G/L Account Determination in SAP SD

Most of the transactions in SAP are recorded against the GL account. During creation of billing document form a sales order , an accounting document is created where material value is posted against a G/L account. The post describes how the system determines the G/L account for a material sold to a particular customer by the GL account determination technique.

Lets try to create a sales order for a customer with some material and then creating a billing document from the sales order which also generated the accounting document.

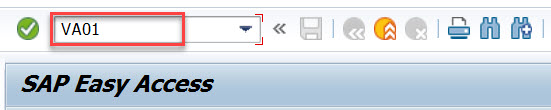

To create sales order go to Tx- Va01

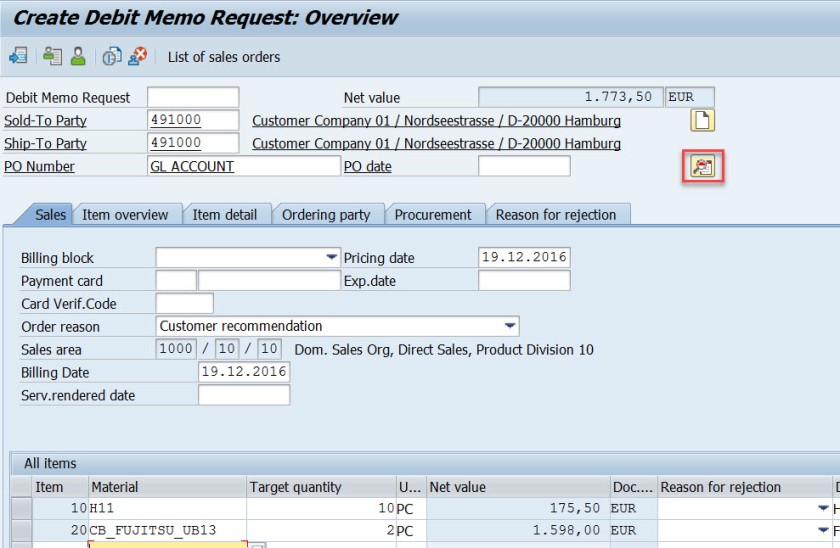

Lets create a debit memo request for the sales area 1000/10/10.

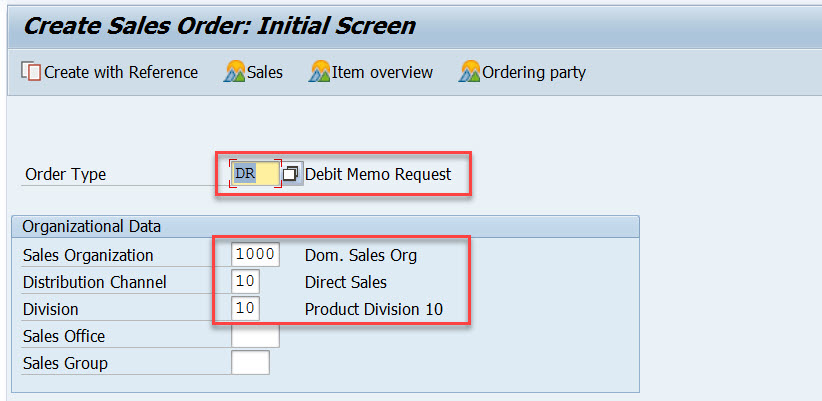

Provide the customer number and few materials and its quantity and double click on the first material to see the item details.

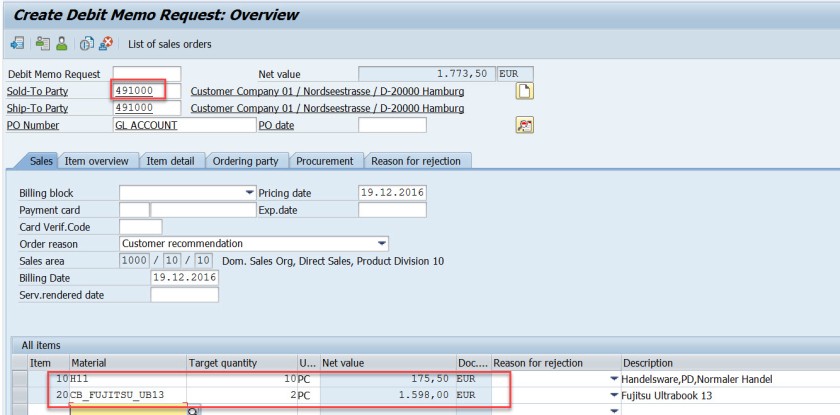

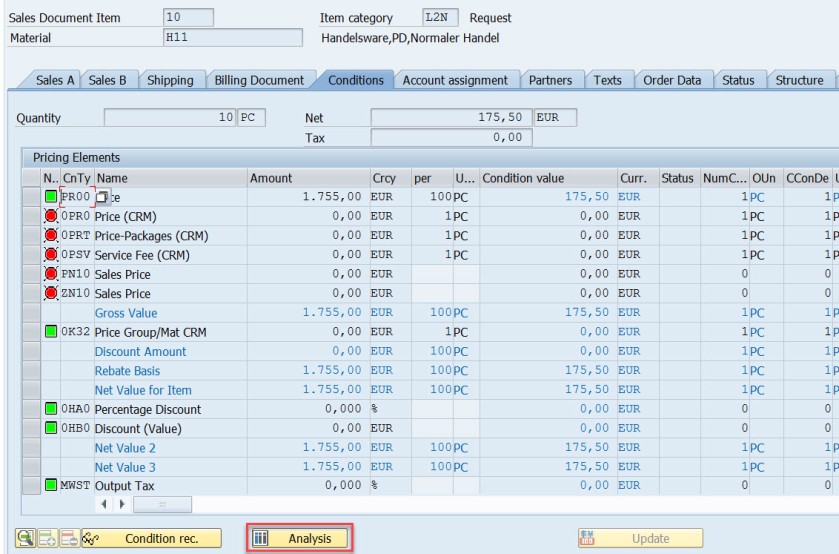

From the pricing procedure – for the pricing condition type- PR00 material value is calculated as 175.50 EUR.

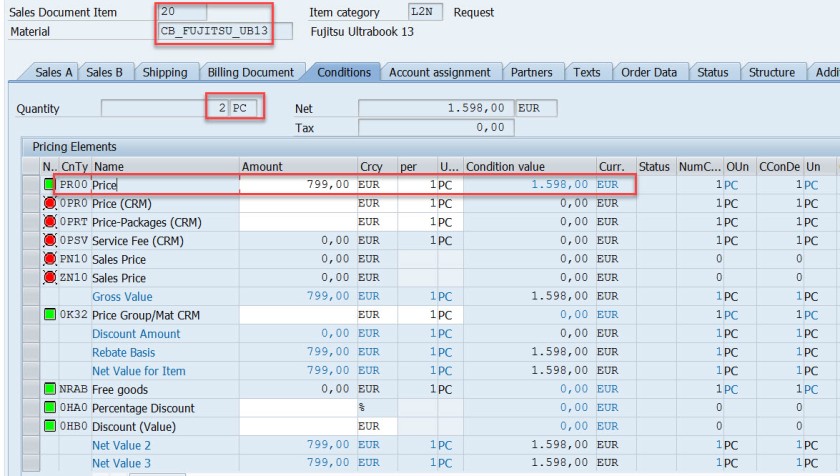

For the second material for the pricing condition type- PR00 material value is calculated as 1598.00 EUR. Go back.

Select the header button.

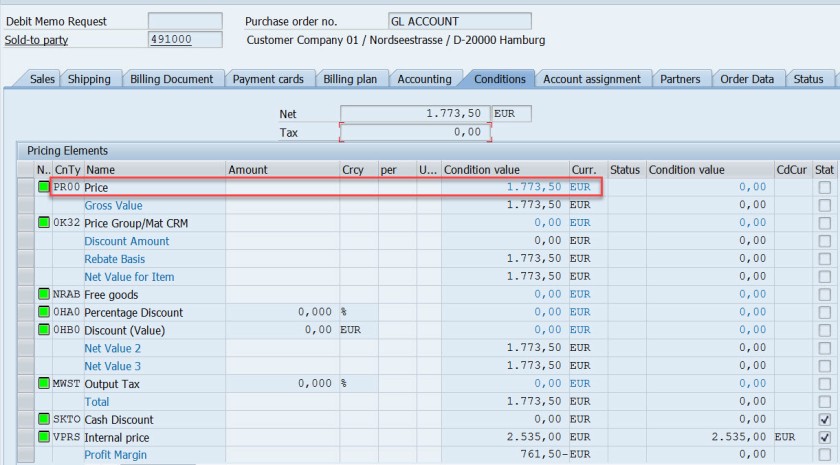

In the header section, in the Conditions tab, the total price is the sum of two materials.

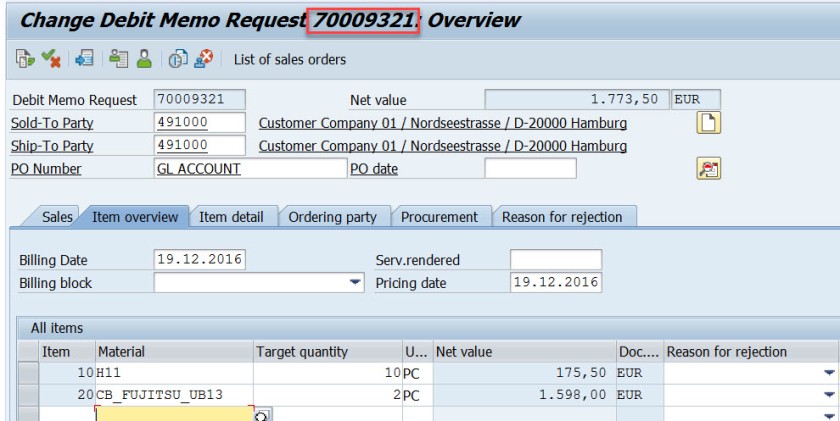

Save and DMR is created.

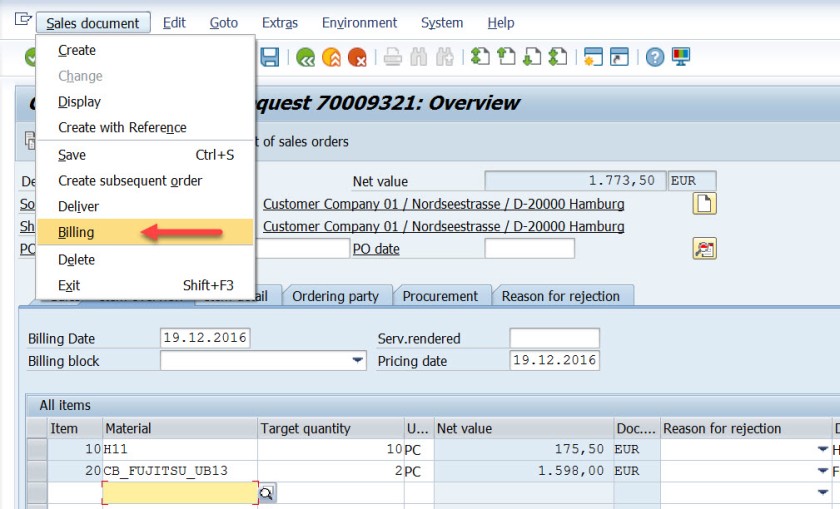

Go to Tx- VA02 and from the menu choose Billing.

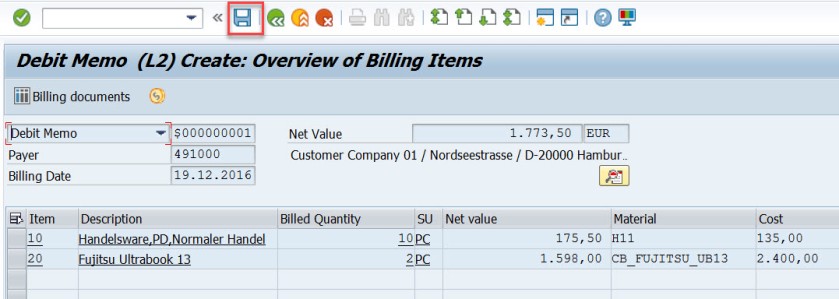

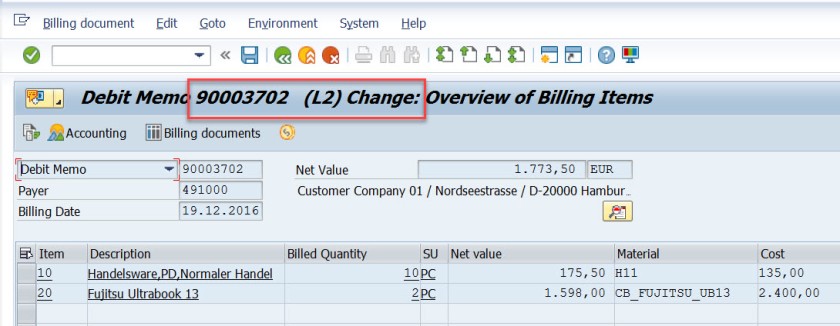

Select Save button to create a billing document. mark billing document type is determined as – L2.

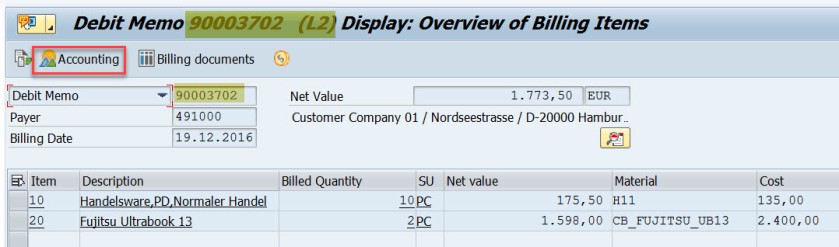

Go to Tx- VF03 and display the billing document. Choose Accounting button.

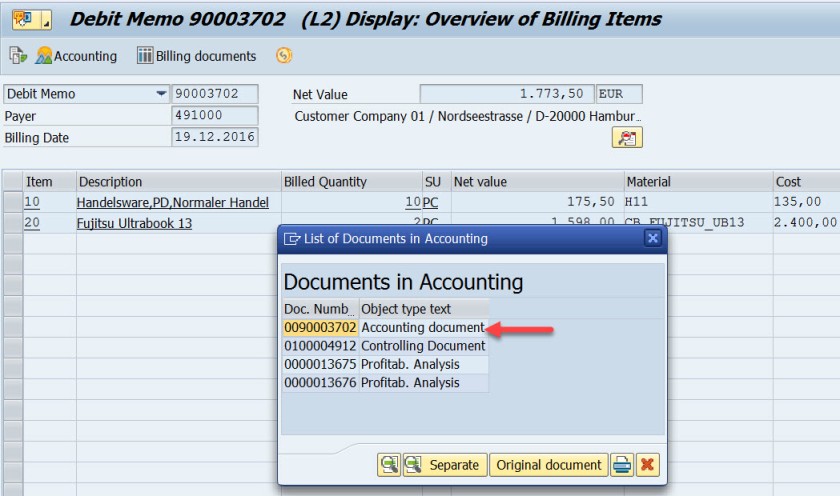

Choose Accounting document.

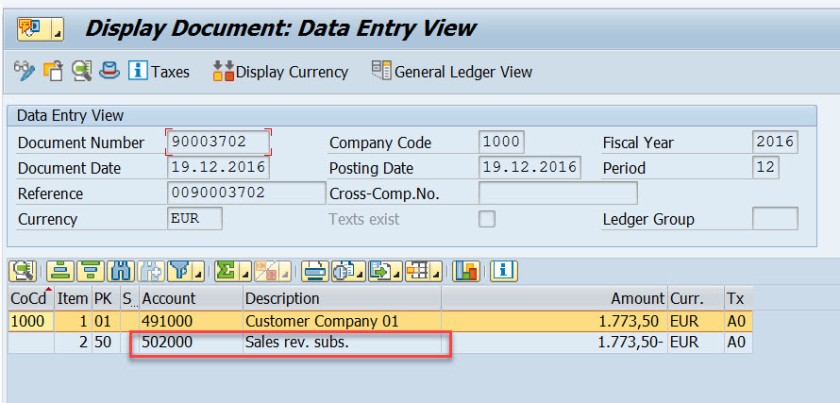

Here is the accounting doc with few lines.

First entry is for the customer as we used the customer – 491000, the account becomes 491000 for the customer.

For the second line, the GL account calculated as 502000. Let’s figure it out how this g/L account is determined.

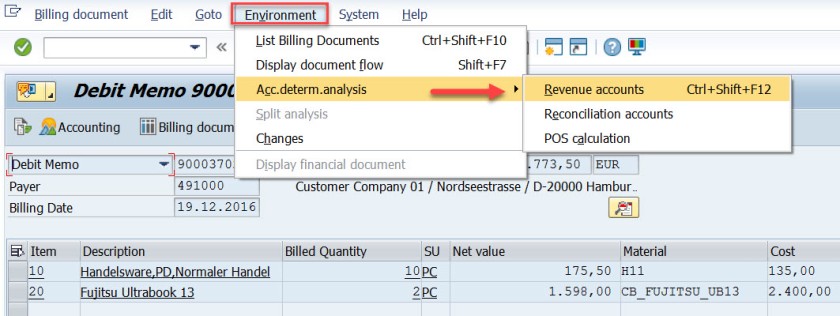

Go to Tx- VF02 and edit the billing document.

From menu, navigate along the highlighted path.

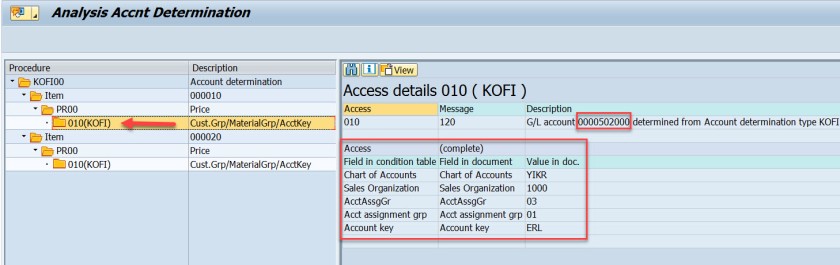

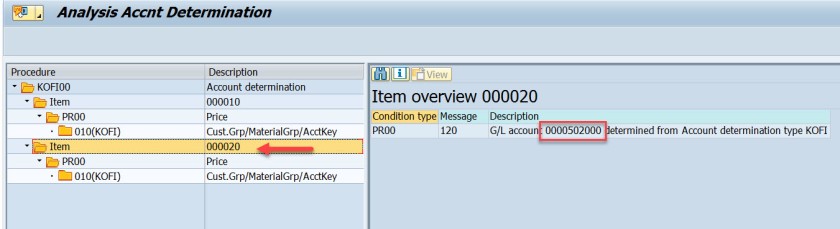

Well, it says the Account Determination procedure is KOFI00 and for the first item , for the pricing condition type PR00, the G/L account as 502000.

Same for the second item.

The G/L account determination requires few customizing steps.

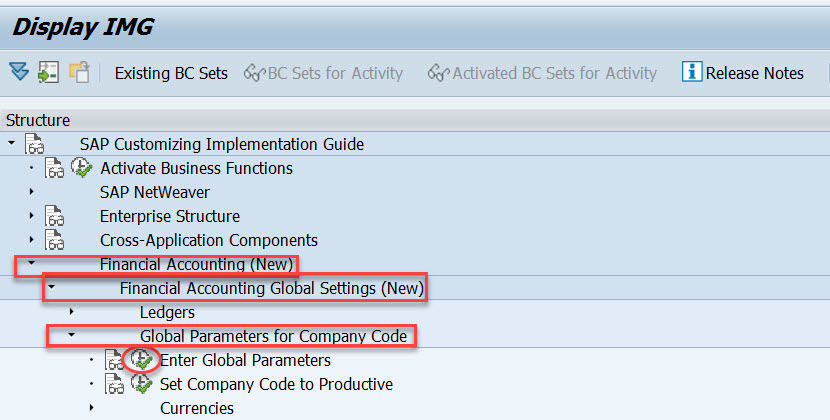

First check what is the chart of account assigned to the company code. In SPRO IMG structure navigate along the highlighted path to see the chart of account assigned to the company code.

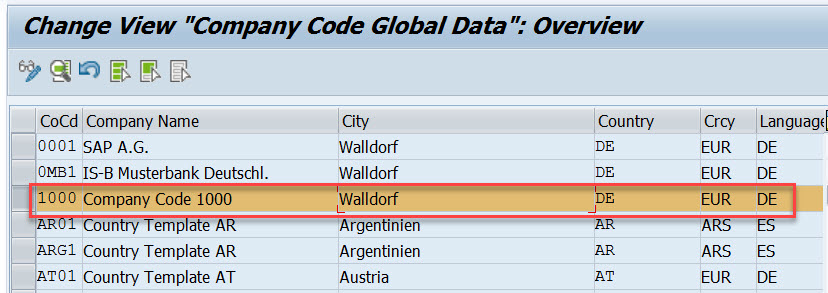

For the demo we use company code- 1000

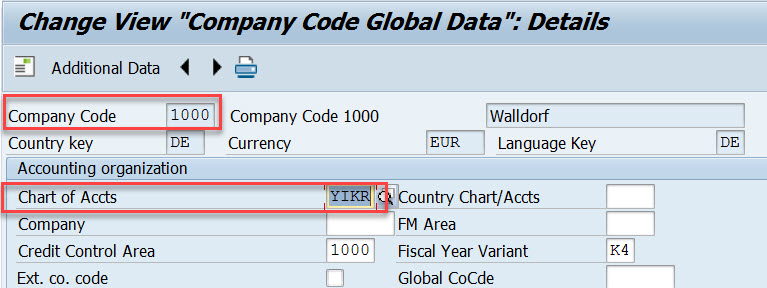

The chart of account is – YIKR

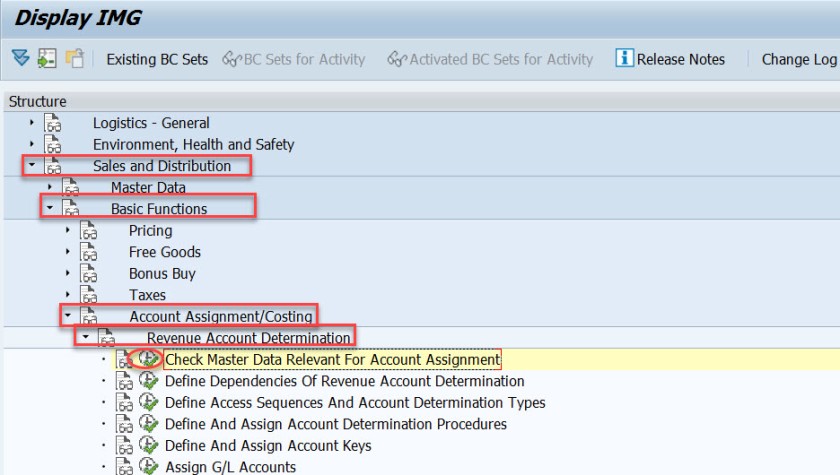

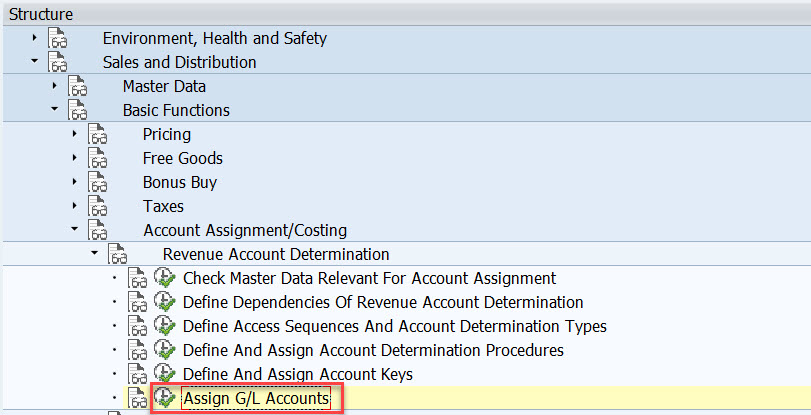

Next step , the customizing in the Sales&Distribution section for the Account Assignment/Costing.

First execute – Check master data relevant for account assignment.

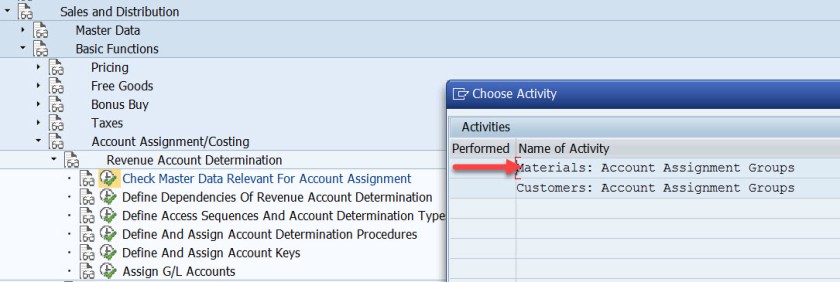

Select first option- Materials : Account Assignment Groups.

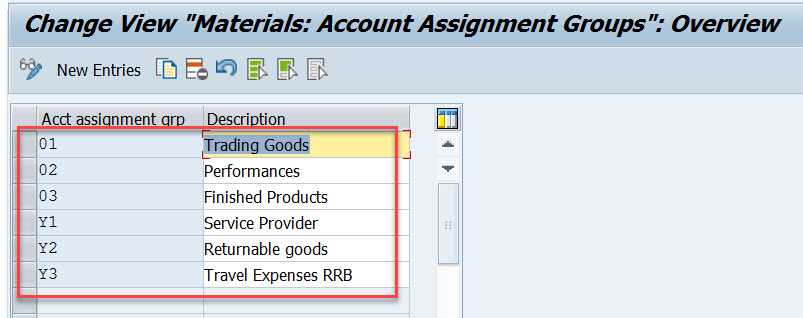

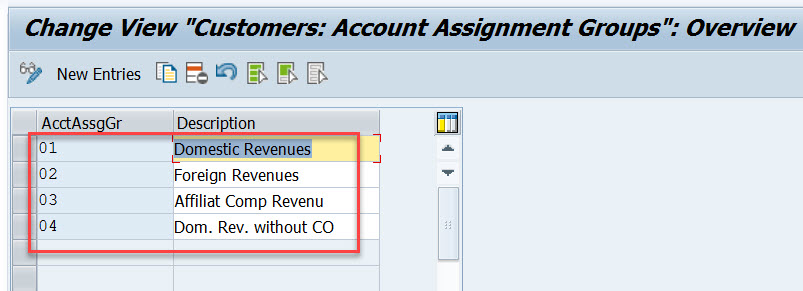

Here Material account assignment group is created which is assigned to the material master when created in Tx- MM01

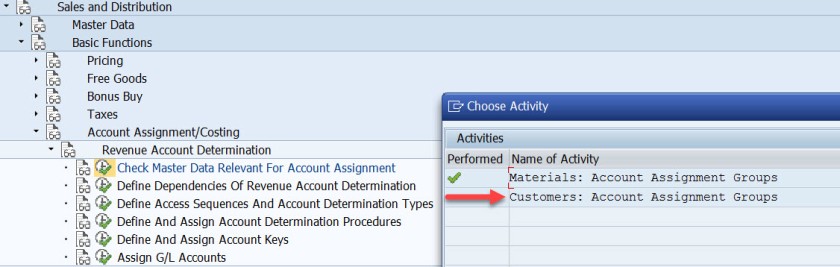

Select second option- Customer : Account Assignment Groups.

Here Cusomter account assignment group is created which is assigned to the customer master when created in Tx- XD01

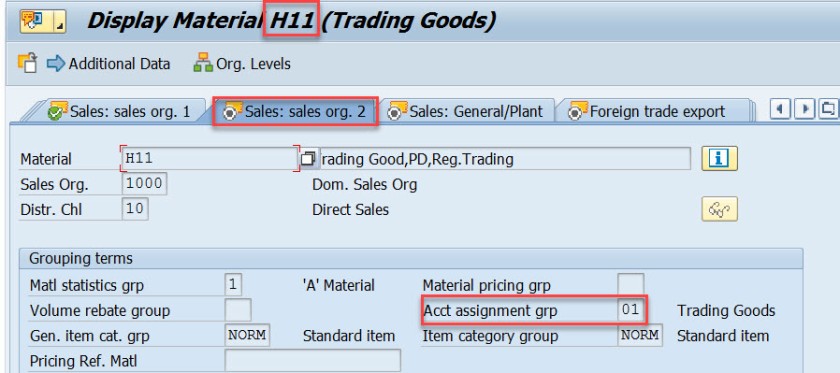

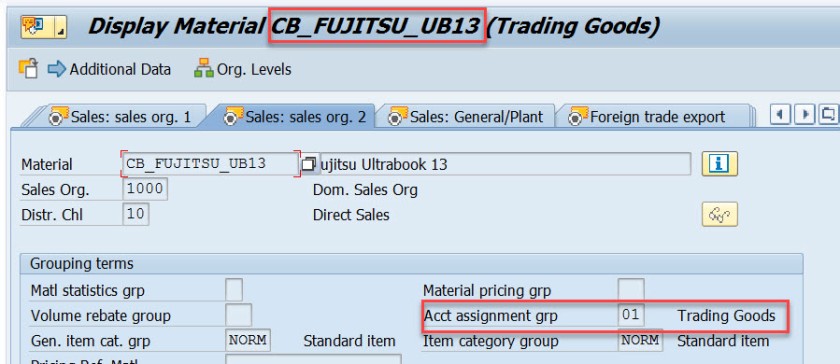

For our used material in sales order- H11, open this material in Tx- MM03 and in the Sales: sales org.2 tab, the material account assignment group is assigned to the material.

Similarly for another material used in sales order, it is assigned to the material account assignment group.

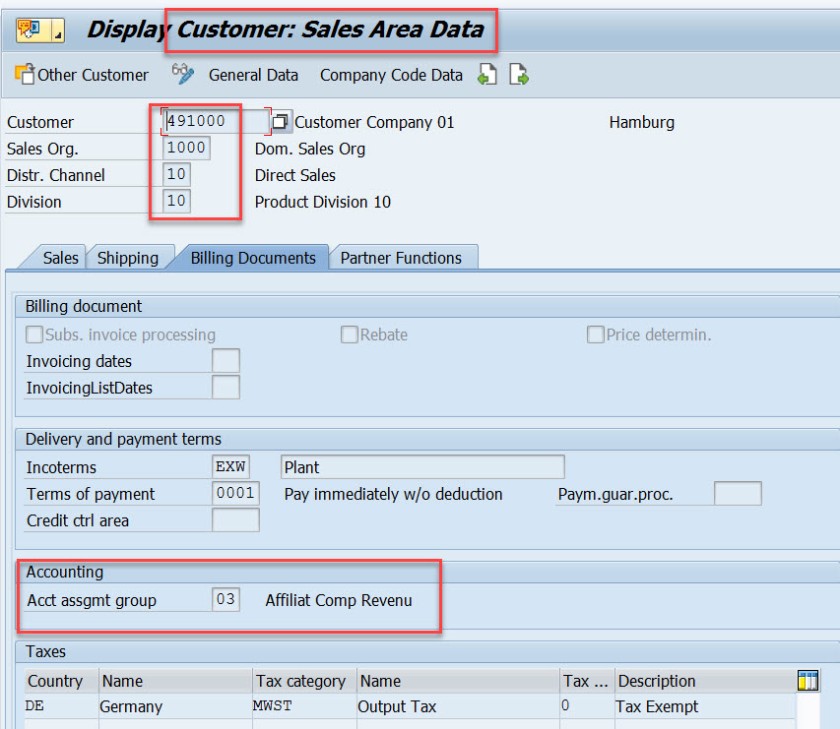

For our customer – 491000, open this customer in Tx- XD03 and go to the sales area data & in the billing document tab, customer account assignment group is assigned to the customer.

This customer and material account assignment group will help to determine the GL account.

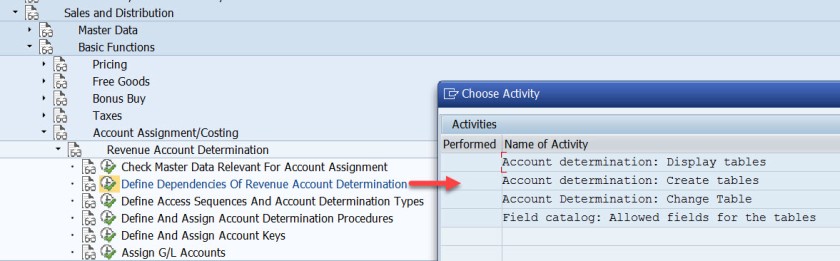

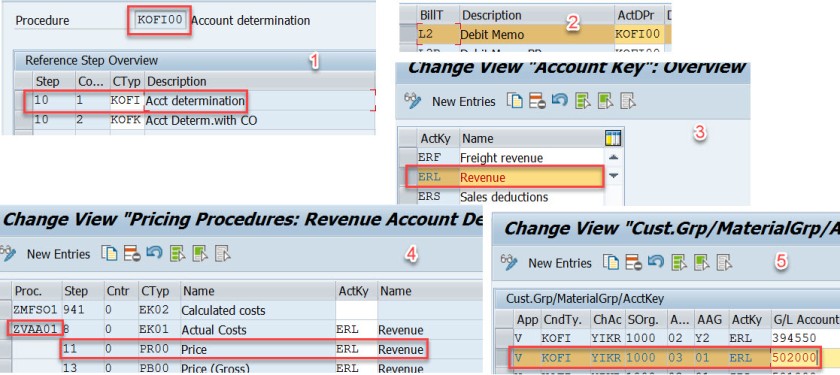

GL account determination uses the condition technique. Now the next step is to define the condition tables. So choose option- Define Dependencies of Revenue Account Determination. If you want to create new tables you can choose Create Table option. For this demo we are leaving this as already we have few condition tables.

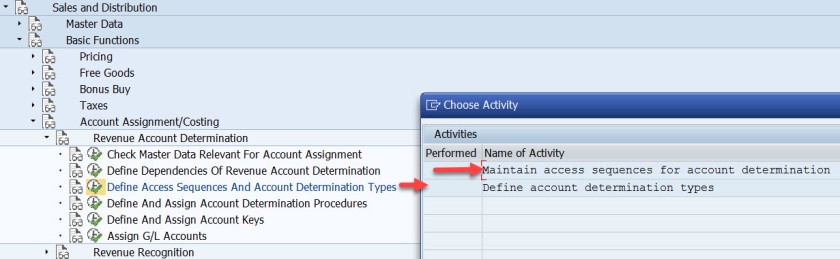

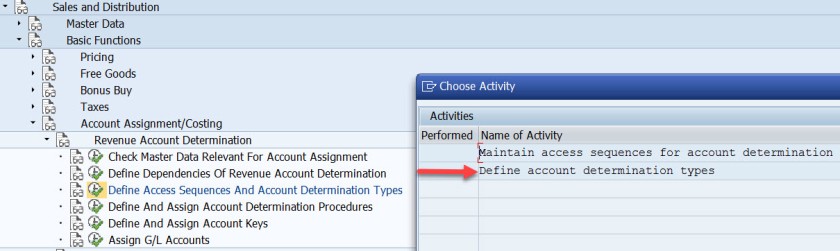

Next is defining the access sequence and the condition type. So choose the highlighted opton.

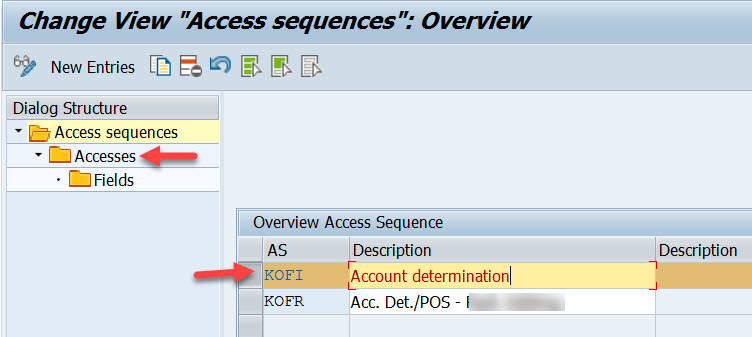

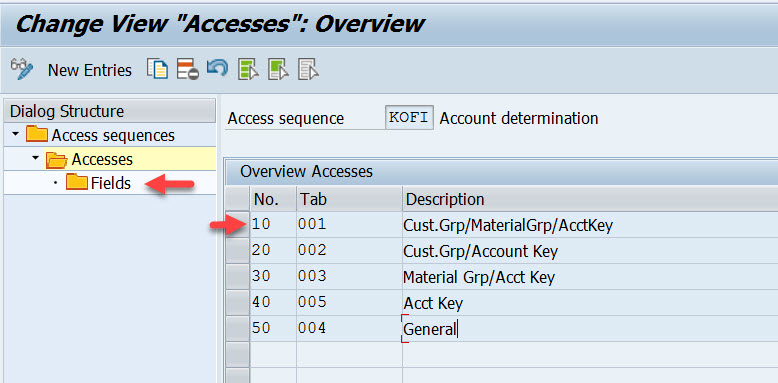

Access Sequence is defined as – KOFI( a new access sequence can be created bu New Entries button ). Select the access sequence and choose Accesses from left hand section to see all the access lines with condition table.

Well this access sequence KOFI has five access line each refers to one condition table.

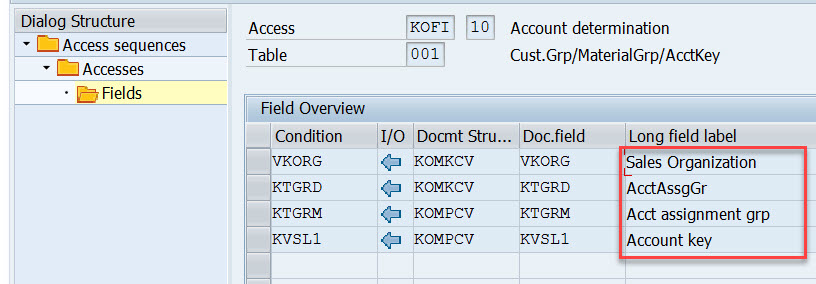

Select one access line and choose Fields button to see all the fields included in the condition table to form the access line 10.

Access line-10 with condition table 001 has 4 fields.

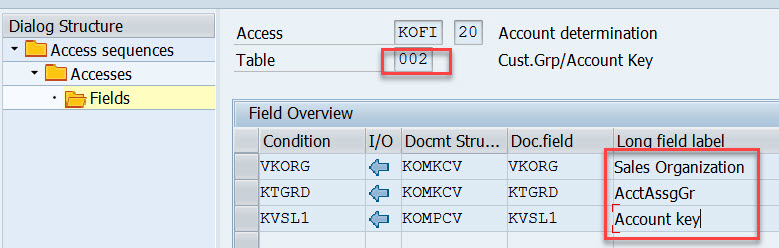

Similarly for other access lines with condition tables other fields are there.

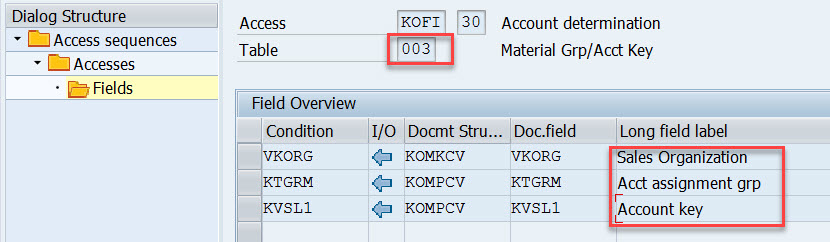

For access line 30.

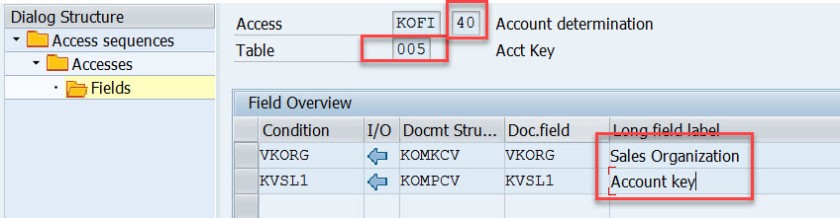

For access line 40.

Choose Define Account Determination type.

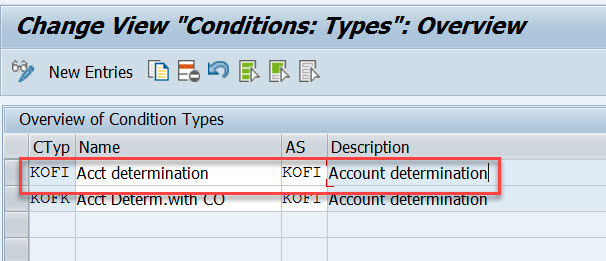

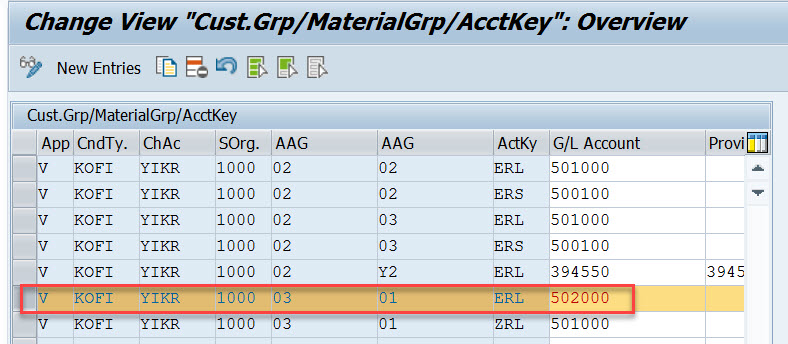

Here Condition type- KOFI is created which is assigned to the access sequence KOFI which has 5 access lines with different condition tables.

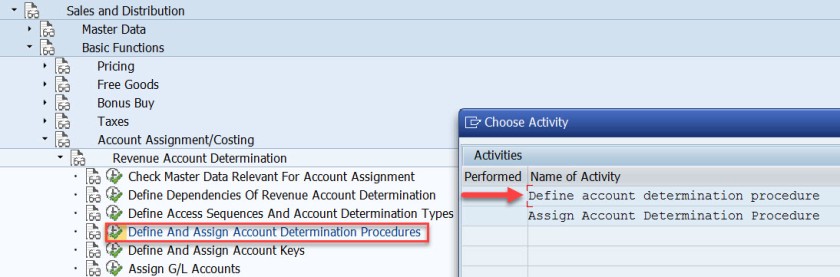

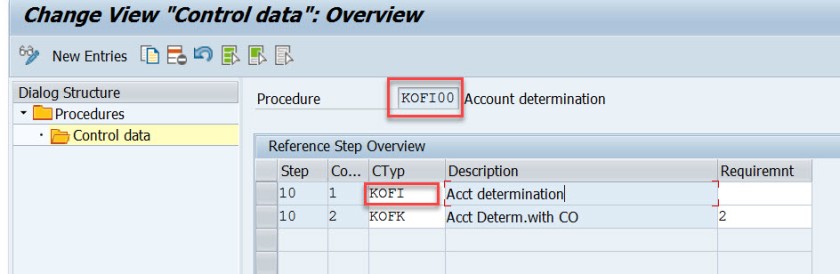

Choose the option as pointed to create account determination procedure.

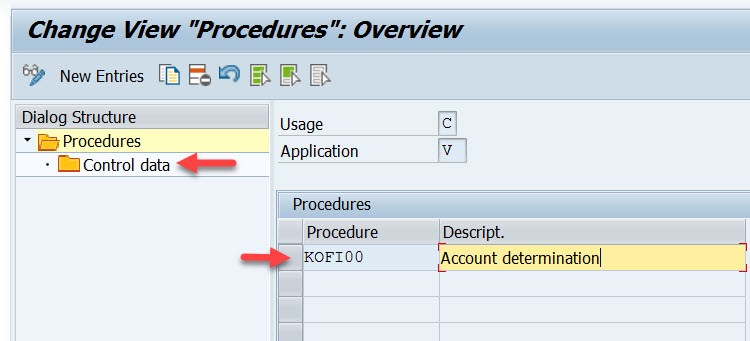

Procedure KOFI00 is created and assigned to the account condition types. Choose the procedure and select Control data from left side.

Here the account determination procedure is assigned to the condition type.

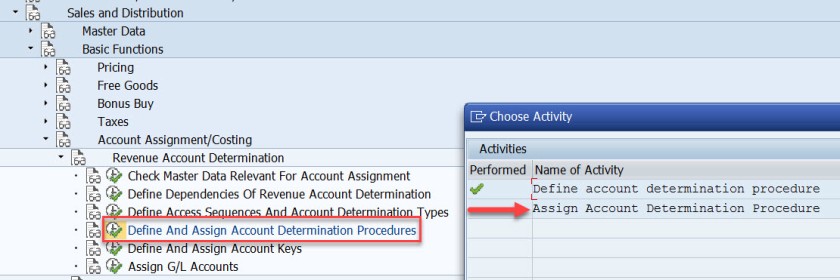

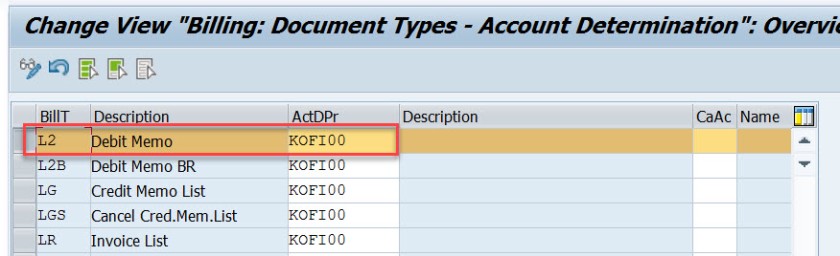

Choose the option – Assign account determination procedure.

Here the account determination procedure is assigned to the billing type.

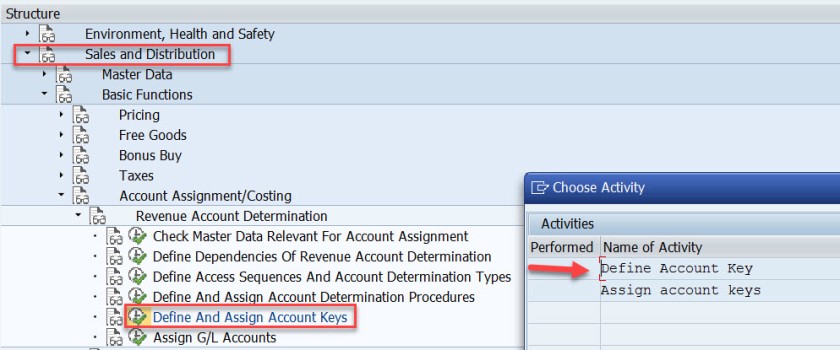

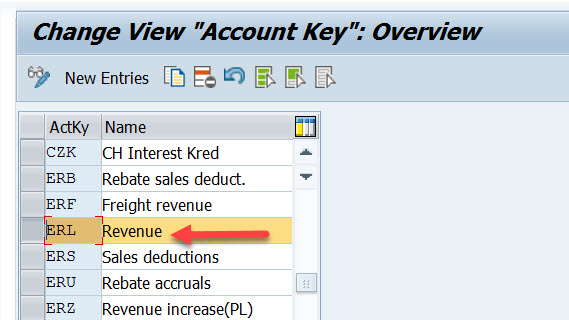

Next step is to define account key. Choose the marked option.

For different types like revenue, tax and other different account keys are defined. For revenue its ERL.

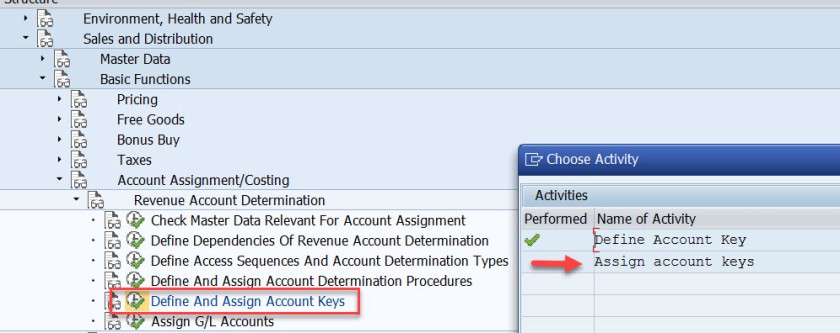

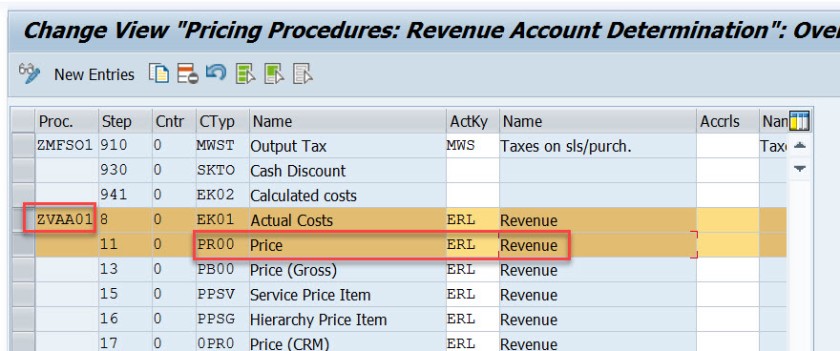

Next step is to assign the account key to the pricing procedure – condition type PR00.

Here for the pricing procedure ZVAA01 and condition type PR00, the account key is assigned as ERL.

In the above created sales order, item we can check the pricing procedure as below bu selecting the Analysis button in the conditions tab of the item detailed screen.

Next time is to assign the G/L account. Choose the marked option.

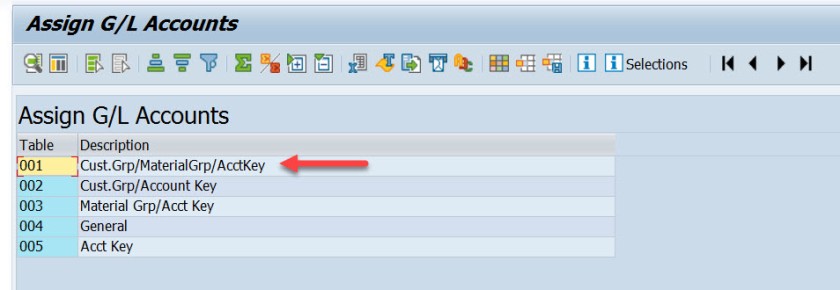

Here we have five options. as account condition type KOFI of the account determination procedure KOFI00 is assigned to the access sequence – KOFI with five access lines.

This is like maintaining the condition records. During the GL account determination process, it checks to find the GL account by taking all the values from the billing document and checking against the condition records for table 001. If found it calculated the G/L account and if not found then checks for the condition records for the second table and so on upto 005 until it finds a G/L account.

Choose/double click on the first line.

Here we have maintained for V-Sales, KOFI- account condition type, YIKR as the chart of account and other four fields like sales org, customer account group, material account group and account key comes from the condition table, for our demo purpose we have assigned the G/L account as- 502000.

( Before assigning to the G/L account here it should be created first).

For our demo

- From Billing Type L2 it derives the account determination procedure as- KOFI00

- From account determination procedure- KOFI00 it find the account condition type as – KOFI

- During creation of billing its finds for the item, pricing procedure and the condition type as PR00

- Then it finds the account key for the pricing procedure with condition type PR00 as ERL

- The customer account assignment group is – 03

- The material account assignment group is – 01

- The chart of account as- YIKR fot the company code- 1000

- By taking all these values, the G/l account number calculated as – 502000

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

12 comments

Very well explained

Can you please explain me how to assign different GL account while creating accounting document? What changes do I have to make?

is there any way to do a mass analysis on how account assignment has been done over a period of time? ie which tables were used with with criteria? We want tot clean up the SD account assigment tables which currently have over 100.000 entries and are not manageble anymore.

It’s truly a nice and useful piece of info. I’m happy that you shared this useful info with us. Please keep us up to date like this. Thank you for sharing.

Hi. I have an inquiry regarding the classification of ERL account group. In my current company, there are two GL accounts which are currently tagged to ERL (Revenue) – one is cash and another is VAT adjustment (based on their description). My question is, are those two accounts valid to be determined under ERL? If so, what is the impact if this matter is unresolved? Hope someone can take up and provide me a good input. Many thanks in advance.

this is how the fucking a document must be. excellent!

Thank you so much, detail explanation. Appreciate the hard work

Could you add little detail on ” how does the pricing procedure ZVAA01 and condition type PR00 linked/determined for an item”

Pricing procedure is not determined on the item level. Pricing Procedure is determined on the header level. In tx- OVKK , the determination of pricing procedure customizing are maintained. The sales area, document pricing procedure and the customer pricing procedure determines the pricing procedure. When an order is created we know the sales area(sales org, dist channel and division), the document pricing procedure derived from the document type and from the sold-to-party (customer) the customer pricing procedure is derived. With all these information, Pricing procedure is derived.

The pricing procedure contains condition types like PR00 and others. In Tx- VK11/VK12/Vk13 we can maintain pricing condition records against each condition types. When we enter a material in an item, from the already determined pricing procedure it gets the condition types and tries to find the pricing condition record for the material. This is how the price is found for that item condition type.

Hope this helps!

Like Liked by 1 person

Thanks to you Siva and Manish, I am not in to SD but was trying to have extended understanding between FI-SD integration and found your tutorial, its really help full. I was going through with the tutorial and played your videos as well in you tube. It helps me to understand the process and bridge the gaps from SD side. Really appreciate your effort on preparing and sharing the knowledge

Thanks for the details .suggest reading the note on account-determination helpful things are described there

execellent..well done..thank you

Leave a Reply Cancel reply

- Already have a WordPress.com account? Log in now.

- Subscribe Subscribed

- Copy shortlink

- Report this content

- View post in Reader

- Manage subscriptions

- Collapse this bar

- Terms of Use

- Privacy Policy

- SAP ERP Solutions

- What does SAP stands for

ETCircle.com SAP FI and CO consultant information

Assign g/l accounts | vkoa.

In this configuration activity we are able to define GL account determination for sales and distribution module (SD).

Transaction: VKOA

IMG Path: Sales and Distribution -> Basic Functions -> Account Assignment/Costing -> Revenue Account Determination -> Assign G/L Accounts

Tables: C001, C002, C003, C004, C005

On the main screen there is a list of levels on which you are able to assign gl accounts. We will start with the first one.

- 1 Cust.Grp/MaterialGrp/AcctKey

- 2 Cust.Grp/Account Key

- 3 Material Grp/Acct Key

Tags Account Assignment C001 C002 C003 C004 C005 VKOA

About Emiliyan Tanev

Related articles, customers: account assignment groups | ovk8, materials: account assignment groups | ovk5, define automatic credit control | ova8, configure automatic postings | omwb.

In this FICO configuration activity we are able to define account determination for automatic postings …

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of followup comments via e-mail. You can also subscribe without commenting.

/support/notes/service/sap_logo.png)

3431836 - How to create new material group and link it to G/L Account

How to create new material group and link it to G/L Account

Environment

SAP S/4HANA Cloud

You can create new material group using SSCUI 102665 'Define Material Groups ' , but you cannot directly assign a Material Group to a G/L Account.

Instead a Material Group is assigned to a Valuation Class using SSCUI 102424.

New material groups, Define Material Groups, G/L account, S/4hana cloud, LO-MD-MM , KBA , LO-MD-MM , Material Master , How To

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

Defining General Ledger (G/L) Accounts and Cost Elements

After completing this lesson, you will be able to define a G/L account

Chart of Account

Each G/L is set up according to a chart of accounts. The chart of accounts contains the definitions of all G/L accounts. The definitions consist of the account number, the account name, and the type of G/L account (e.g. balance sheet, non operating expenses/revenues, primary costs/revenues, secondary costs or cash accounts).

Assignment of Company Codes to Chart of Accounts

A chart of accounts can be used by multiple company codes so that the general ledgers of these company codes have an identical structure.

General Ledger Account and Cost Element

The two segments of the G/L master record from a Financial Accounting perspective are as follows:

The chart of accounts segment contains a description of the account, the account type that classifies how the account can be used in FI and/or CO and, the account group that controls the company code segment fields, and the consolidation account number.

The company code segment contains values specific to how the company code will manage that account.

Account Groups

Accounts with the same account group normally have similar business functions. You can, for example, have an account group for:

Cash accounts

Expense accounts

Revenue accounts

Other balance sheet accounts

The account groups are assigned number ranges. You can control which account numbers are permissible for cash accounts, expense accounts, and so on, through the number ranges.

Account groups also control the appearance of the company code segment of G/L accounts. Account groups control:

The fields that are required for data entry

The fields that are optional for data entry

The fields that are display only.

The fields that do not show up at all in the company code segment

Reconciliation Accounts

Expenditures versus costs.

In the economical theory, there are two approaches for values:

In the first approach, the values in Financial Accounting and Management Accounting are the same:

Controlling provides additional reporting opportunities by separating the FI documents along additional characteristics, such as segments, profit centers, projects, stored in a coding block. The results may be P&L statements and balance sheets per segment, per profit center or per project.

In the second approach (most used in central Europe), Management Accounting is based on cost and revenues. Costs are only those expenditures, which are as follows:

Related to the business of the company

Exactly assigned to periods (source specific)

For example, a gift to a welfare organization is an expenditure, but not a cost, because it is not the business of the company to make gifts.

Expenditures, which do not meet the definition of costs, are only reflected in Financials, and not in Management Accounting. They are called neutral expenditures.

SAP provides the opportunity to realize each of the theories. In SAP S/4HANA revenues, expenditures, and cost are represented by financial accounts and separated by the Account Type of the accounts. Based on the account type, the accounts used in CO are also called cost elements.

Account Types

The controlling area-specific data is only needed for Secondary Costs and Primary Costs or Revenue accounts. In the controlling area-specific data, you assign a Cost Element category. This category determines which account can be used for which business transaction in CO.

Create a Primary Cost Account

Log in to track your progress & complete quizzes

IMAGES

VIDEO

COMMENTS

Hiya. VKOA settings are open for changes even in a production environment; you can straight away map your GL accounts in transaction VKOA without it being opened. However, if you still feel the need to transport - that can be done after making the changes in a DEV environment, after which manually attaching to a transport.

For cases where you create your own customized Account Assignment Categories (SPRO --> MM --> Purchasing --> Maintain Account Assignment Categories), you have to use this field called Acct modification.

there are 2 account assignment groups. one is in the customer master, which is the source for the entry in account assignment group at the billing document's header level. the other is in the material master, which is the source for the billing document's item level.

This customer and material account assignment group will help to determine the GL account. GL account determination uses the condition technique. Now the next step is to define the condition tables.

SAP S/4HANA Cloud. Resolution. In the configuration activity Define Financial Statement Versions (SSCUI: 102669), there are two buttons named Assign Accounts and Assign Functional Area. So accounts can be allocated in two ways: one is account assignment, and the other is assigning a functional area.

Configuration assigning GL Accounts in SD module. Transaction VKOA or IMG Path - Sales and Distribution -> Basic Functions -> Account Assignment/Costing -> Revenue Account Determination -> Assign G/L Accounts.

Operational chart of accounts assigned to the company code. G/L Account Type determines how the general ledger account can be used in financial accounting (FI) and controlling (CO). The Account Group determines the fields for the data entry screens on the Company Code Data tab.

You can create new material group using SSCUI 102665 'Define Material Groups ' , but you cannot directly assign a Material Group to a G/L Account. Instead a Material Group is assigned to a Valuation Class using SSCUI 102424.

Account Groups. Accounts with the same account group normally have similar business functions. You can, for example, have an account group for: The account groups are assigned number ranges. You can control which account numbers are permissible for cash accounts, expense accounts, and so on, through the number ranges.

Here we need to assign GL Accounts in - Inventory Postings - BSX (Double Click) - Here we assign GL Accounts according to the Valuation Class wise, which is nothing but Material Type wise.. like Raw Material, Semi-Finished, Finished Goods and Non-Valuated Materials, etc..