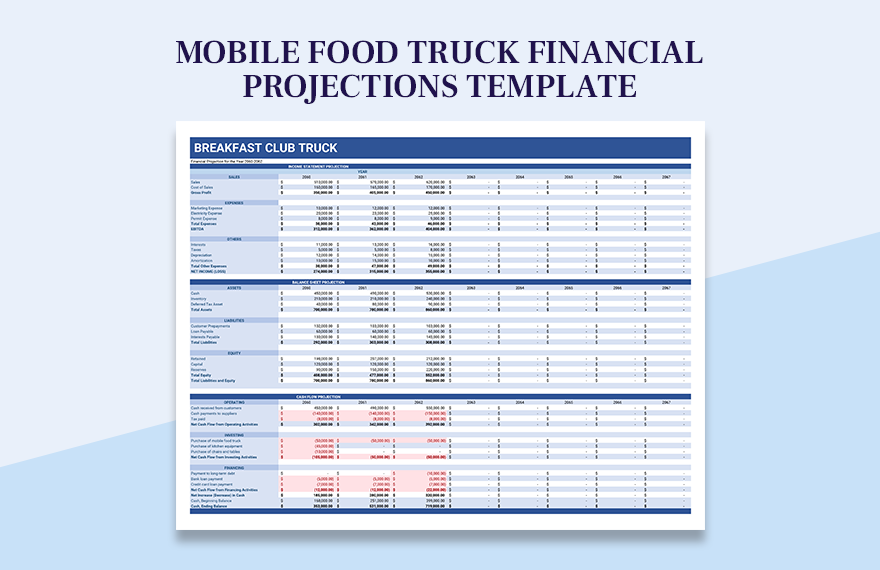

Mobile Food Truck Financial Projections Template

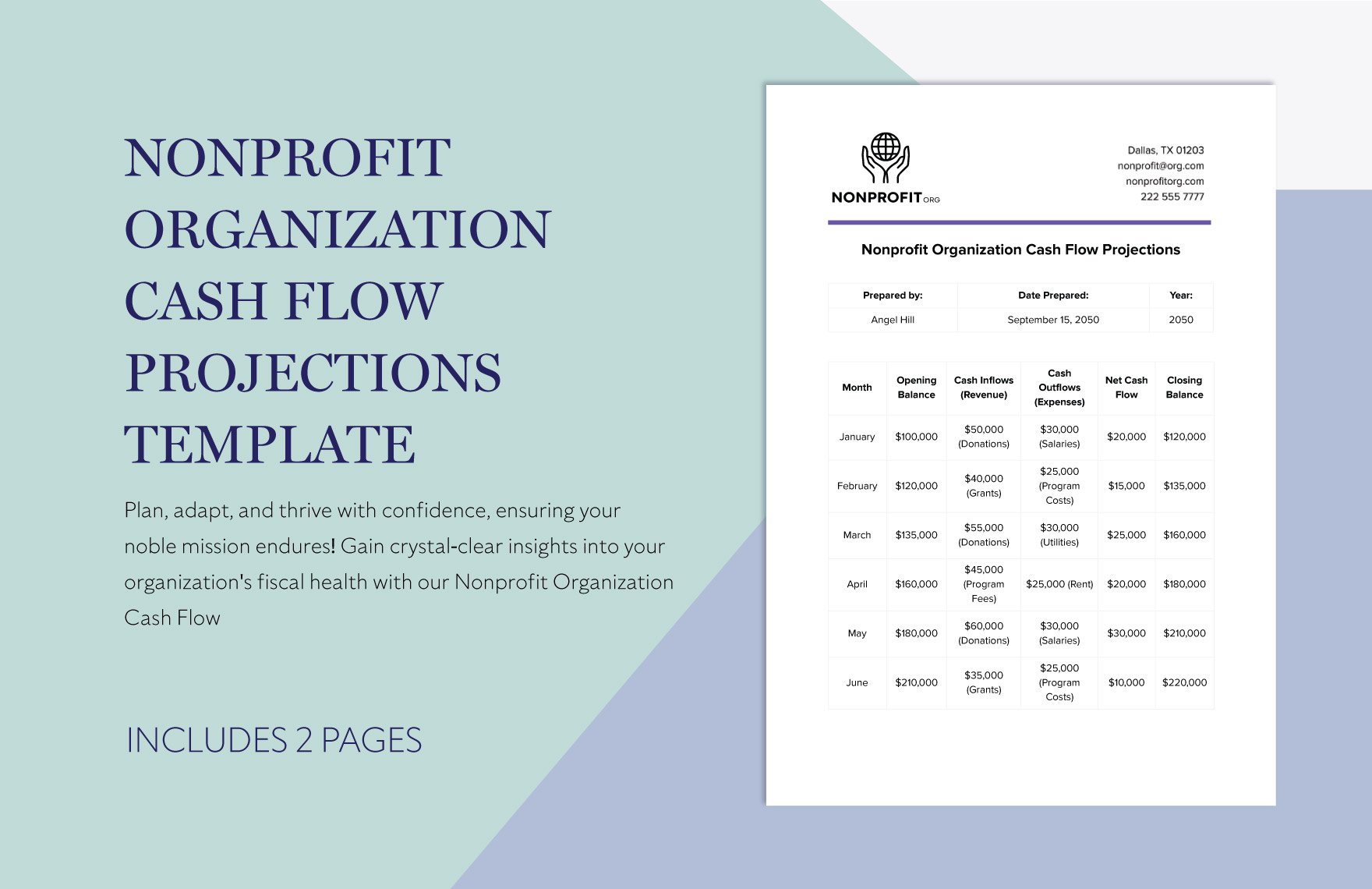

Nonprofit Organization Cash Flow Projections Template

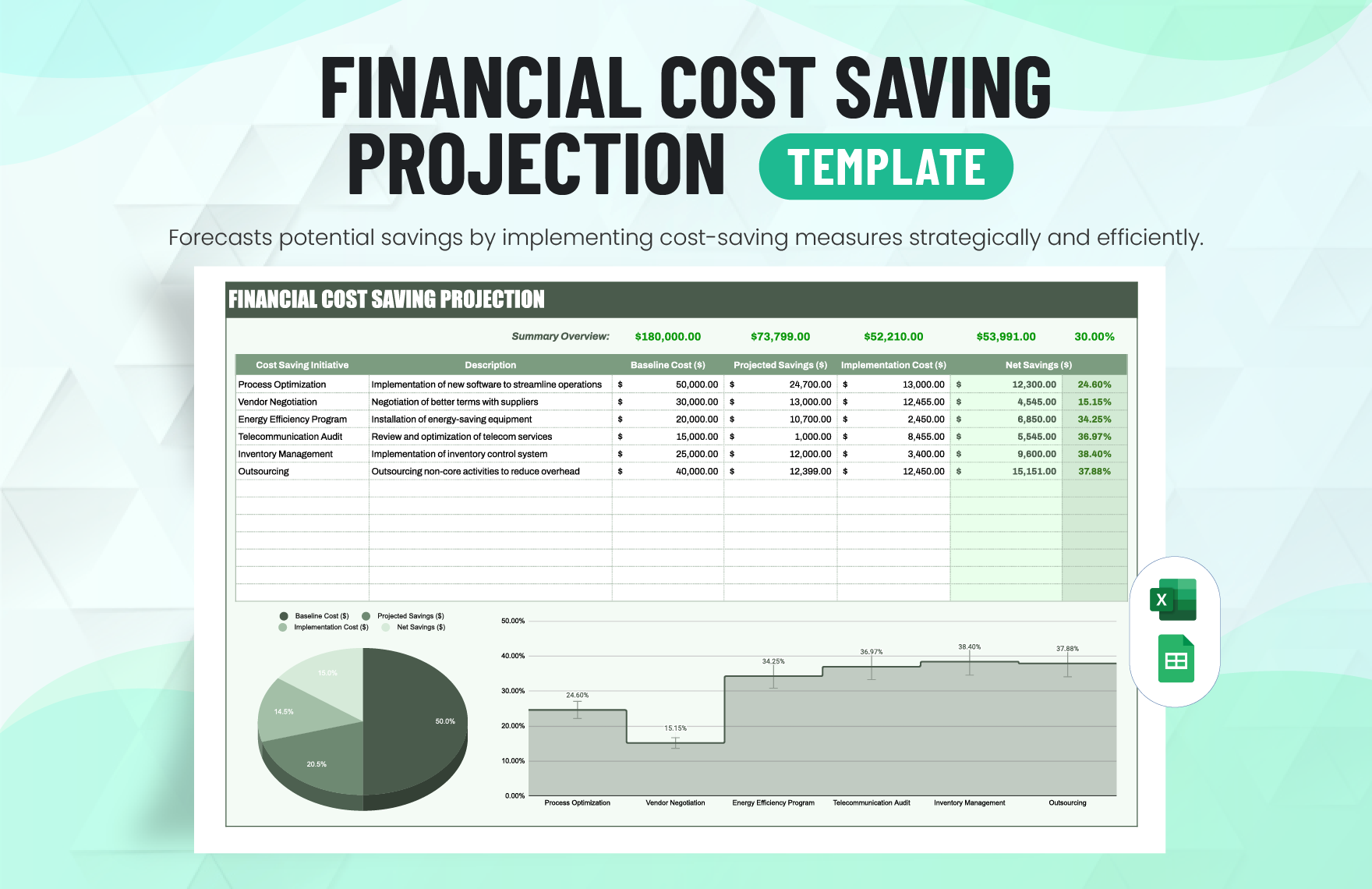

Financial Cost Saving Projection Template

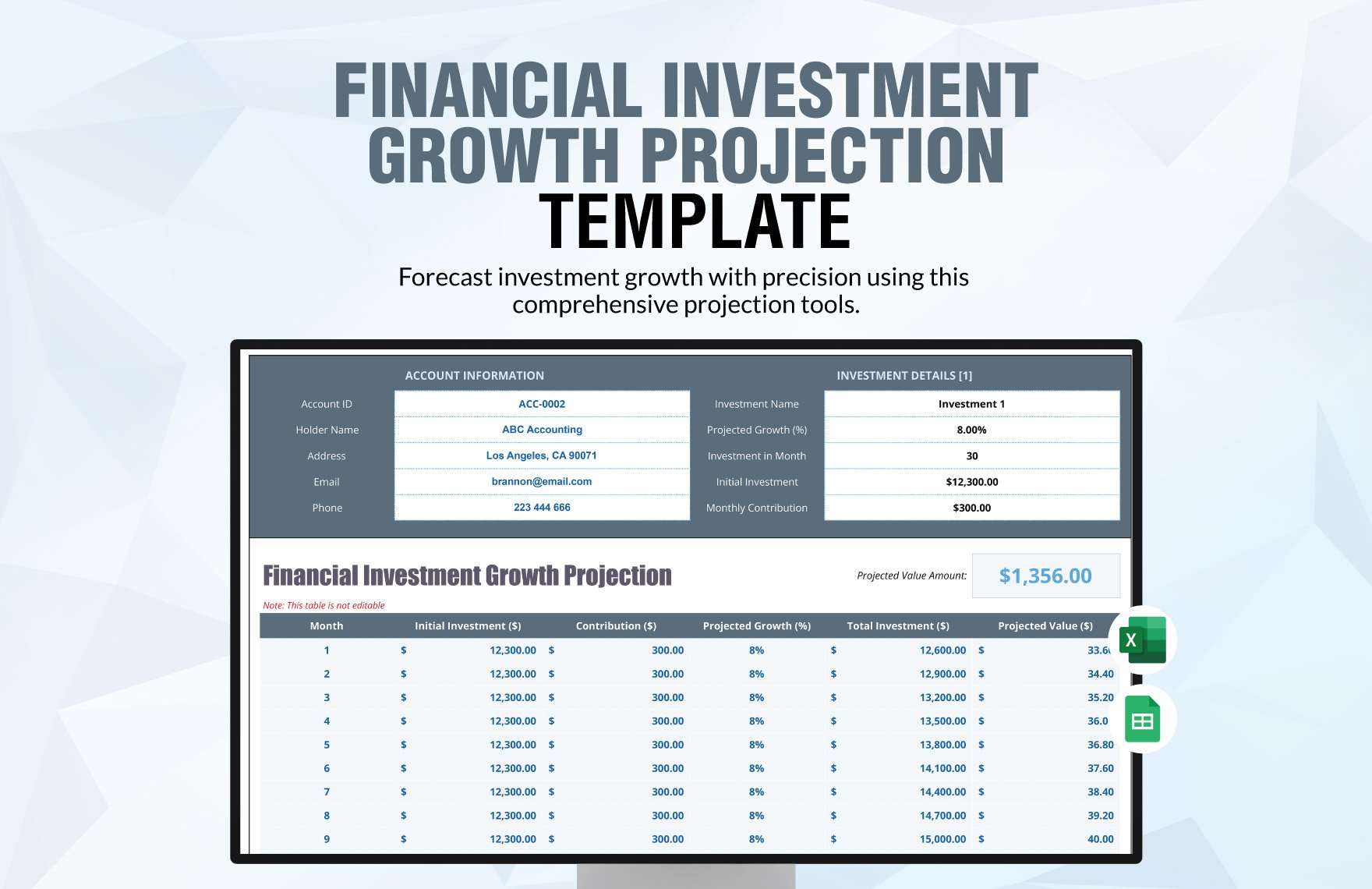

Financial Investment Growth Projection Template

Sales Financial Analysis of the Impact of Commissions on Net Profit Template

Sales Detailed Financial Breakdown of Revenue Template

Digital Marketing Agency Financial Planning and Budgeting Guide for HR Department Template

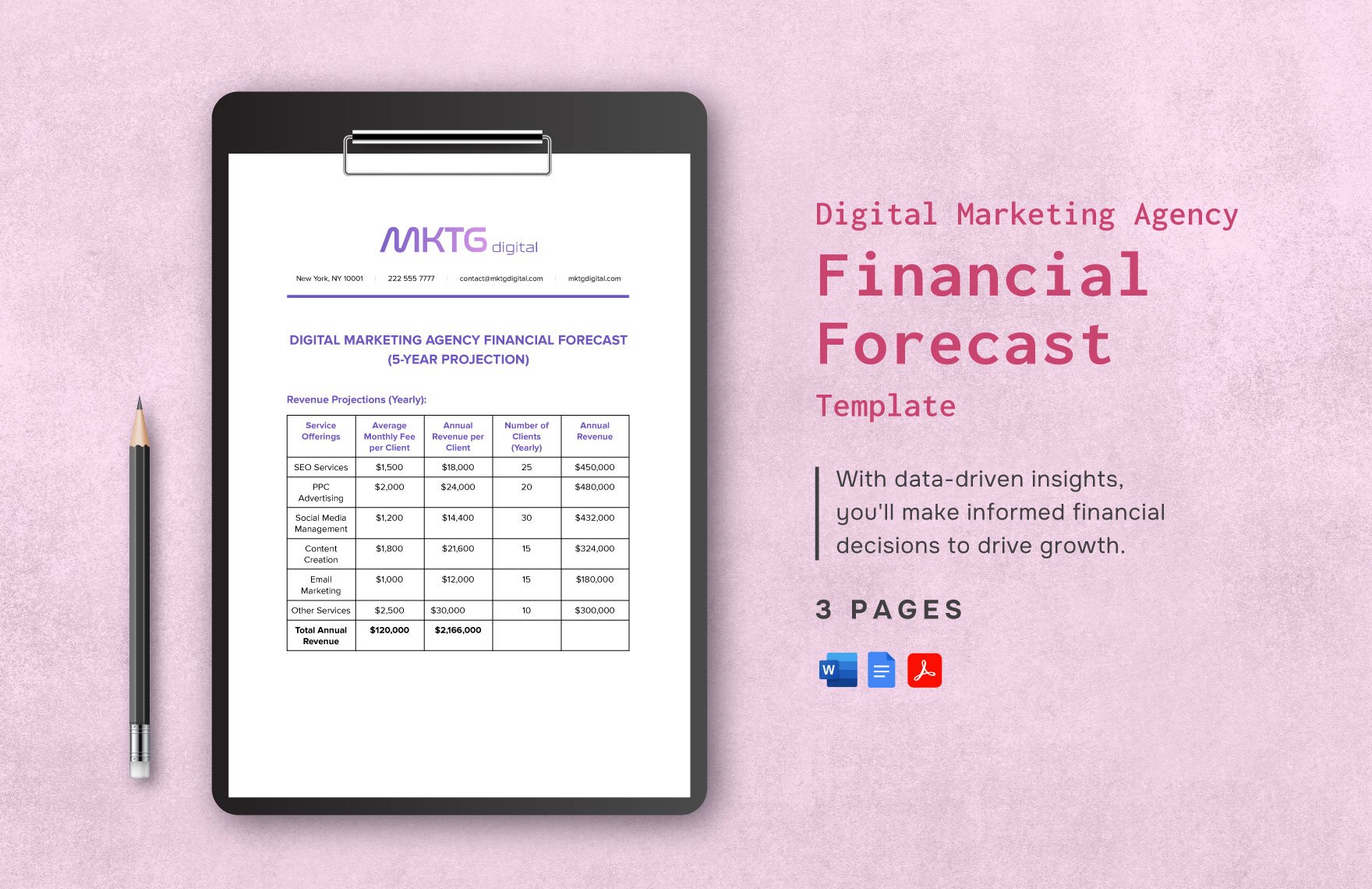

Digital Marketing Agency Financial Forecast Template

Transport and Logistics Financial Forecast and Projection Template

Nonprofit Organization Financial Forecasting Methods Template

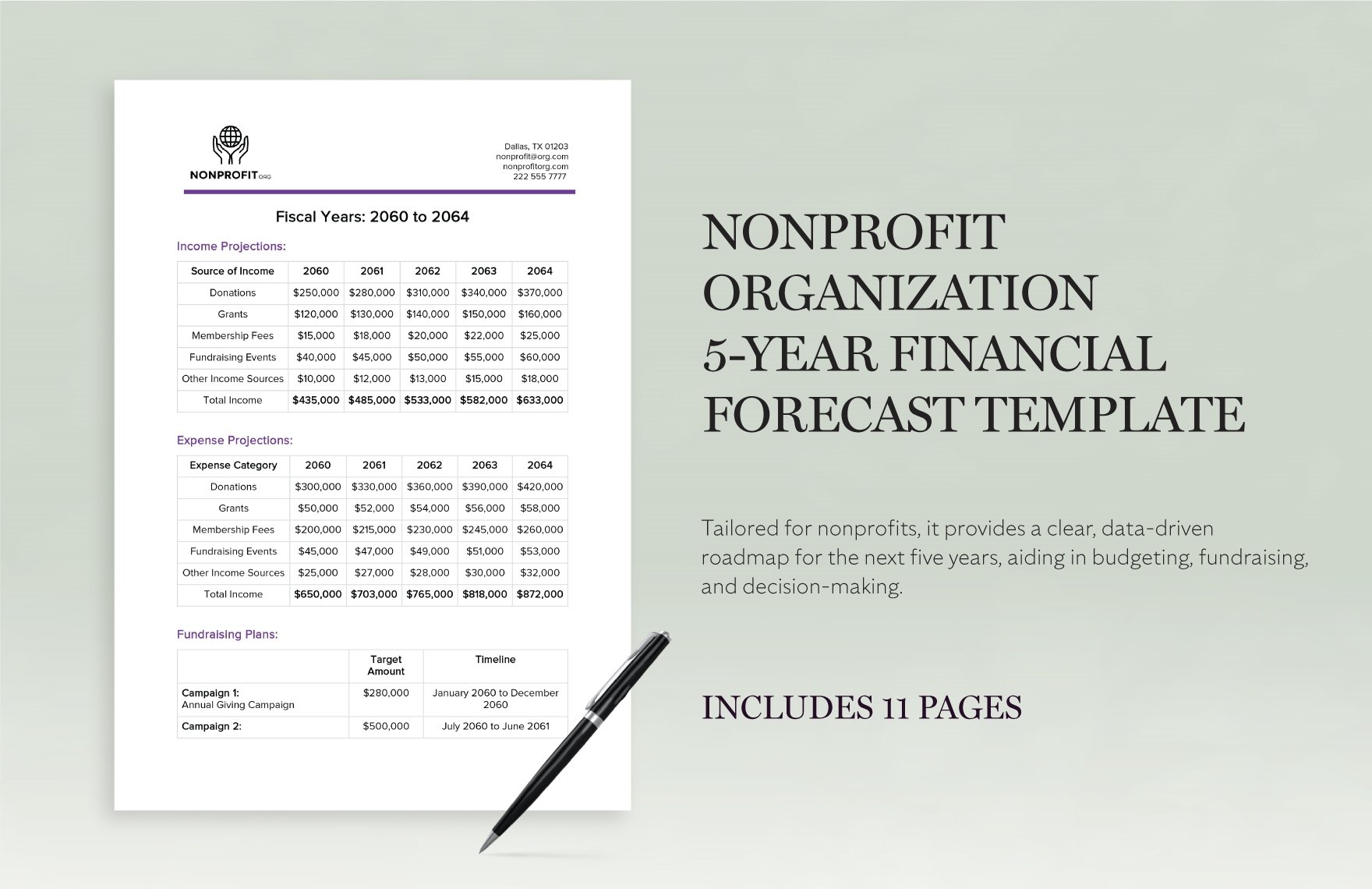

Nonprofit Organization 5-Year Financial Forecast Template

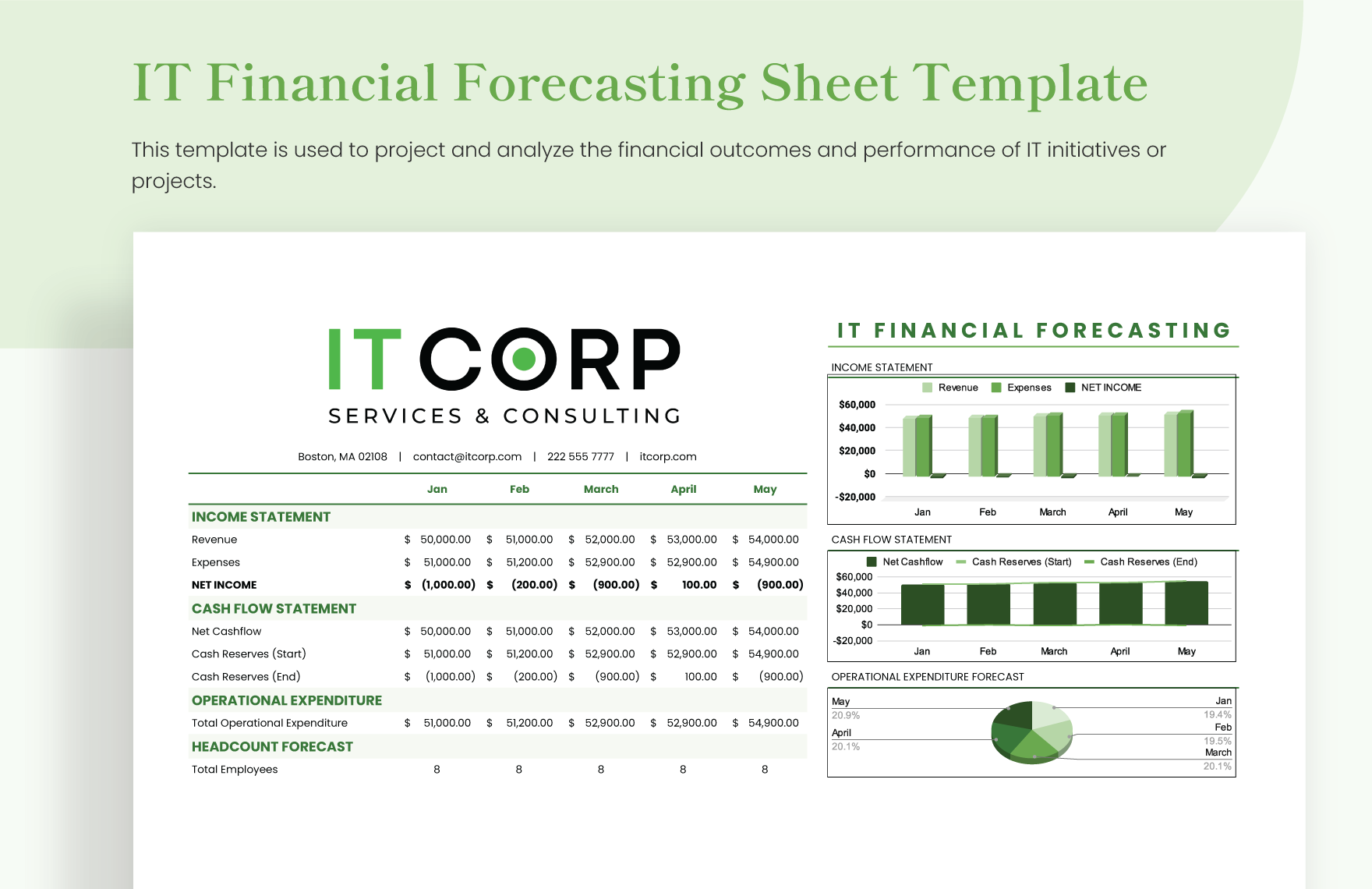

IT Financial Forecasting Sheet Template

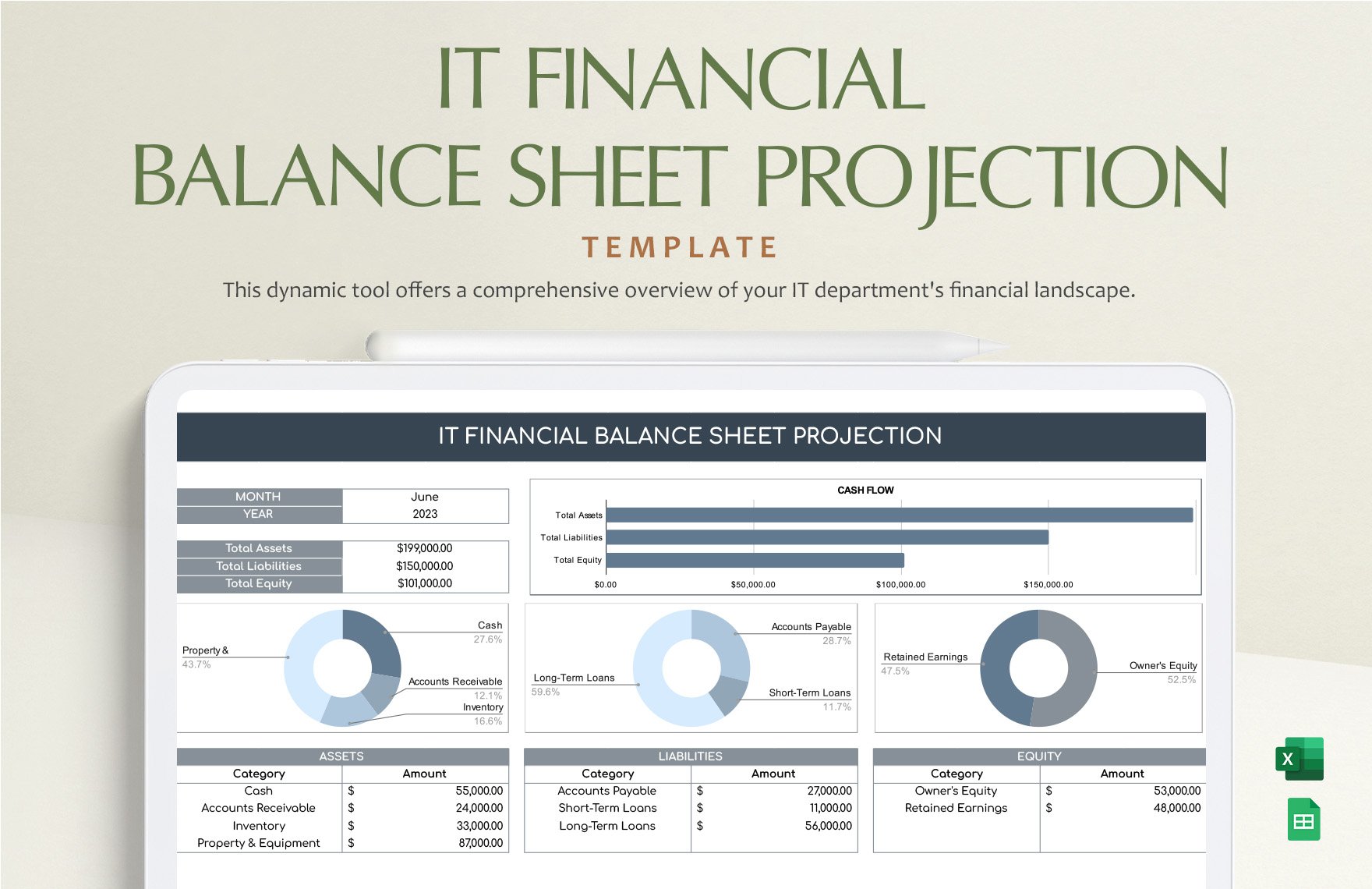

IT Financial Balance Sheet Projection Template

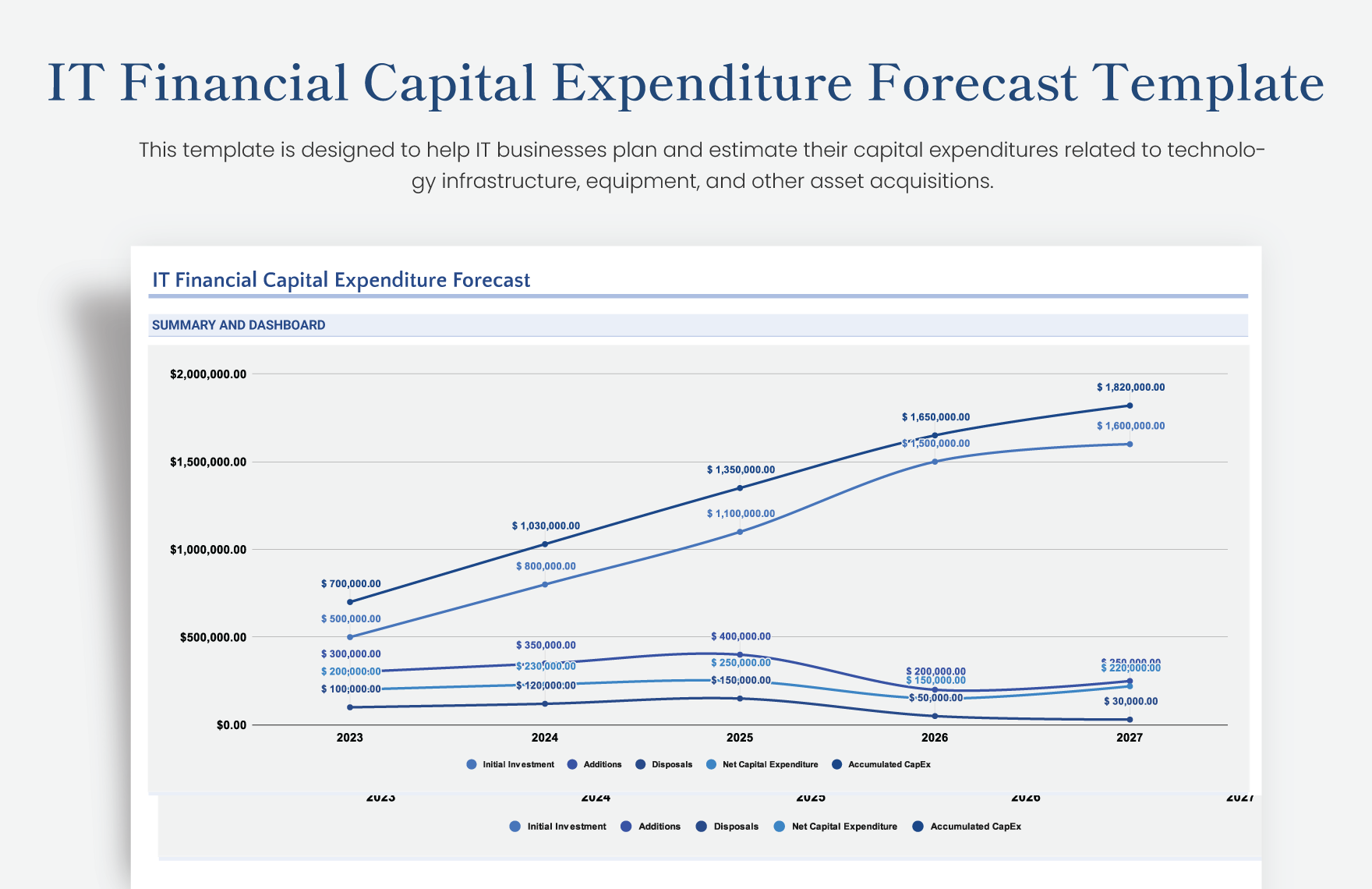

IT Financial Capital Expenditure Forecast Template

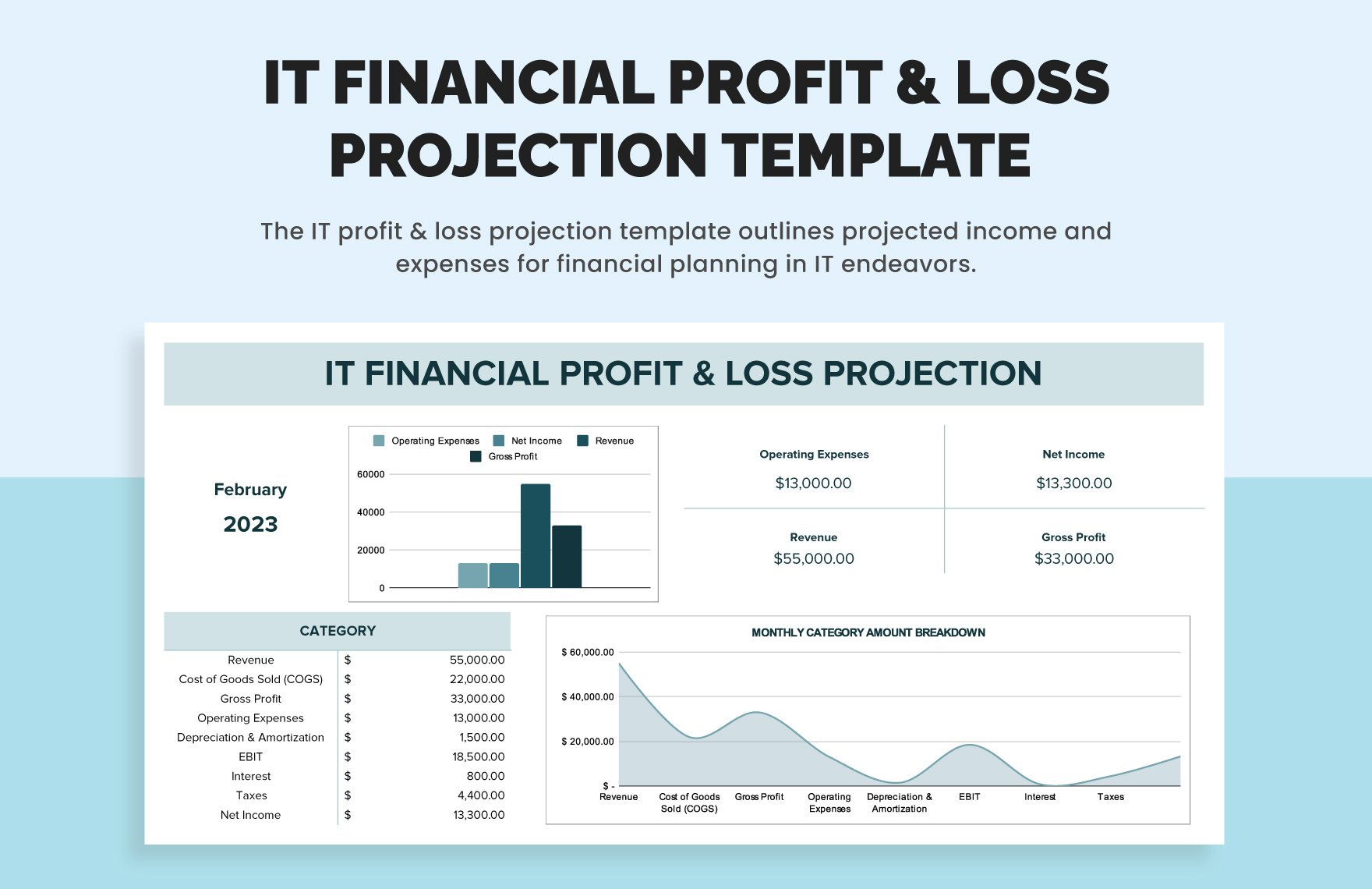

IT Financial Profit & Loss Projection Template

School Financial Projection Template

Income Statement Financial Projection Sample Template

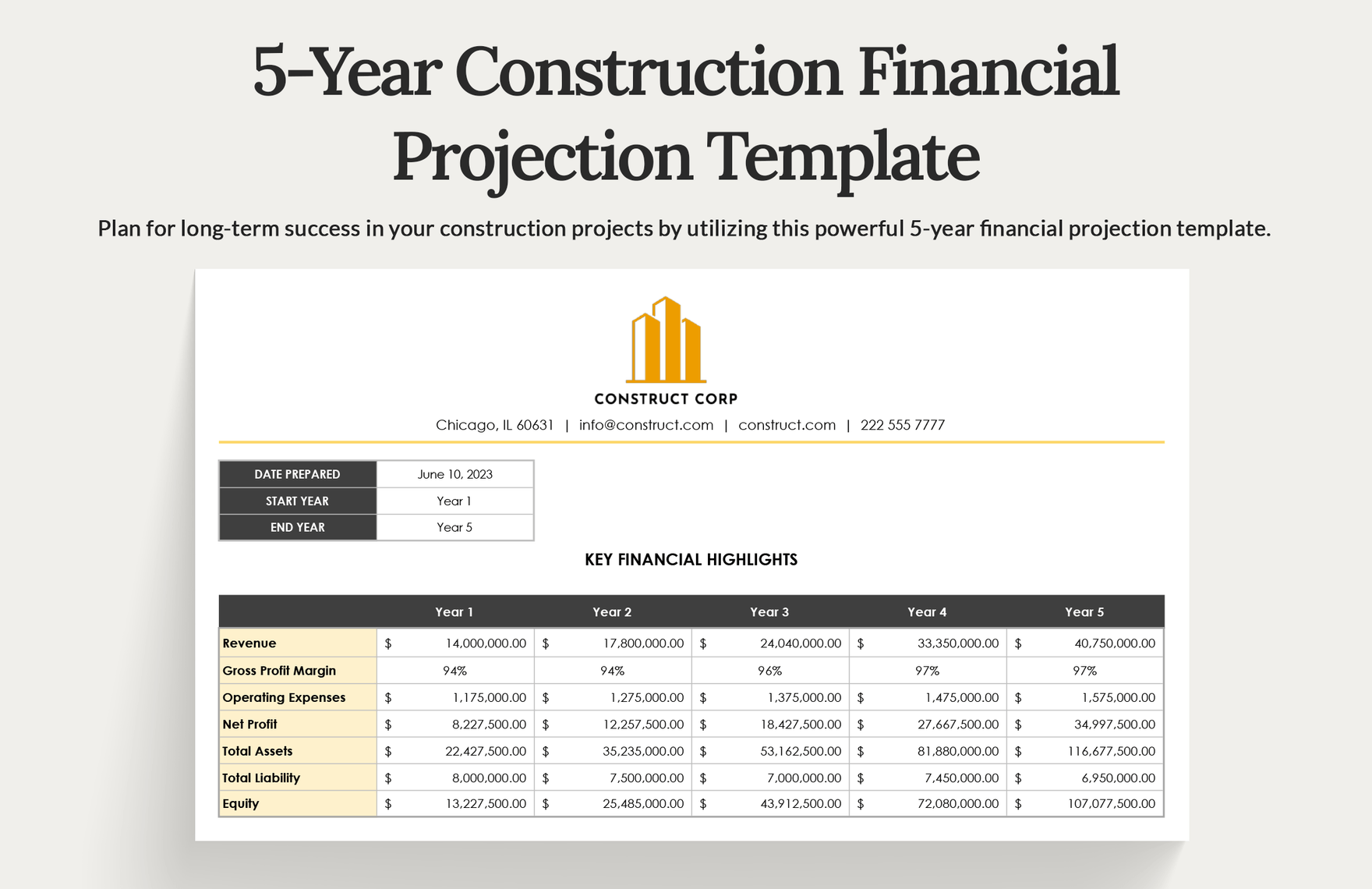

5-Year Construction Financial Projection Template

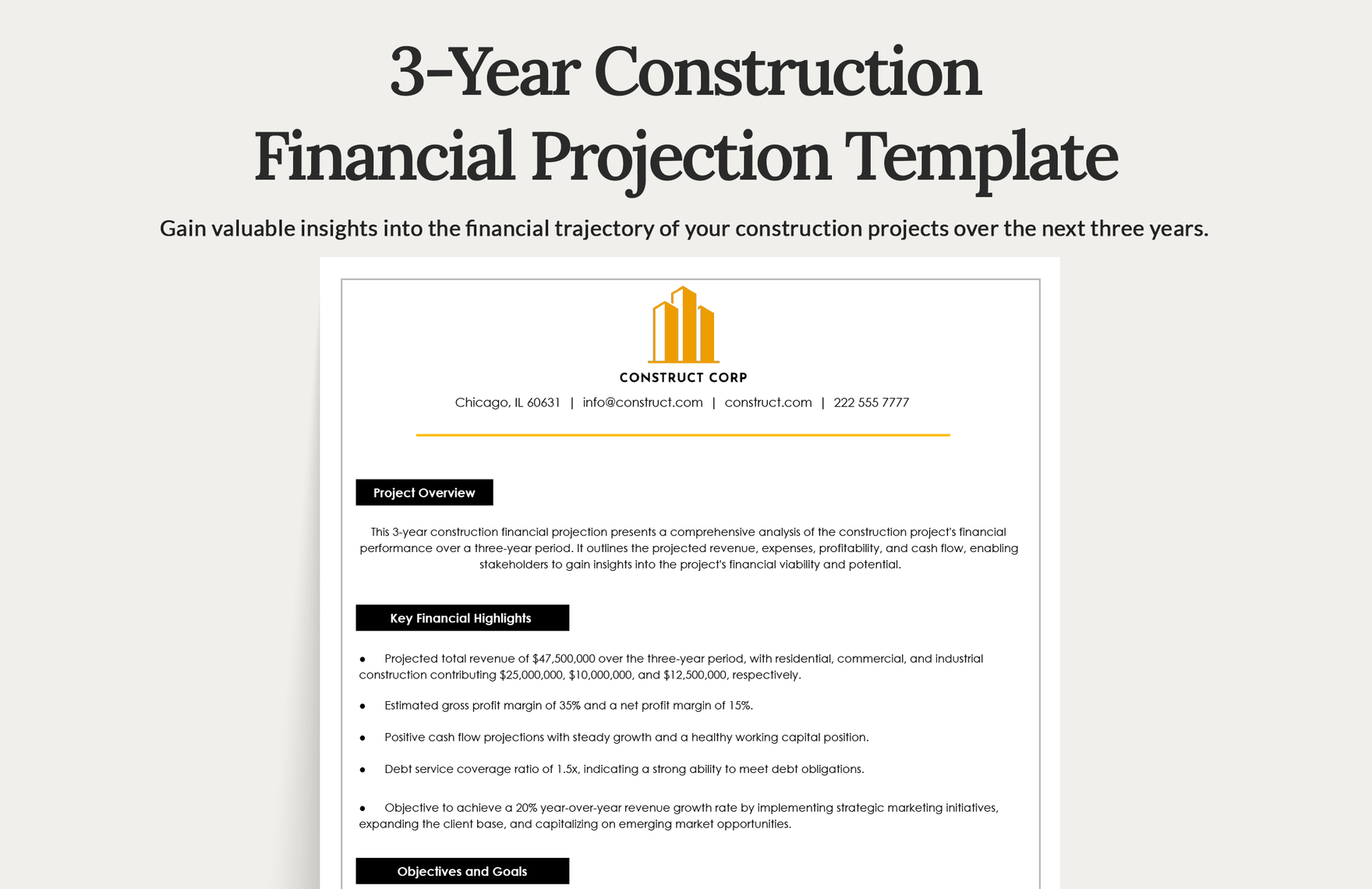

3-Year Construction Financial Projection Template

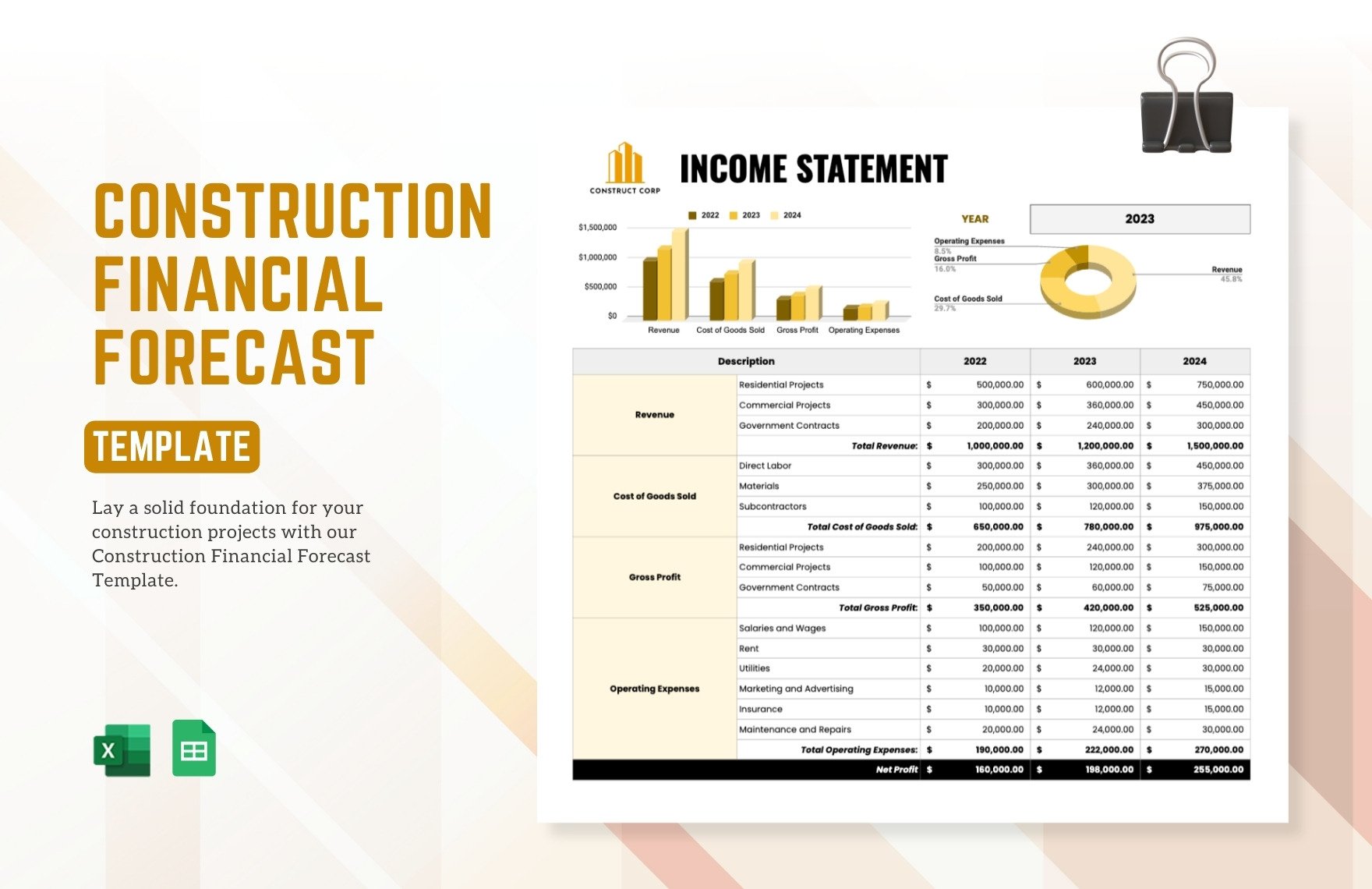

Construction Financial Forecast Template

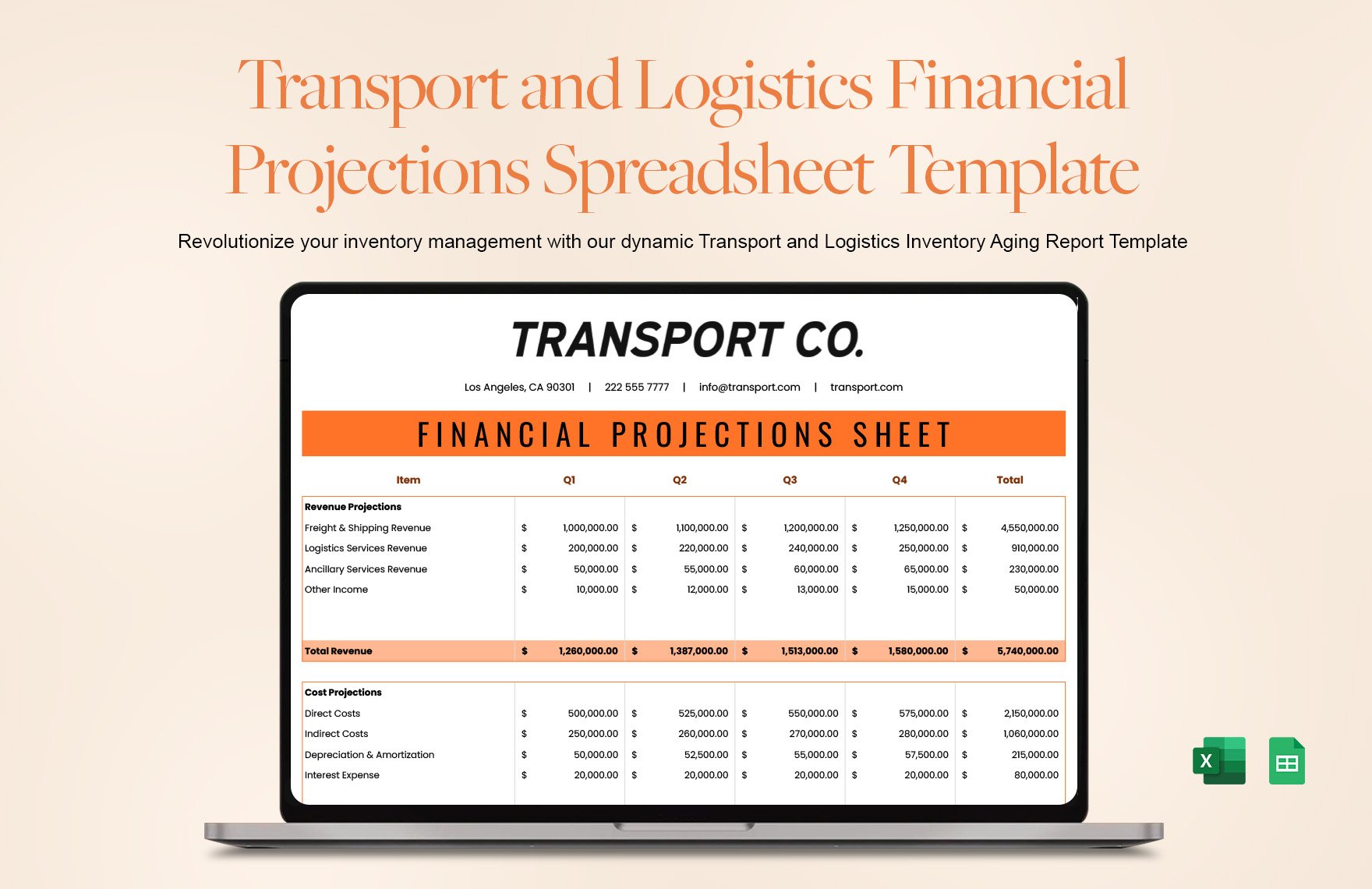

Transport and Logistics Financial Projections Spreadsheet Template

Financial Projections Small Business Plan Template

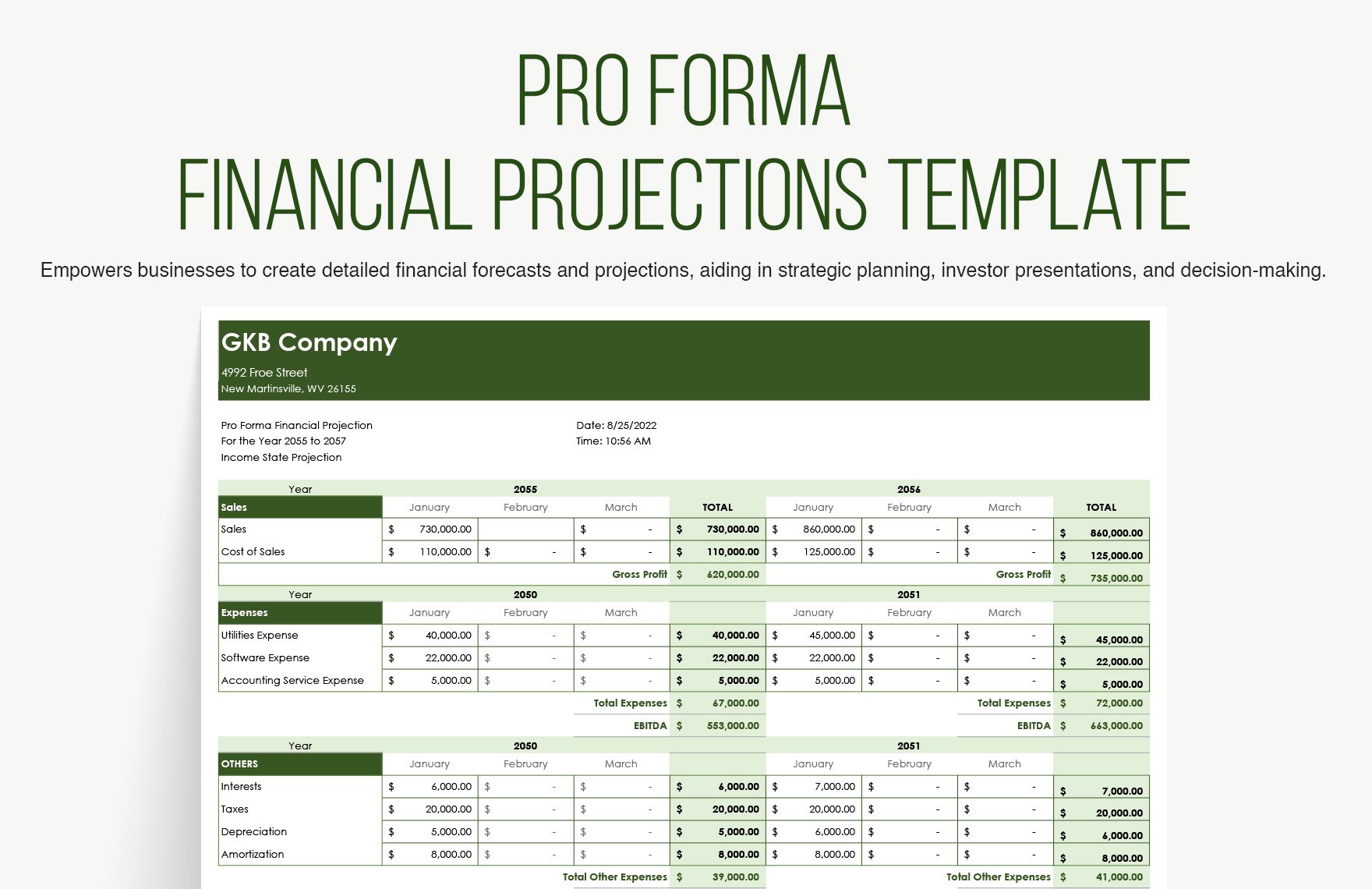

Pro Forma Financial Projections Template

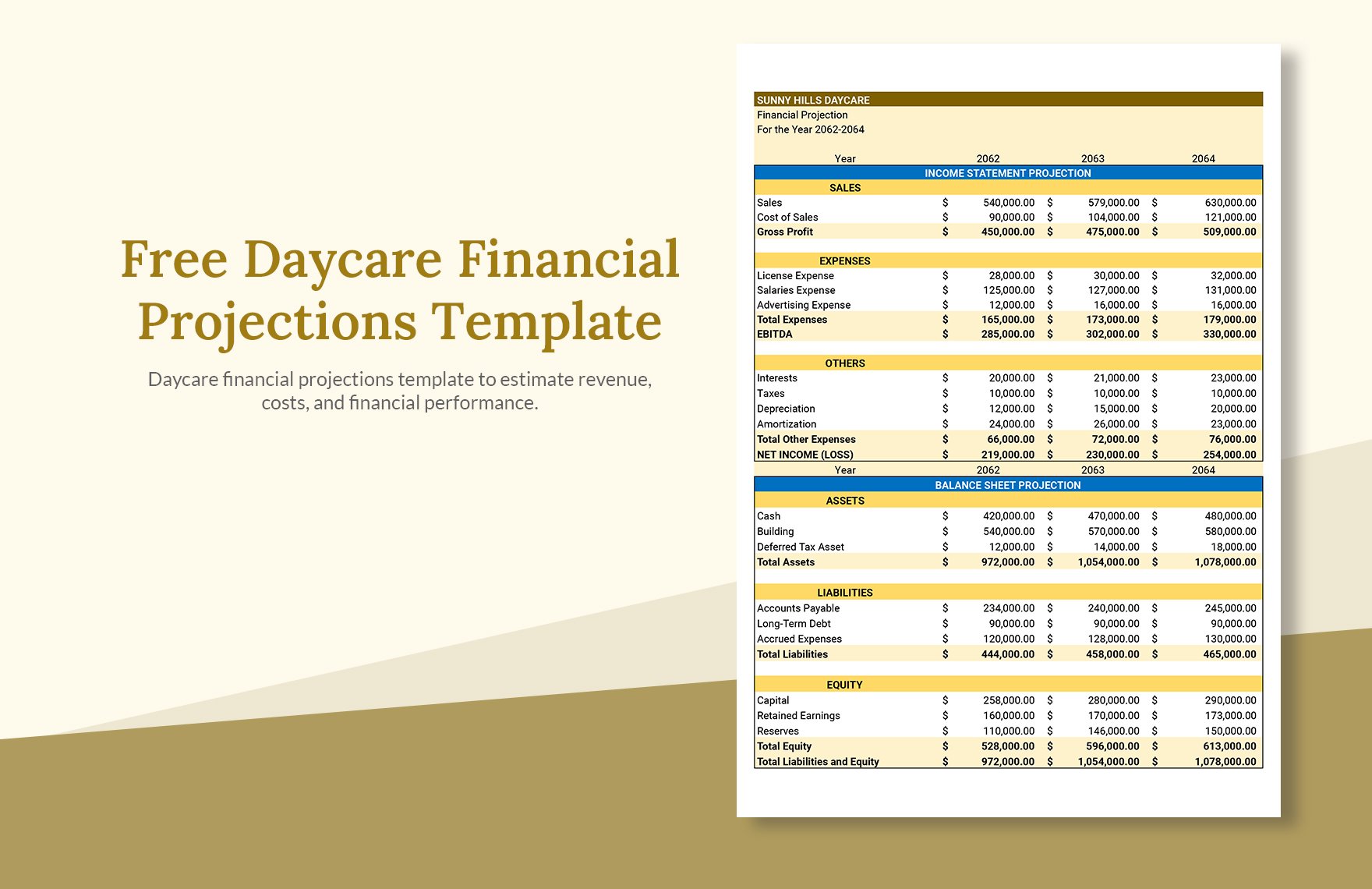

Daycare Financial Projections Template

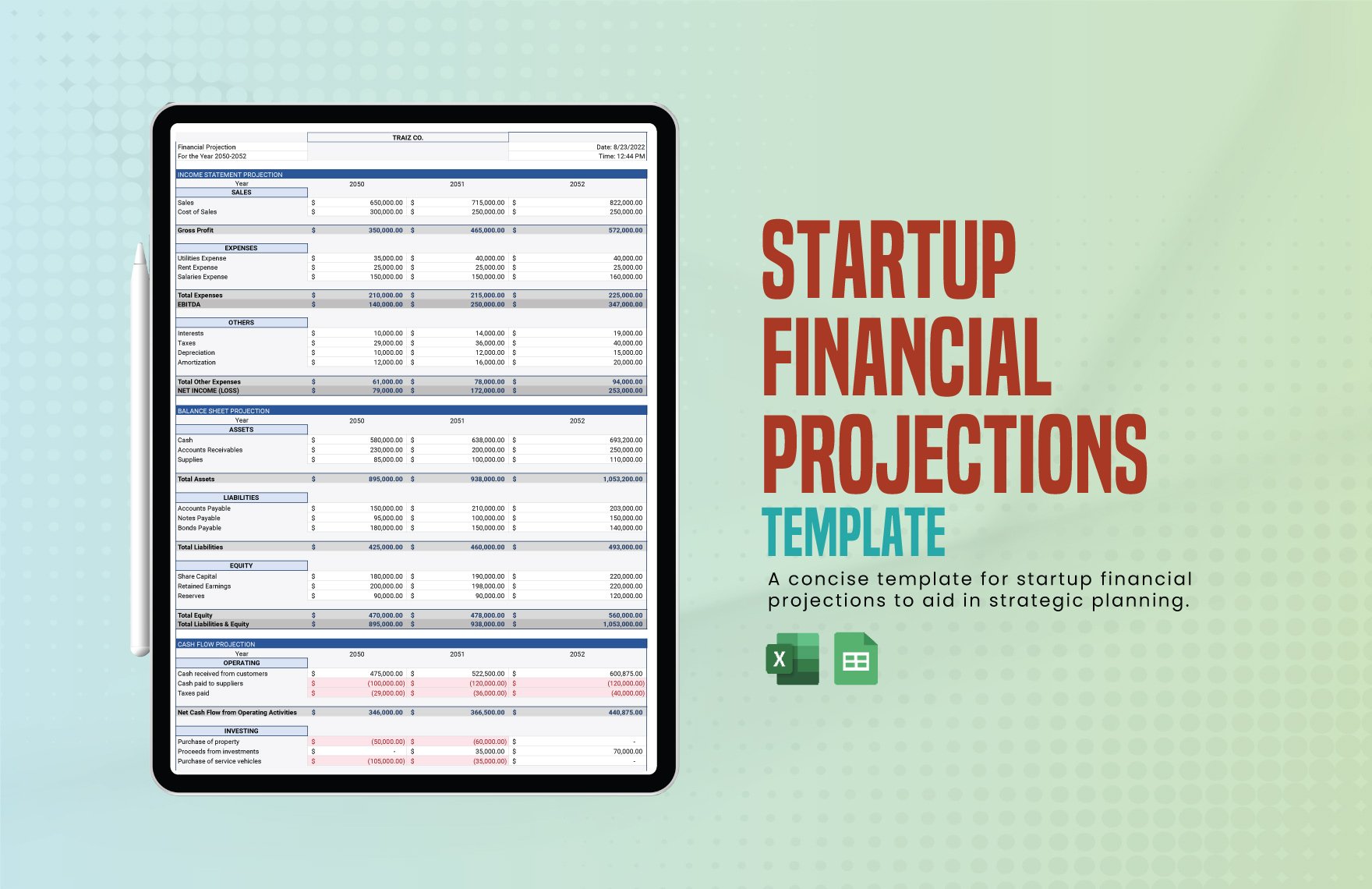

Startup Financial Projections Template

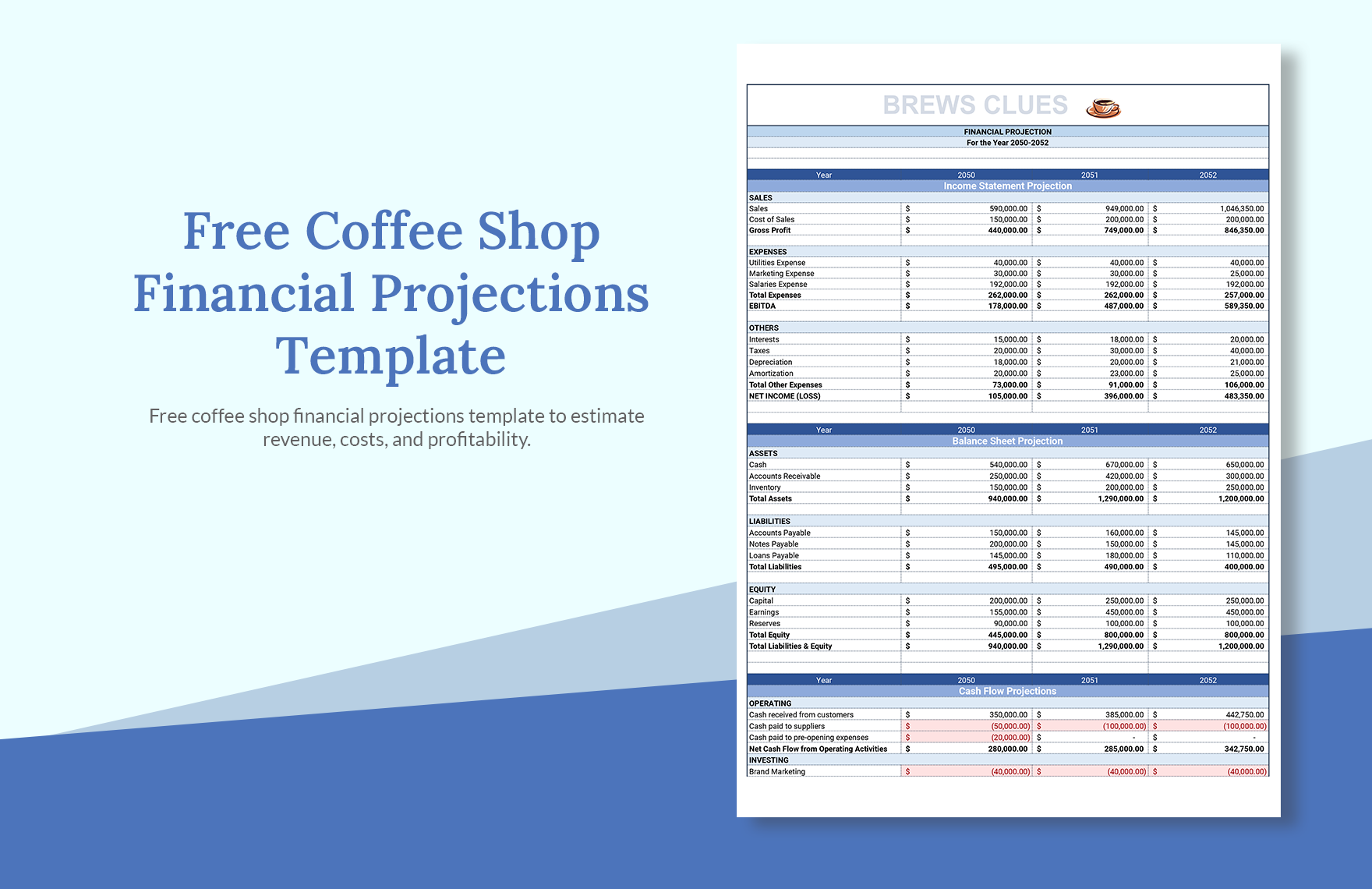

Coffee Shop Financial Projections Template

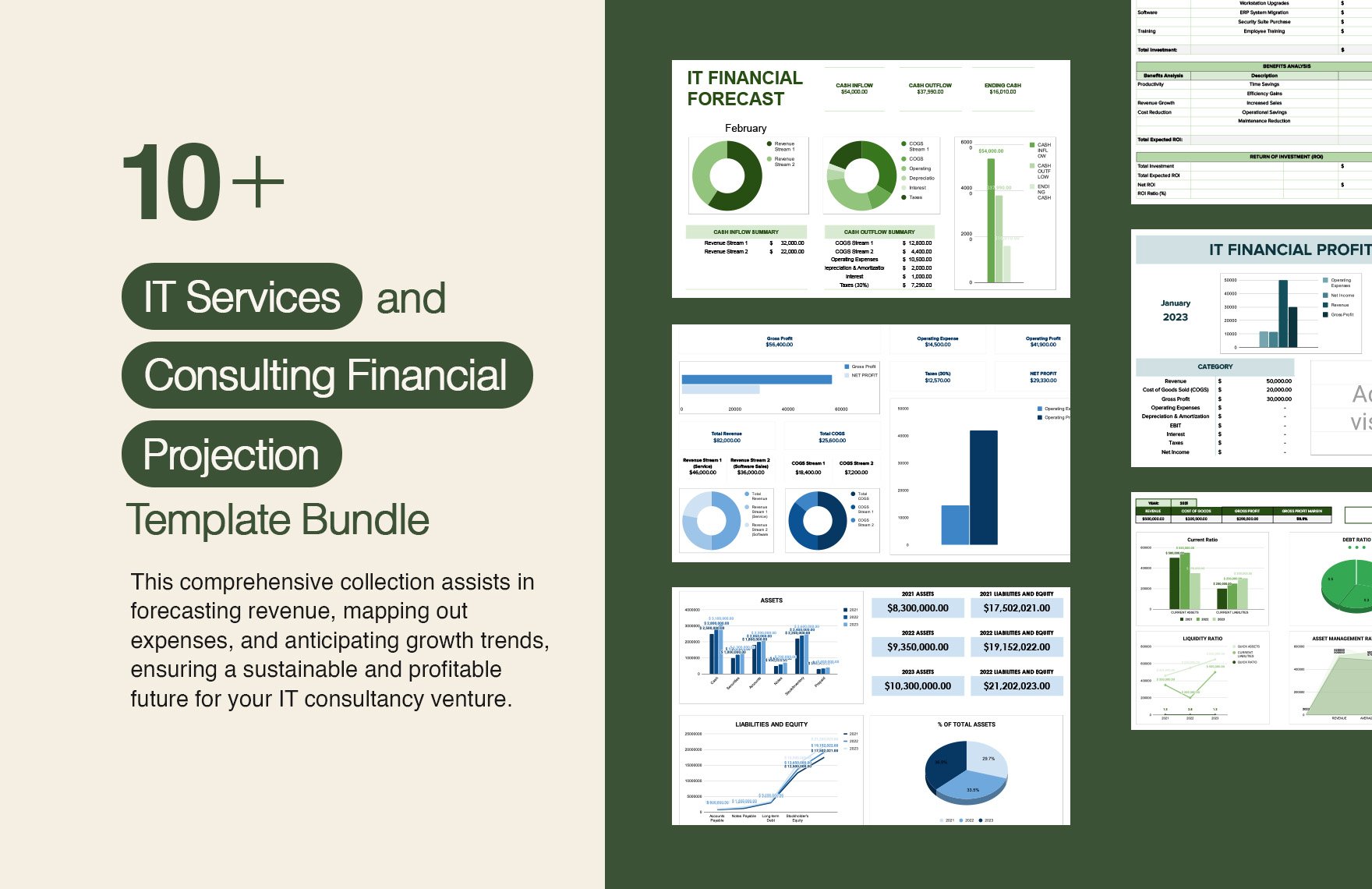

10+ IT Services & Consulting Financial Projection Template Bundle

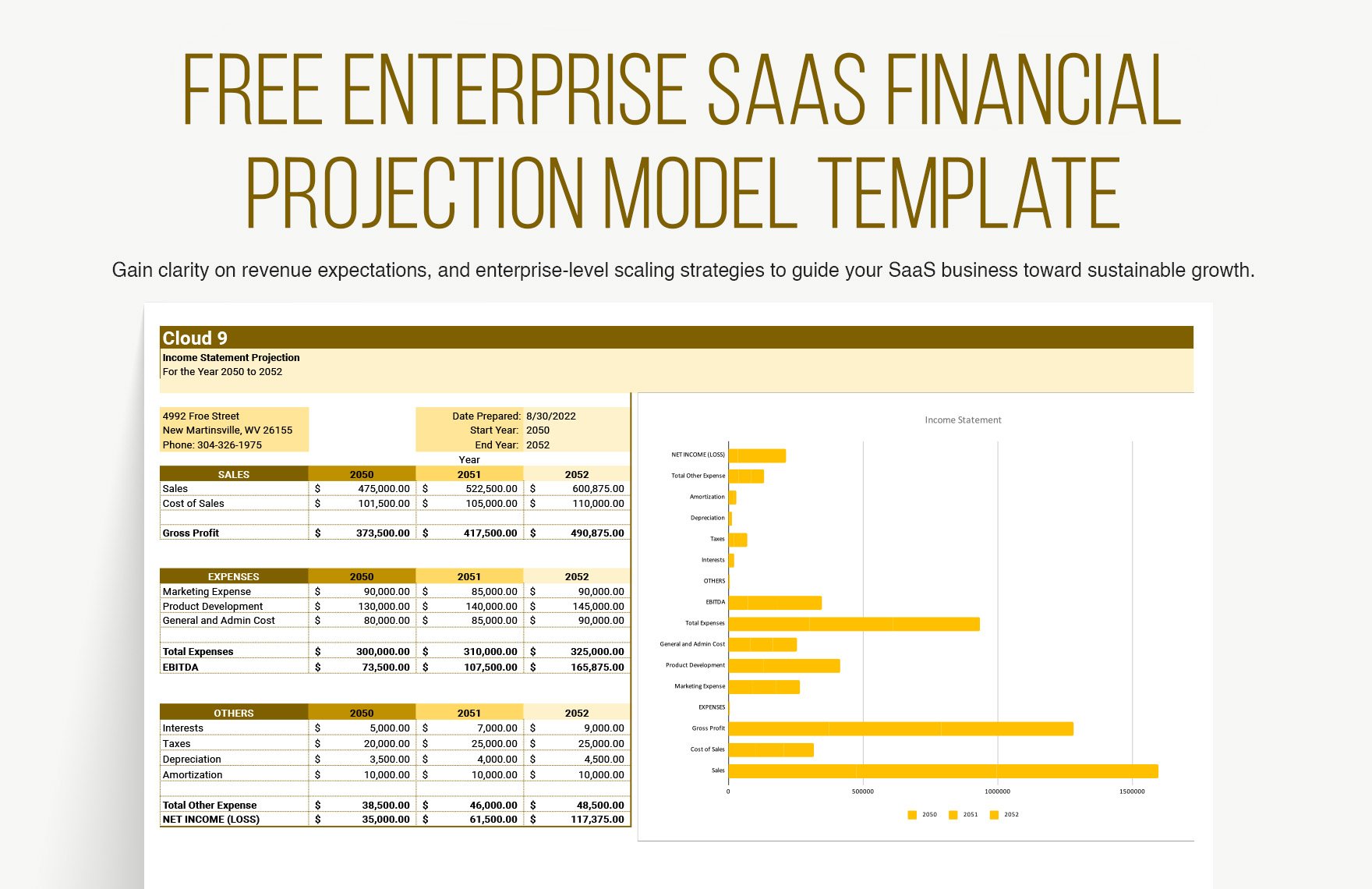

Enterprise SaaS Financial Projection Model Template

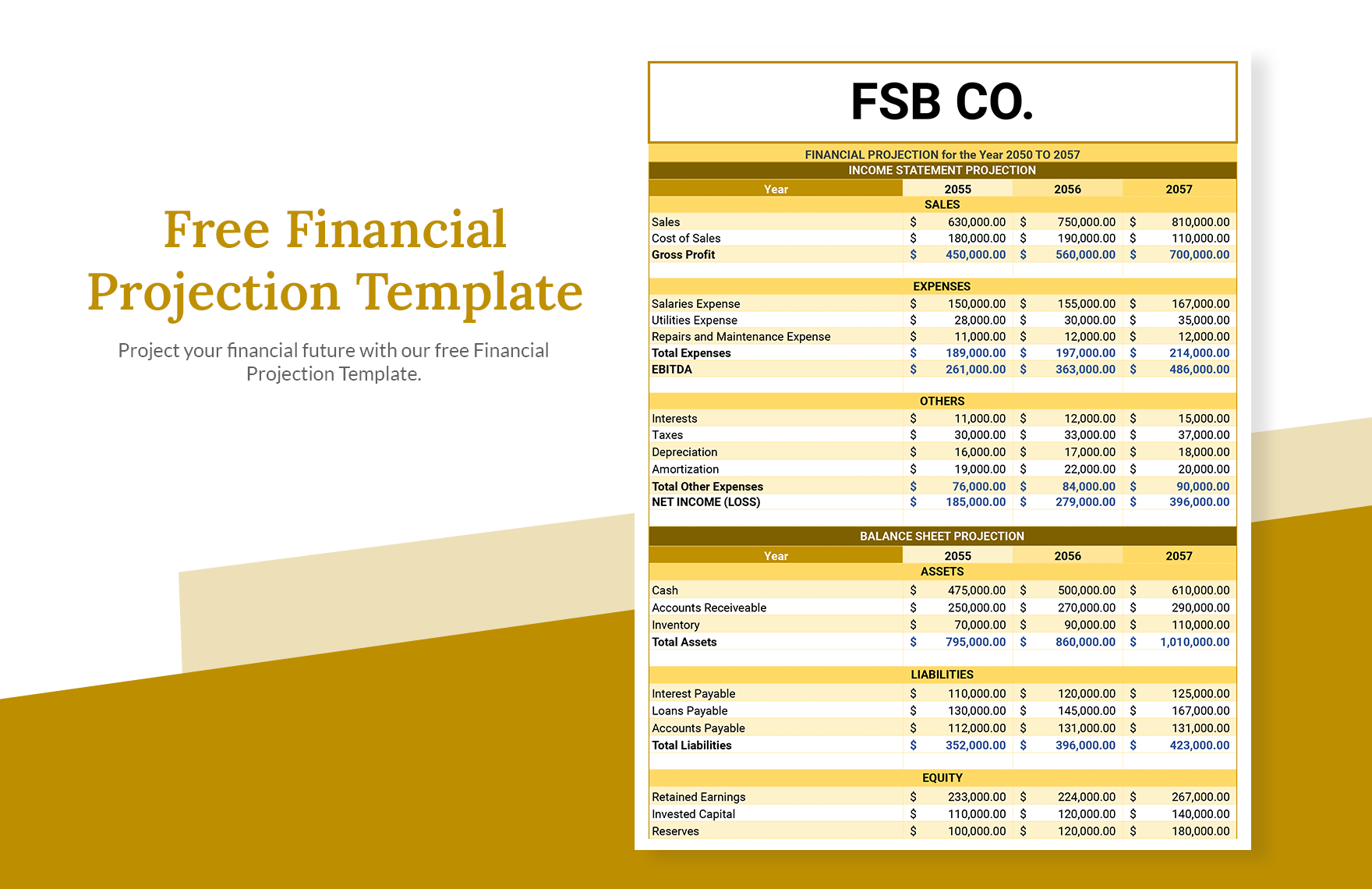

Financial Projection Template

3 Year Financial Projection

What do you think of this template.

Product details

Financial projections use existing or estimated financial data to forecast your business’s future income and expenses. They often include different scenarios so you can see how changes to one aspect of your finances such as higher sales or lower operating expenses might affect your profitability.

Your business plan’s financial projections will be the most analyzed part of your plan by investors and banks. While never a precise prediction of future performance, an excellent financial model outlines the core assumptions of your business and helps you and others evaluate capital requirements, risks involved, and rewards that successful execution will deliver.

Having a solid framework in place also will help you compare your performance to the financial projections and evaluate how your business is progressing. If your performance is behind your projections, you will have a framework in place to assess the effects of lowering costs, increasing prices, or even reimagining your model. In the happy case that you exceed your projections, you can use your framework to plan for accelerated growth, new hires, or additional expansion investments.

Hence, the use of 3 years financial projections is multi-fold and crucial for the success of any business. Your projections should include three core financial statements – the income statement, the cash flow statement, and the balance sheet. The following section explains each statement in detail.

When it comes to financial forecasting, simplicity is key. Your 3 years financial projections do not have to be overly sophisticated and complicated to impress, and convoluted projections likely will have the opposite effect on potential investors. Keep your tables and graphs simple and fill them with credible data that inspires confidence in your business plan and vision.

Your 3 years financial projections should be tied to a list of assumptions. For example, one assumption will be the initial monthly cash sales you achieve. Another assumption will be your monthly growth rate. As you can imagine, changing either of these assumptions will significantly impact your projections.

This template will primarily be useful to financiers in the preparation of financial plans for the development of the company. Also, this template can be used by company leaders when preparing a company development strategy.

Investment companies can use the slides in this template when preparing information for clients about the development of companies and the need to purchase shares. This template can also be used by startups when preparing for a meeting with investors.

Economists and analysts can use this template when preparing financial forecasting and long-term cash flow reports.

3 Year Financial Projection is a professional and modern template that contains six stylish and fully editable slides. If necessary, you can change all elements of the slide in accordance with your corporate requirements. This template will be useful for financiers, company executives, startups, economists. 3 Year Financial Projection template will complement your presentations and will be a great addition to your collection of professional presentations.

Related Products

Project Executive Summary

Cash Flow Projection

Investment Proposal

People Silhouette Shapes

Start Stop Continue

Annual Report

Knowledge Transfer

Project Estimate

One Page Marketing Plan

Investor Pitch Deck

You dont have access, please change your membership plan., great you're all signed up..., verify your account.

PowerSlides.com will email you template files that you've chosen to dowload.

Please make sure you've provided a valid email address! Sometimes, our emails can end up in your Promotions/Spam folder.

Simply, verify your account by clicking on the link in your email.

Access our collection of user-friendly templates for business planning, finance, sales, marketing, and management, designed to assist you in developing strategies for either launching a new business venture or expanding an existing one.

You can use the templates below as a starting point to create your startup business plan or map out how you will expand your existing business. Then meet with a SCORE mentor to get expert business planning advice and feedback on your business plan.

If writing a full business plan seems overwhelming, start with a one-page Business Model Canvas. Developed by Founder and CEO of Strategyzer, Alexander Osterwalder, it can be used to easily document your business concept.

Download this template to fill out the nine squares focusing on the different building blocks of any business:

- Value Proposition

- Customer Segments

- Customer Relationships

- Key Activities

- Key Resources

- Key Partners

- Cost Structure

- Revenue Streams

For help completing the Business Model Canvas Template, contact a SCORE business mentor for guidance by phone

From creating a startup budget to managing cash flow for a growing business, keeping tabs on your business’s finances is essential to success. The templates below will help you monitor and manage your business’s financial situation, create financial projections and seek financing to start or grow your business.

This interactive calculator allows you to provide inputs and see a full estimated repayment schedule to plan your capital needs and cash flow.

A 12-month profit and loss projection, also known as an income statement or statement of earnings, provides a detailed overview of your financial performance over a one-year period. This projection helps you anticipate future financial outcomes by estimating monthly income and expenses, which facilitates informed decision-making and strategic planning.

If you’re trying to get a loan from a bank, they may ask you for a personal financial statement. You can use this free, downloadable template to document your assets, liabilities and net worth.

A Personal Financial Statement is a snapshot of

Marketing helps your business build brand awareness, attract customers and create customer loyalty. Use these templates to forecast sales, develop your marketing strategy and map out your marketing budget and plan.

How healthy is your business? Are you missing out on potential growth opportunities or ignoring areas of weakness? Do you need to hire employees to reach your goals? The following templates will help you assess the state of your business and accomplish important management tasks.

Whether you are starting your business or established and looking to grow, our Business Healthcheck Tool will provide practical information and guidance.

Learn how having a SCORE mentor can be a valuable asset for your business. A SCORE mentor can provide guidance and support in various areas of business, including finance, marketing, and strategy. They can help you navigate challenges and make important decisions based on their expertise and experience. By seeking out a SCORE mentor, you can gain the guidance and support you need to help grow your business and achieve success.

SCORE offers free business mentoring to anyone that wants to start, currently owns, or is planning to close or sell a small business. To initiate the process, input your zip code in the designated area below. Then, complete the mentoring request form on the following page, including as much information as possible about your business. This information is used to match you with a mentor in your area. After submitting the request, you will receive an email from your mentor to arrange your first mentoring session.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

3-Year Business Plan Template

Written by Dave Lavinsky

In today’s fluid business environment, developing a structured and detailed business plan is essential for both small business startups and large corporations. If you’re ready to develop a three-year business plan, you already know it is a thoughtful and essential approach to a sustained plan for growth and movement forward. However, tackling the entire business plan can be slightly overwhelming when you examine the components that go into such a document. We’re here to suggest solutions for a successful outcome in your business planning process to complete your own business plan. In this article, you’ll see the framework of a 3-year business plan template, segment by segment, which will create “digestible bites” for your thought processes; one step at a time. The many benefits of creating a three-year business plan are just ahead, so let’s get to work.

Download our Ultimate Business Plan Template here >

Three-Year Business Plan Template

Executive summary.

The initial portion of your business plan will offer an executive summary that includes a brief sketch of the essential components of your plan: a business overview, success factors, and a three-year financial plan. This snapshot of your business enables busy executives or other stakeholders an opportunity to quickly review your business and make a quick decision to more fully explore the complete business plan that follows. And, further to consider, many lenders or investors will make a decision regarding your business based on the executive summary alone. As a result, this section is as critical in and of itself as is the remainder of your business plan.

It will detail the type of business you’ve started, the business location, and the industry in which it operates. Detail only the salient facts in this summary and offer your mission statement, as well. Include in a few brief remarks, the success factors already achieved, and outline a clear, concise picture of the financial status of your business. Using the business plan helps to rein in any temptation to oversell your business; keep it concise and clear overall.

Company Overview

Next, the company overview section of the business plan is presented. Start with general statements and refine them as the overview continues. For example, “company name” operates in the “industry” sector, leveraging our expertise in “specific skills/experience.” Started in “date,” our primary products/services include a “list of products/services.” And, we are targeting a “specific target customer”, aiming to meet their needs and surpass expectations. From this general idea, move to the company’s complete list of products or services, including the business structure, how the business operates, and the location(s) of the business. Crucial information will also include the plans to generate revenue within the current status and a three-year forecast of financial projections.

The company description should also include major milestones already achieved, target customers, long-term contracts in place, and other primary facts; such as number of customers served, prototypes or products built, leases secured and employees hired. Each of these details is an indicator of business health and comparative success within the industry sector.

Industry Analysis

Next, an industry analysis will need to be compiled and shared in the business plan. An industry analysis is a crucial component of any business plan, as it provides an in-depth understanding of the market dynamics, trends, and competitive landscape. Include in your business plan the current and projected market size, including potential opportunities for growth. And, finally, analyze the current trends and dynamics within the industry. This may include technological advancements, regulatory changes, consumer preferences, or shifts in distribution channels. Highlight any emerging trends that may affect your business.

Customer Analysis

A full market analysis of your target audience follows the industry analysis. Identify the target market and its demographics, preferences, and buying behavior. Who are your customers? Do they want speed of delivery, a set price point, or comfort in ordering? Reading the data and responding satisfactorily can make the difference between a company that fails within three years and one that will thrive through it.

Review the data outlining the current target market trends and dynamics within the industry. This may include technological advancements, regulatory changes, consumer preferences, or shifts in distribution channels. Highlight any and all emerging trends that may affect your business. If, at this point, you’re wondering why the analysis of the industry and target audience are so thorough, you’ll be glad to know the results are critically integral to the sales and marketing strategies that follow these sections of your business plan.

Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitor Analysis

The competitors you face in your industry need to be analyzed and thoroughly examined in order to win your target audience over the offers of your competitors. First, Identify your main competitors and evaluate their strengths, weaknesses, market share, and strategies. Determine what sets your business apart and how you can gain that competitive advantage if your business does not hold it already. Remember to support your analysis with relevant data, statistics, and market research. The industry analysis should demonstrate your knowledge of the industry and your ability to navigate its challenges successfully. Also, you’ll want to collect the data from secondary and indirect competitors, as well. Such competitors often take a leap into a larger market position while completely unnoticed.

In this section of the plan, turn the analysis on your business to examine the competitive advantages your business has to outperform both direct and indirect competitors. Expand on the advantages of the business, such as the products or services offered, operational systems that outperform others, the ideal location of the business, and the intellectual property held by your business. These are salient factors that give your business a boost in terms of relevance and advantage.

Marketing Plan

The marketing strategy for the business is based on the status of current marketing efforts and data collected during the analysis of the industry, customers, competitors and internal processes of the business. It makes sense to pull all the key elements together to form a cohesive marketing plan directed exactly to the ideal customer base. Include in this portion of the plan the current products and/or services, pricing and promotions plans. The business to date should identify its capability to generate revenue, resulting in profitability, a quality highly desired by lenders and investors. It proves that you have a solid plan for reaching new customers, you can attain new customers profitably, and the customer acquisition cost is significantly less than the customer lifetime value. Include in the plan subsections highlighting products, services and pricing, promotions plan and the product distribution plan.

Operations Plan

The operations plan is where reality meets expectations and, sometimes, it’s not a happy introduction. In a three-year business plan, much of the information is still speculative, while the present picture remains too new to extrapolate and analyze the data. A three-year business plan can, however, offer a healthy look at the present sales and revenue, strategic moves and options, paving the way to an informed look in years two and three ahead. The operations plan is affected by both the revenue collected or outstanding and the strategic moves that could follow.

Contained within the operations plan are the key day-to-day processes that have been accomplished within year one, as listed:

- Established a production facility/office that meets current and future needs.

- Developed strong supplier relationships to ensure a reliable supply chain.

- Implemented efficient inventory management systems to optimize stock levels.

- Hired and trained skilled personnel to handle production, sales, marketing strategy, and customer service.

- Implemented quality control measures to maintain high product/service standards.

The extent to which the key operational plan is detailed, lenders and investors will understand how developed your business is internally and externally, as well as how “hungry” for growth your business may be. These factors can exponentially affect future business.

Management Team

The introduction of the key management team in this plan is also indicative of your attention to detail and the drive you have to move toward years three, ten and twenty. Offer the name, title and background of each management person and include the members of the board of directors or board of advisors, if such exist within the corporate structure. These are the hungry executives, ready to work hard to make the business better for all. As the business owner, be sure to highlight your specific qualifications to run a successful business.

Financial Plan

Finally, introduce the financial plan at the end of the business plan. It is a multipart framework for making decisions regarding how to parse out, invest, and best use the monies received. Based on the market analysis and sales forecasts, project the following financials for the next three years:

- Year 1: Revenue of [amount], with an operating expense of [amount].

- Year 2: Revenue of [amount], with an operating cost of [amount].

- Year 3: Revenue of [amount], with an operating expense of [amount].

Indicate when achieving profitability will occur, such as “by the end of Year One” and pinpoint when, at what date, the business expects steady revenue growth thereafter. The projections need to be based on conservative estimates and prudent financial management.

To provide a comprehensive overview of the business’s financial health, the following financial statements should be included in the business plan: income statements, balance sheets, and cash flow statements.

Provide a conclusion at the end of the business plan and construct the executive summary after the body of the business plan is complete. Indicate throughout the conclusion the strategic initiatives and sales strategies that make it a viable document for the years ahead. Update the business plan as needed, during that time and continue to refer to the data collected, the conclusions formed and the ways in which competitors can be overcome by differentiation and better product positioning. After completing the traditional business plan, you’ll have the confidence to share it as a viable, sustainable document that indicates a healthy foundation, a growing revenue stream and a solid plan for long-term growth and success ahead. Congratulations!

Simplifying Your Office Tasks

Ready-To-Use Startup Financial Model Excel Template

Download the Startup Financial Model Template in Microsoft Excel, OpenOffice Calc, and Google Sheets to prepare financial projections for 3 years for your startup.

Just insert data for the first year. The template will automatically prepare the remaining 2 years of Income Projections, Sales Projections, Cash Flow Statements, Balance Sheets, and Break-even Analysis for your startup.

This template can be useful if you plan to get a business loan from banks or raise capital for your startup from private investors.

Table of Contents

Download Startup Financial Model Template (Microsoft Excel, Google Sheets & OpenOffice Calc)

We have created a ready-to-use 3-year Financial Projection Model For Startups to help you easily prepare Income Projections, Sales Projections, Cash Flow Statements, Balance Sheets, and Break-even Analysis for your startup.

This extremely useful Startup Financial Model Excel Template was voluntarily contributed by Kirti Tiwari, MBA Finance, Gold Medalist.

She has prepared this Startup Financial Model and also provided related explanations. Highly Appreciated.

Click on the link below to download your desired format.

Microsoft Excel OpenOffice Calc Google Sheet

Additionally, you can download the Income Statement Projection Template , Balance Sheet Template With Analysis , Cash Flow Statement Template , and Break-even Analysis Template depending on your requirements.

In case, you want to customize any of the above templates feel free to contact us. You can hire us for our services on Fiverr or contact us at [email protected].

How To Use Startup Financial Model Excel Template?

INTRO Sheet: Enter the preparer name, Company name, Starting Month, and Starting year. The Company name will be reflected in all the sheets ahead.

Startup Expenses

Startup Expenses (Year 1): Insert applicable data in the white cells. Orange cells contain formulas, hence do not enter or delete the cells.

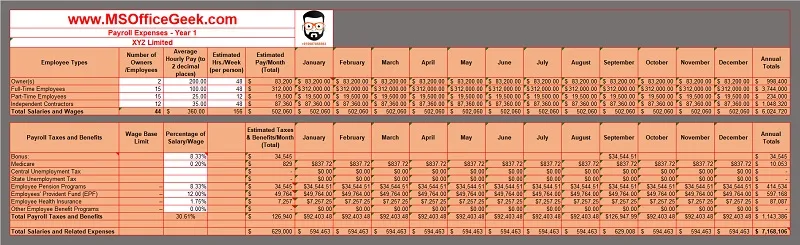

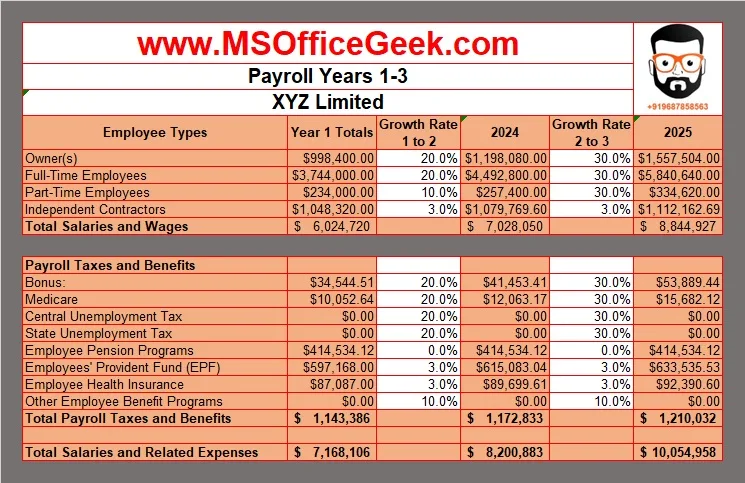

Payroll Expenses

Payroll Expenses (Year 1): Insert applicable data in the white cells. Orange cells contain formulas, hence do not enter or delete the cells.

Payroll Expenses (Year 2 and Year 3): Insert the growth rate percentage to populate the cells automatically.

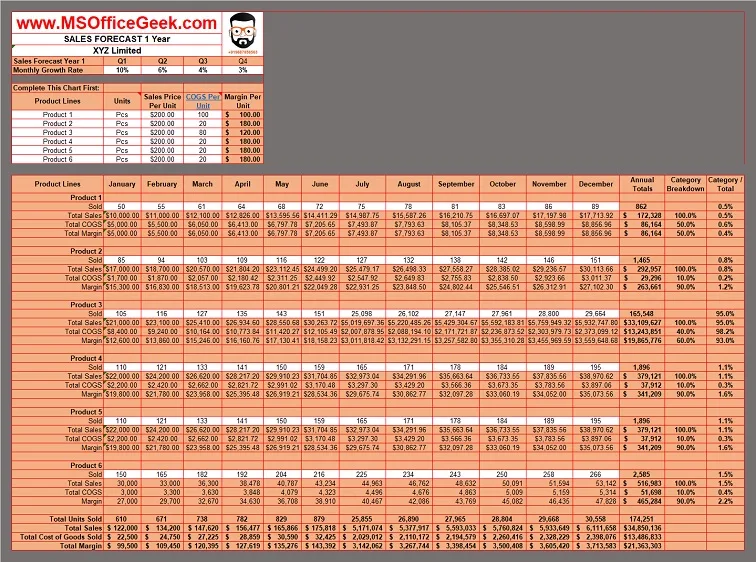

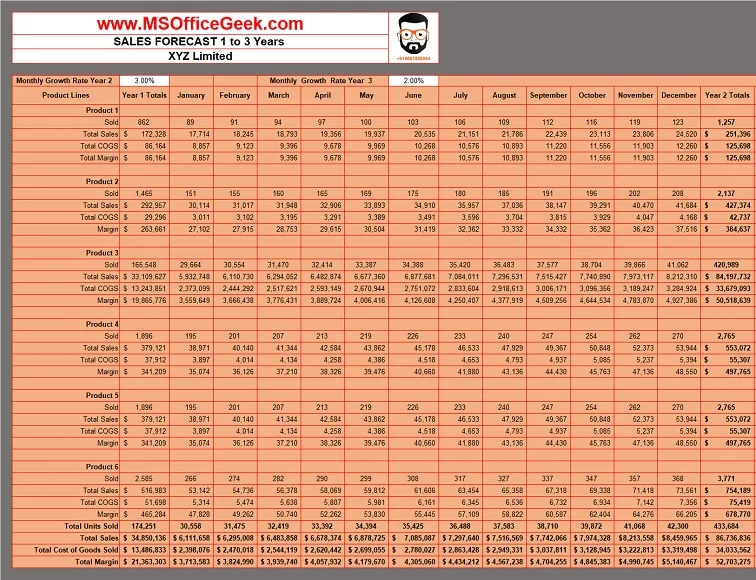

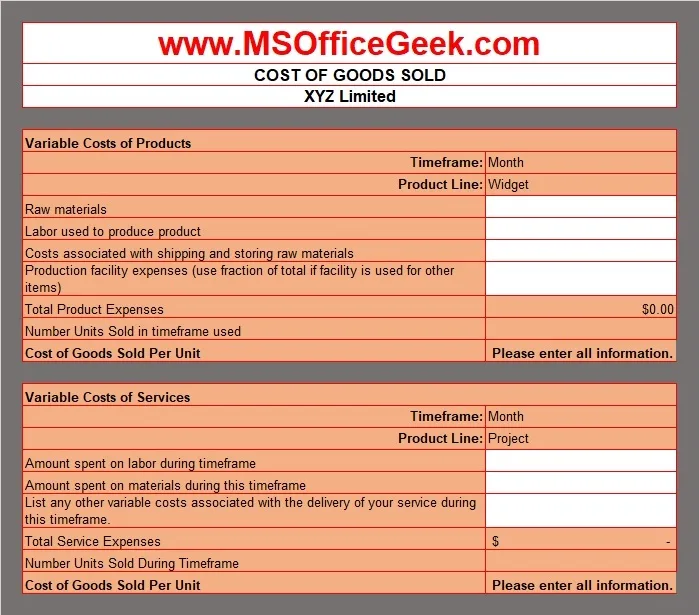

Sales Forecast

Sales Forecast (Year 1): Insert product names, Units, Sales Price per unit for each product, and COGS per unit. It calculates the Margin per unit for each product automatically.

Additionally, insert sales of units for each product in each month and it will calculate the rest.

Sales Forecast (Year 2 and Year 3): Insert Sales Growth Rate at the top for year 2 and year 3 and it auto-populates the sheet for you.

Other Expenses

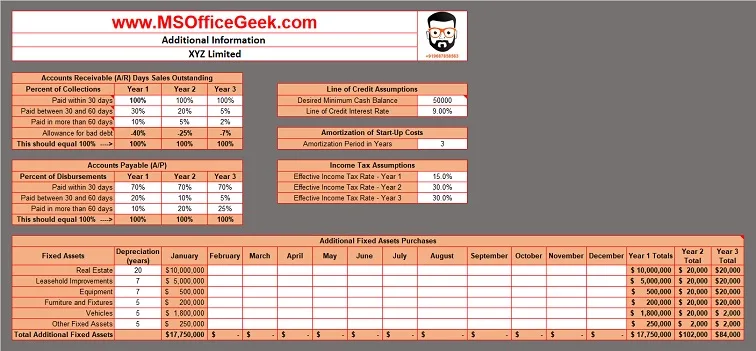

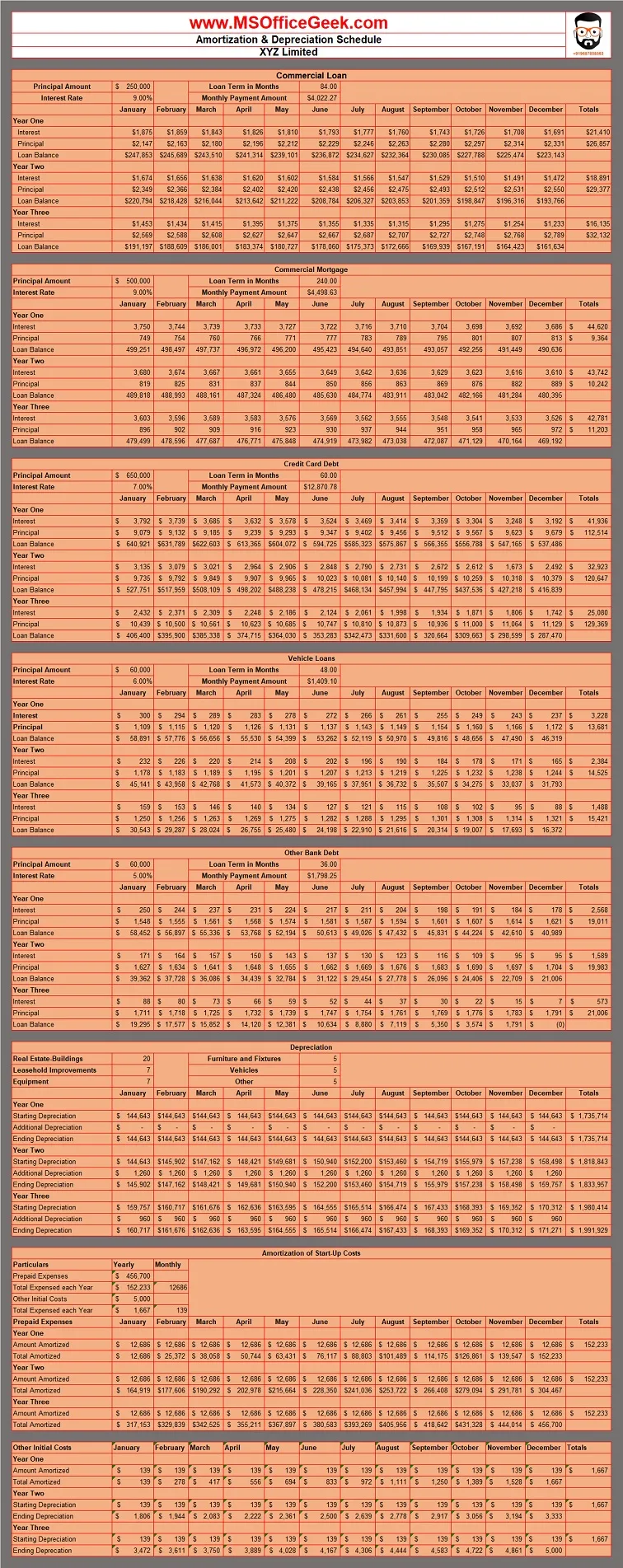

Additional Information: Insert other startup-related costs such as schedules for Accounts Payable, Accounts Receivable, Amortization, Income Tax, and Depreciation.

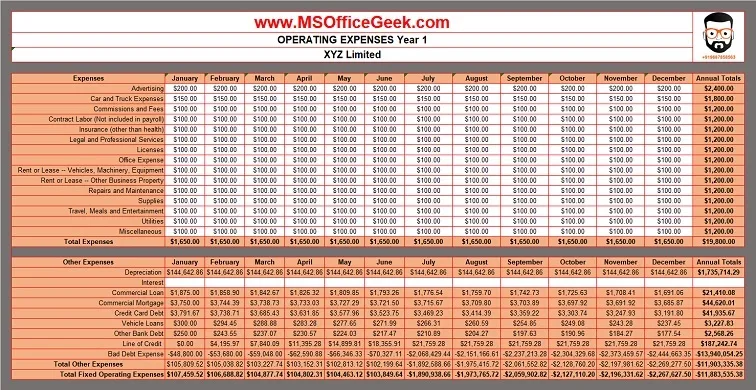

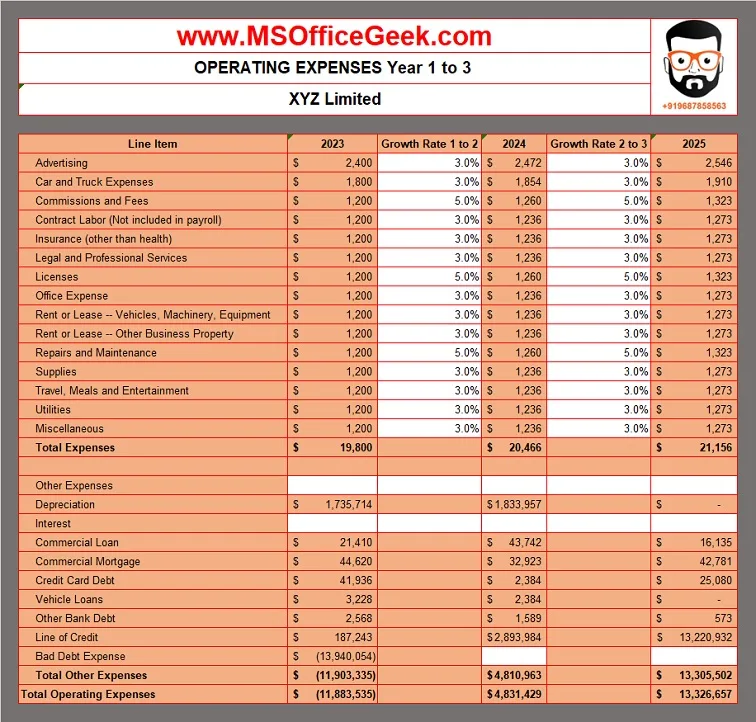

Operational Expenses

Operational Expenses (OPEX Year 1): Insert applicable data in the white cells. Orange cells contain formulas, hence do not enter or delete the cells.

Operational Expenses (OPEX Year 2 and Year 3): Insert the growth rate percentage to populate the cells automatically.

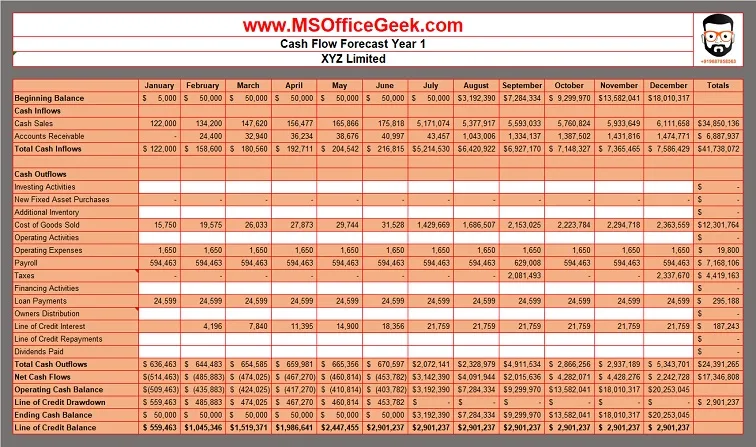

Cashflow Forecast

Cash Flow (Year 1): Based on the entries in the previous sheets, the sheet auto-populates the data. Insert data in white cells if applicable to your business.

Cash Flow (Year 2 and Year 3): No need to enter any data in this sheet because it auto-populates the data based on previous entries.

Amortization & Depreciation Schedule

Amortization and Depreciation: This sheet consists of monthly amortization and depreciation schedules for 3 years for all the different heads. No need to enter any data in this sheet because it auto-populates the data based on previous entries.

COGS: Insert applicable data in the white cells. Orange cells contain formulas, hence do not enter or delete the cells.

Income Statement Projections

Projection Income Statement (Year 1): No need to enter any data in this sheet because it auto-populates the data based on previous entries.

Projection Income Statement (Year 2 and Year 3): No need to enter any data in this sheet because it auto-populates the data based on previous entries.

Balance Sheet

Balance Sheet: This sheet auto-populates the Balance Sheet for all three years. Hence, there is no need to enter any data.

Breakeven Analysis

Breakeven Analysis: This sheet auto-populates the Balance Sheet for all three years. Therefore, there is no need to enter any data in this sheet.

Financial Ratios

Financial Ratio: This sheet auto-populates the Balance Sheet for all three years. Therefore, there is no need to enter any data in this sheet.

That’s it and your Financial Projection for Startup is ready.

The template is self-explanatory. If you want more information on what things and figures you need to input in the sheet we have made a comprehensive guide for you below.

Startup Balance Sheet

A startup balance sheet is a snapshot of your company’s financial health at a specific point in time. It shows what you own (assets), what you owe (liabilities), and the value of your owners’ equity. It’s crucial for both internal decision-making and external communication, especially when seeking funding or partnerships.

In the whirlwind of building your dream startup, understanding your financial landscape is crucial. That’s where the startup balance sheet comes in, your financial snapshot at a specific time. Like a map guiding your next steps, it reveals what you own (assets), what you owe (liabilities), and the value of your ownership (equity).

Importance of Startup Balance Sheet

- Track your progress: Monitor your financial journey, celebrating milestones and identifying areas for improvement.

- Stay ahead of curves: Early detection of potential cash flow shortfalls or overly burdensome debt empowers you to make proactive decisions.

- Unlock new avenues: Investors heavily rely on balance sheets to evaluate the financial health of the business and make informed investment decisions.

- Guide your growth: These data-driven insights inform strategic choices about resource allocation, investments, and financing.

Fixed Assets

Fixed assets are the long-term, tangible property or equipment a company owns and uses to generate income or run its operations. They are expected to last for more than one year and are not easily converted into cash.

Key Characteristics of Fixed Assets

- Durability: They are expected to have a useful life of more than one year.

- Not for resale: They are not intended to be sold in the ordinary course of business.

- Used for production or operations: They are used to generate revenue or support business activities.

- Depreciated over time: To reflect their wear and tear and loss of value, fixed assets are depreciated over their useful lives, except for land.

Importance of Fixed Assets

Essential for operations: Fixed assets are often crucial for a company’s ability to produce goods, provide services, and generate revenue.

Significant investment: They can represent a significant portion of a company’s total assets and investment.

Impact on financial statements: Their value and depreciation affect a company’s financial statements, including its balance sheet, income statement, and cash flow statement.

Startup Operating Capital

Operating capital, the lifeblood of your startup, is the short-term financial resources needed to keep your business humming day-to-day. Think of it as the oil that lubricates your gears, ensuring smooth sailing through daily operations.

Components of Operating Capital

Operating capital covers a range of essential expenses, including:

Inventory: Raw materials, finished goods, and anything awaiting sale.

Payroll: Salaries and benefits for your amazing team.

Marketing and Sales: Reaching your target audience and converting leads.

Rent and Utilities: Keeping the lights on and doors open.

Administrative Costs: Paperclips, office supplies, and other essentials.

Importance Of Operating Capital

Sufficient operating capital ensures your startup can thrive in the fast-paced world of business.

It helps you:

Meet immediate obligations: Avoid late payments and maintain supplier relationships.

Seize opportunities: Grab limited-time deals or invest in quick-win marketing campaigns.

Weather unforeseen challenges: Handle unexpected expenses without breaking a sweat.

Maintain flexibility: Adapt to changing market conditions and pivot if needed.

How To Estimate Your Needs For Operating Captial?

Determining your operational capital needs takes careful planning. Consider factors like:

Industry standards: Research average operating capital requirements for your industry.

Business model: Analyze your projected sales and expenses to understand cash flow patterns.

Growth plans: Factor in upcoming milestones and potential scaling needs.

Securing operational capital can be achieved through various means:

Bootstrapping: Using personal savings or funds from friends and family.

Bank loans: Seeking traditional or short-term business loans.

Investor funding: Attracting venture capitalists or angel investors.

Line of credit: Accessing a flexible source of credit for ongoing needs.

Startup Funding Sources

Kickstarting your entrepreneurial journey requires securing initial capital which fuels your venture dream into reality. Funding sources are the sources from where your capital needs are met.

Thankfully, a diverse landscape of funding sources awaits, each with its advantages and considerations.

Key Funding Sources

Bootstrapping: A true test of grit and self-reliance, bootstrapping involves leveraging personal savings, family loans, or even credit cards to fund your initial operations. This approach offers autonomy and avoids external pressures, but comes with limited capital and potential personal financial strain.

Angel Investors: These wealthy individuals with a penchant for promising ventures can inject crucial capital in exchange for equity or convertible debt. The process often involves pitching your vision and demonstrating traction, making it crucial to have a well-honed narrative and compelling business plan.

Venture Capitalists (VCs): Geared towards high-growth potential startups, VCs invest larger sums for significant equity stakes. Expect rigorous due diligence and intense scrutiny, but also gain access to expertise, mentorship, and valuable networks.

Business Loans: Traditional bank loans or lines of credit offer secured funding based on business potential and personal creditworthiness. While less dilutive than equity options, they come with stricter repayment terms and interest rates.

Government Grants and Programs: Specific initiatives supporting innovation and entrepreneurship may offer grants or subsidized loans, often focused on sectors like technology or social impact. Research relevant programs and tailor your application to their criteria.

Crowdfunding: Platforms like “ ZestMoney ”, “ Fueladream ”, “Crowdfund India” etc. allow you to raise capital from a large pool of individual investors in exchange for rewards or pre-orders. This approach can be effective for building community and generating early buzz but requires a compelling campaign and marketing strategy.

Startup Payroll Expenses

Payroll, in essence, is the lifeblood of your startup. It’s the system for calculating and distributing compensation to your team – the talented individuals who breathe life into your vision. It encompasses wages, salaries, bonuses, taxes, deductions, and all the intricate details that ensure your people get paid correctly and on time.

Why You Need to Get This Right from the Start?

Attract and Retain Top Talent: Competitive and accurate payroll sets the tone for your company culture. It demonstrates respect for your team’s contributions and fosters trust, attracting and retaining the best minds who can accelerate your growth.

Compliance is Key: Navigating the intricacies of labor laws, tax regulations, and social security contributions can be tricky, especially for early-stage businesses. Proper payroll management mitigates risks, avoiding legal woes and fines that can derail your trajectory.

Efficiency Matters: Manual payroll calculations are time-consuming and prone to errors. Investing in reliable payroll software or outsourcing to a skilled payroll provider frees up your valuable time and resources for more strategic endeavors.

Transparency Builds Trust: Clear and transparent pay structures with accurate paystubs go a long way in fostering trust and motivation within your team. It empowers your employees to track their earnings and understand their compensation package.

Data-Driven Insights: Properly structured payroll data becomes a valuable asset. You can analyze trends, identify cost-saving opportunities, and make informed decisions about employee compensation and benefits to optimize your workforce investments.

Startup Sales Forecast

A sales forecast is an estimate of how much revenue a company expects to generate from its products or services during a specific period, typically a quarter, a year, or several years.

It’s a crucial tool for business planning, as it helps companies:

Understand future demand: Forecasting future sales helps businesses allocate resources efficiently, plan production schedules, and set realistic sales targets.

Make informed decisions: Sales forecasts inform budget decisions, marketing campaigns, inventory management, and even hiring plans.

Monitor performance: Comparing actual sales to the forecast helps track progress and identify areas for improvement.

Techniques for Sales Forecasting

There are several methods for forecasting sales, each with its strengths and weaknesses. Some common techniques include:

Historical data analysis: Analyzing past sales trends and seasonality can provide valuable insights for future projections.

Causal models: These models consider external factors like competitor activity, economic conditions, and marketing campaigns to estimate their impact on sales.

Expert judgment: Consulting with experienced salespeople or industry experts can provide valuable qualitative insights.

Statistical methods: Advanced statistical techniques like regression analysis can identify complex relationships between various factors and sales.

Benefits of Accurate Sales Forecasts

Having accurate sales forecasts offers several benefits, including:

Improved financial planning: Businesses can allocate resources more effectively, manage cash flow, and secure funding with greater confidence.

Enhanced decision-making: Accurate forecasts help companies make informed decisions about production, pricing, inventory, and marketing strategies.

Boosting operational efficiency: Businesses can optimize production schedules, workforce planning, and logistics to meet future demand efficiently.

Increased profitability: By anticipating market trends and customer needs, companies can make strategic decisions that maximize revenue and profitability.

Formula for Sales Forecast

While there’s no single formula universally applicable to all sales forecasts, a common starting point is:

Projected Sales = (Average Unit Price) x (Estimated Units Sold)

This formula requires estimates for both the average price per unit and the number of units to be sold. The accuracy of the forecast depends on the reliability of these estimates, which can be derived from historical data, market research, and expert judgment.

Additional factors to consider Sales Forecasting

Besides the techniques and formula mentioned above, several other factors can impact the accuracy of your sales forecast:

Market size and trends: Understanding the overall market size and growth potential for your product or service is crucial.

Competitor activity: Analyzing your competitors’ strategies and offerings can help you anticipate their impact on your sales.

Marketing and sales efforts: Planned marketing campaigns and sales initiatives can significantly influence sales volume.

Unforeseen events: Be prepared to adjust your forecast based on unexpected events like economic downturns, natural disasters, or technological disruptions.

Sales forecasts are not crystal balls; they are based on estimates and assumptions. Use multiple forecasting methods to gain a more comprehensive view.

Accounts Receivable (A/R) Days Sales Outstanding (DSO)

The average number of days it takes a company to collect cash from its customers after goods or services are sold on credit.

It’s calculated as DSO = (Average Accounts Receivable / Credit Sales) × Number of Days in Period .

Interpretation:

- A lower DSO (e.g., 30 days) indicates efficient collection practices and strong cash flow.

- A higher DSO (e.g., 60 days) suggests potential cash flow concerns, slower collections, or lenient credit terms.

Impact on Financial Performance:

- A high DSO can tie up funds, limit growth opportunities, and increase financing costs.

- Strategies to improve DSO include offering early payment discounts, tightening credit policies, and implementing efficient collection processes.

Accounts Payable (A/P)

The amount a company owes to its suppliers for goods or services purchased on credit. It’s listed as a current liability on the balance sheet.

- A higher A/P balance can indicate strong purchasing power and good relationships with suppliers.

- A lower A/P balance might suggest limited supplier relationships or missed potential discounts.

- Managing A/P effectively can optimize cash flow and leverage supplier relationships.

- Stretching payables too long can damage supplier relationships and harm creditworthiness.

Line of Credit Assumptions

A pre-approved borrowing limit that allows a company to draw funds as needed, up to a certain maximum, usually with interest charged on the used amount.

- Lines of credit provide flexibility for unexpected expenses or short-term funding needs.

- Assumptions about interest rates, borrowing limits, and repayment terms are crucial for financial modeling and planning.

- Access to a line of credit can enhance financial resilience and support growth.

- Overreliance on lines of credit can lead to excessive debt and interest costs.

Income Tax Assumptions for 1 to 3 Years

Estimates of the income taxes a company will pay based on projected earnings, tax rates, and deductions.

- Accurate tax assumptions are crucial for financial modeling, budgeting, and planning.

- Factors to consider include current tax legislation, industry norms, and potential changes in tax laws.

- Taxes directly affect available cash and profitability.

- Overly optimistic tax assumptions can lead to inaccurate financial projections and potential misrepresentation of earnings.

Amortization of start-up costs

Amortization of start-up costs refers to the process of gradually writing off the cost of certain start-up expenses over a set period, instead of expensing them all in the year they are incurred. This is done for accounting and tax purposes, as it provides a more accurate picture of the company’s financial performance over time.

Startup Operating Expenses

Operating expenses (OpEx) are the lifeblood of any business, representing the costs directly associated with running your core operations and generating revenue. They are crucial for understanding your efficiency and profitability.

Calculating OpEx

There are two main ways to calculate OpEx:

- Using the Income Statement(mainly for existing business): Locate the “Operating Expenses” section on your income statement. This section often lists subcategories, allowing you to analyze specific expense areas. Add up all listed expenses to get the total OpEx.

- Using a Formula:

Formula 1: OpEx = Revenue – Operating Income – Cost of Goods Sold (COGS) Formula 2: OpEx = SG&A Expenses + COGS + Depreciation + Amortization

These formulas might vary depending on your accounting practices and industry standards. OpEx excludes non-operating expenses like interest, taxes, and gains/losses from investments.

Analyzing OpEx alone isn’t enough. Consider metrics like the OpEx ratio (OpEx / Net Sales) and EBITDA margin (EBITDA / Net Sales) * 100% to assess how efficiently you convert sales into profit.

Importance of Forecasting Startup Operation Expenses For 3 years

There are several compelling reasons why calculating operating expenses (OpEx) for 3 years is crucial for projection calculations in a startup:

Accurate Financial Planning and Forecasting

A 3-year projection allows you to anticipate future expenses associated with growth, hiring, marketing, and other vital business functions. This helps in:

Securing funding: Investors heavily rely on realistic projections to assess financial viability and potential return on investment.

Making informed decisions: A clear understanding of future expenses enables strategic planning for resource allocation, budgeting, and potential cost-saving measures.

Identifying potential risks: Proactive insights into rising costs or operational inefficiencies allow you to mitigate risks and adapt your business model.

Demonstrating Business Maturity and Credibility

Projecting OpEx for 3 years shows investors and stakeholders a long-term perspective and commitment to sustainable growth. This commitment translates to:

Increased confidence: A well-defined plan instills confidence in your ability to manage future expenses and achieve profitability.

Competitive edge: It differentiates you from startups lacking long-term planning, potentially attracting better funding opportunities.

Adapting to Market Dynamics and Growth

The business landscape is ever-changing, and a 3-year projection allows you to:

Factor in potential cost changes: This could include fluctuations in raw materials, labor costs, or regulatory shifts.

Plan for scaling: As your business grows, operational needs and expenses will evolve. Having a 3-year plan helps you anticipate and prepare for these changes.

Remain agile: The projection serves as a flexible framework, allowing you to adjust based on actual performance and emerging trends.

Assessing Financial Sustainability

By projecting OpEx over 3 years, you can:

Identify potential cash flow issues: You can assess if your projected revenue will adequately cover operational costs, highlighting potential financing needs.

Optimize pricing strategies: Understanding future expense trends allows you to set sustainable pricing that covers costs and ensures profitability.

Monitor profitability: Projecting how OpEx impacts gross and net margins over time helps you optimize operations for long-term financial health.

Startup Cashflow Projections

Cash flow refers to the net movement of cash into and out of a business during a specific period. It reflects the company’s ability to generate cash from its operations and meet its financial obligations.

Analyzing cash flow is crucial for understanding a business’s financial health, making informed decisions, and ensuring long-term success.

Cash Flow Components

1. Cash Inflow:

Money received by the business.

- Sales revenue

- Loan proceeds

- Investment Income

- Grant funding

Example: A customer paying for a product or service.

2. Cash Outflow:

Money paid by the business.

- Operating expenses (rent, salaries, supplies)

- Loan repayments

- Capital expenditures (equipment, property)

- Dividend payments

Example: Paying rent for office space.

Calculating Net Cash Flow:

You can’t directly apply a single formula to calculate cash flow.

However, the basic principle is:

Net Cash Flow = Cash Inflow – Cash Outflow

3. Operating cash balance (OCB)

Operating cash balance (OCB) is the amount of cash a company has on hand after accounting for all its operating expenses. It represents the cash readily available to fund day-to-day operations, pay bills, and seize short-term opportunities.

OCB = Beginning Cash Balance + Net Cash Flow from Operating Activities – Ending Cash Balance

Analysts and investors often use OCB to assess a company’s financial health and short-term liquidity. A high OCB indicates that a company is generating sufficient cash from its operations to meet its obligations and potentially invest in growth. Conversely, a low or negative OCB could signal potential financial difficulties.

4. Line of Credit Drawdown

A line of credit drawdown is the act of borrowing money from a pre-approved and revolving credit line established with a financial institution (e.g., a bank, or credit union).

Similar to a credit card, you only pay interest on the amount you borrow, offering flexibility and avoiding unnecessary interest charges on unused funds.

Startup Income Statement Projections

The income statement shows the flow of income and expenses during a specific period. It starts with the total revenue earned from selling goods or services and then subtracts all the expenses incurred to generate that revenue.

The resulting figure is the net income (profit) or net loss, indicating the company’s overall financial performance for the period.

While the income statement doesn’t have a single formula, it follows a specific structure:

Net Income = Revenue – Expenses

Revenue: All the income generated from the company’s core operations, such as sales of goods or services.

Expenses: All the costs incurred to generate that revenue, categorized into:

Cost of Goods Sold (COGS): Direct costs associated with producing or acquiring the goods or services sold.

Operating Expenses: Indirect costs related to running the business, such as rent, salaries, marketing, and depreciation.

Other Expenses: Non-operating expenses like interest and taxes.

Analysis of the Income Statement

Gross Profit: Revenue minus COGS measures the profit earned after direct production costs.

Operating Profit: Gross profit minus operating expenses indicates the profit from core business operations before financing activities.

Net Income: Operating profit minus other expenses and taxes reflects the company’s overall profitability for the period.

Ratios: Various ratios like gross profit margin, operating profit margin, and net profit margin can be calculated to compare profitability across companies or over time.

Startup Projected Balance Sheet

The balance sheet, also known as the statement of financial position, is another fundamental financial statement alongside the income statement. It provides a snapshot of a company’s financial health at a specific point in time, typically the end of a reporting period like a quarter or year.

The balance sheet presents a company’s assets, liabilities, and shareholders’ equity at a specific date. It adheres to the fundamental accounting equation:

Assets = Liabilities + Shareholders’ Equity

This equation ensures every dollar on the company’s books is accounted for, representing a financial equilibrium.

Components Of Balance Sheet

Assets: Resources owned by the company that have future economic value, categorized as:

Current Assets: Cash, inventory, accounts receivable, etc., readily convertible to cash within a year.

Non-current Assets: Long-term assets like property, plant, and equipment, are not readily convertible to cash within a year.

Liabilities: Debts and obligations the company owes to others, categorized as:

Current Liabilities: Short-term debts due within a year, such as accounts payable and accrued expenses.

Non-current Liabilities: Long-term debts like loans and mortgages, due beyond a year.

Shareholders’ Equity: The company’s net worth, representing the claims of owners (shareholders) on the company’s assets after accounting for liabilities.

Breakeven Analysis of Startups

Break-even analysis is a financial tool used to determine the point at which a company’s total revenue equals its total cost, resulting in neither profit nor loss. It helps businesses understand how much they need to sell to cover their expenses and start making a profit.

FORMULA: = TOTAL FIXED EXPENSES/(GROSS MARGIN/SALES*100)

Financial Ratios for Startups

Financial ratios are powerful tools used to analyze a company’s financial health, performance, and efficiency.

Here’s a list of commonly used ratios, categorized by their purpose, along with their formulas.

Liquidity Ratios

These ratios measure a company’s ability to meet its short-term obligations.

Current Ratio: Current Assets / Current Liabilities

Quick Ratio: (Current Assets – Inventory) / Current Liabilities

Safety Ratios

Assess a company’s ability to meet its long-term debt obligations.

Debt-to-Equity Ratio: Total Liabilities / Shareholders’ Equity

DSCR = Net Operating Income / Debt Service

Profitability Ratios

Evaluate a company’s ability to generate profits.

Sales Growth: ((Current Period Sales – Previous Period Sales) / Previous Period Sales) * 100%

COGS to Sales: Cost of Goods Sold (COGS) / Sales

Gross Profit Margin: (Sales – COGS) / Sales * 100%

SG&A to Sales: Sales General & Administrative Expenses (SG&A) / Sales

Net Profit Margin: Net Income / Sales * 100%

Return on Equity (ROE): Net Income / Average Shareholders’ Equity

Return on Assets (ROA): Net Income / Average Total Assets

Owner’s Compensation to Sales: Owner’s Compensation / Sales

Efficiency Ratios: Analyze how effectively a company uses its resources.

Days in Receivables: (Average Accounts Receivable / Revenue) * Number of Days in Period

Accounts Receivable Turnover: Revenue / Average Accounts Receivable

Days Inventory: (Average Inventory / Cost of Goods Sold (COGS)) * Number of Days in Period

Inventory Turnover: Cost of Goods Sold (COGS) / Average Inventory

Sales to Total Assets: Net Sales / Average Total Assets

Enjoy using this template and let us know if you want us to make any other template.

If you like this article, kindly share it on different social media platforms so that your friends and colleagues can also benefit from the same. Sharing is Caring.

Please send us your queries or suggestions in the comment section below. We will be more than happy to assist you.

Privacy Overview

Three-Year Financial Projections Template

Identify revenue sources, estimate potential growth rates for these sources, determine costs related to these sources, prepare initial draft of projection, assess market and economic trends, approval: financial controller for draft.

- Prepare initial draft of projection Will be submitted

Revise projection based on feedback

Obtain projected balance sheet and profit and loss statement, estimate potential investments and expenditures, include inflation and exchange rate effects, approval: cfo for revised projections.

- Obtain projected balance sheet and profit and loss statement Will be submitted

- Estimate potential investments and expenditures Will be submitted

- Include inflation and exchange rate effects Will be submitted

Incorporate feedback, refine and finalize projections

Review additional revenue opportunities, estimate risks and uncertainties, approval: ceo for final version.

- Incorporate feedback, refine and finalize projections Will be submitted

- Review Additional revenue opportunities Will be submitted

- Estimate risks and uncertainties Will be submitted

Prepare presentation for board members

Present final projection to board of directors, approval: board of directors.

- Present final projection to board of directors Will be submitted

Communicate approved financial projections to relevant departments

Archive final version of three year financial projections, stay updated—subscribe to our blog, more templates like this.

Explore Our Excel Financial Projection Templates

Selecting a financial projection template.

Every projection template works in Excel as well as Google Sheets. Each template will produce comprehensive financial pro forma statements in a simple and easy-to-use way. Every template purchase includes free technical support as well as our 30-day money back guarantee if you are not satisfied. Need any help choosing a template? Get a recommendation from our team! Interested in lifetime access to ALL of our templates? Checkout ProjectionHub+.

.png)

Looking for a Specific Industry?

Most Popular Templates

Here you'll find a business projection template for any of our most popular industries, including a two-sided marketplace, coffee shop and daycare facility. If you want an industry-specific financial projection template for your business plan, we've got you covered. You'll find our financial forecast worksheet easy to understand and use.

Universal Industry Templates

In this section you will find some of our most powerful templates that will help create financial projections for any industry. They are best for established businesses that have historical revenue and expense data to use as the basis for the financial projections. The existing business template features a built in valuation calculator to help provide business value estimates.

Restaurants, Food and Drink Templates

Find the restaurant projections template you need to properly present your financials. We offer restaurant financial templates for businesses ranging from food trucks to fine dining establishments. Our CPA-developed restaurant sales projection templates empower you to create presentations that truly represent your operation. If you want easy-to-use restaurant business plan financial modeling spreadsheets , you want ProjectionHub's financial templates for restaurants.

Healthcare and Fitness Templates

Whether you're running a cannabis dispensary, home healthcare business or gym, we have the healthcare financial modeling template that you need. Our healthcare financial forecasting models and fitness financial projection templates will make your job easy. When you choose healthcare financial models from ProjectionHub, you get the full benefit of our extensive expertise. The easy-to-find tabs and highlighted cells in our healthcare financial projection templates will simplify the process for you.

Retail Templates

Our CPA-developed business financial model templates will give you all the tools you need to create financial projections for retail operations. Whatever your type of retail business, we have a retail store income statement template that's right for you. We even offer a dispensary financial projection template for CBD and cannabis outlets. Backed by our years of expertise, financial forecast worksheets from ProjectionHub deliver the retail store revenue projections you require to properly run your business.

Services Templates

We've developed an Excel financial model for service businesses that allows you to easily create financial forecasts for lenders, investors and internal planning. With ProjectionHub's industry-specific approach to service business financial projection templates , you can be sure to find a financial forecast worksheet that meets your business needs. Check out our service business projection templates now to find what you need.

Technology Templates

Leave the complexity and confusion behind with a CPA-developed financial forecast worksheet for your tech business. Ecommerce entrepreneurs appreciate the simplicity of our ecommerce business financial models . And our SaaS financial modeling templates are just as easy to use. You can accurately calculate and share your business projections with ProjectionHub's SaaS business financial model. See how financial modeling for a SaaS company has never been easier.

Real Estate Templates

Leave behind the complexity and confusion associated with financial forecasting for your real estate business with a CPA-developed worksheet. Our real estate business financial models offer a simple and straightforward approach for real estate entrepreneurs. Whether you manage properties or are involved in other aspects of the industry, our financial modeling templates are user-friendly and easy to use. With ProjectionHub, you can accurately calculate and share your business projections, making financial modeling for your real estate company a breeze.

Passive Income Templates

Say goodbye to the uncertainty and confusion of financial forecasting for your passive income business with a CPA-developed worksheet. Our financial models are designed to offer a simple and easy to understand approach for entrepreneurs looking to generate income through passive means. Whether you are invested in rental properties or other forms of passive income, our financial modeling templates are user-friendly and easy to use. With our templates, you can accurately calculate and share your business projections, making financial modeling for your passive income business a breeze.

Other Templates

Led by our industry-specific philosophy, ProjectionHub offers Excel financial projection templates for a wide range of businesses. Our library includes a growery sales projection template, logistics financial modeling, predictive financial models for manufacturing and an Airbnb business financial model . Learn more about our financial forecast worksheets to see how ProjectionHub's manufacturing and logistics financial projection templates are right for your business. Whether you run a church or a realty firm, we have a template that will simplify your financial projections.

Financial Projection Template FAQs

How many years of financial projections can i create with a projectionhub template.

All of our financial projection templates are 5 year financial models. If you only need a 3 year financial projection, you can simply hide the last two years of the model. The templates will provide you with annual and monthly projections for up to 60 months.

How to create a profit and loss projection?

In order to create a profit and loss projection you will need to forecast both revenue and expenses. If you are forecasting for an existing business with historical financial data, the easiest way to forecast is to use your historical data as a baseline to forecast off of. This is the approach we take with our Existing Business Forecast Template .

If you are looking to create a profit and loss projection for a startup you will need to develop a set of assumptions and build your projections from the ground up. You will need both revenue and expense assumptions in order to produce a pro forma P&L. You can see an example from one of our templates below.

Example Pro Forma Profit and Loss

How to forecast cash flow for a business.